Press release

How the Market Structure of the Automation’s Suppliers has been changing - Part 2 of the Series „Automation Trends, Market Structure, Economic Crisis“ in the Quest Trend Magazine

Bochum, September 13th, 2010. The Quest Trend Magazine has recently published the second part of the three-part series of articles with the headline „Automation trends, market structure, economic crisis“. This serial investigates the connection between the trends in the automation technology, the market structure of their suppliers and the economic crisis.The first article with the headline „The trends in the automation technology“ identified the two main trends in automation. The first main trend marked the substitution of the electromechanics by microelectronics in the 1980 and 1990 years. Around the year 2000 an ever higher degree of integration of microelectronics resp. automation came to the fore as new main trend. This trend is also determining these days but differentiating.

The second article of this serial consists of two sections according to the two main trends in automation.

The first section states that the substitution of the electromechanics by microelectronics favoured the formation of numerous new and medium-sized suppliers. The article calls four reasons for this development i.e. the know-how about microelectronics and its concentration on new products, fast and user-friendly enhancement of the products, relatively low capital requirement and growing sales markets.

The substitution of electromechanics by microelectronics provided both benefits and disadvantages for the large market leading suppliers. The benefits consisted in offering electromechanics and microelectronics at the same time making the transition process in the machinery industry and its customers easier. In addition the large suppliers could easier fulfill the need for standardisation of the microelectronics. On the other hand the disadvantages became apparent in speed losses related to the dynamic development of the microelectronics. At this point the medium-sized suppliers operated much faster.

The second main trend, starting from the year 2000, consists in an ever higher degree of integration of the automation. This again changed the market structure of the suppliers. The article calls six reasons for these changes, e.g. the wave of foundation of new suppliers was exhausted because capital requirement and know-how for integrated solutions had risen; the sales markets for integrated solutions differentiated into markets for integrated partial and total solutions being smaller in each case than the former markets determined by substitution. Accordingly the medium-sized suppliers differentiated into three groups: the first group was focused on integrated part solutions, the second one grew into integrated total solutions and the suppliers of the third group were bought up by large companies. During this period of differentiating markets large suppliers were losing market shares to the group of medium-sized suppliers being able to process differentiated markets in a better differentiated manner.

The proceeding internationalisation of the production favours in turn the large, worldwide active suppliers that can offer integrated total solutions in particular for the production sites of the other worldwide active companies.

The article closes with referring to the perspectives of the medium-sized suppliers of the automation technology.

This series of articles addresses the connections between automation, market structure and economic crisis. Particularly in times of rapid, partly erratic changes the Quest Trend Magazine tries for facilitating the orientation and decisions both of the machine-builders and the suppliers of automation technology with this series of articles.

Quest TechnoMarketing, Bochum, London, is the publisher of the Quest Trend Magazine. Quest TechnoMarketing analyses the automation market for more than 20 years.

The link to the article „How the market structure of the suppliers of automation technology changed” is http://www.quest-trendmagazin.de/How-the-market-structure-of-th.131.0.html?&L=1.

About Quest Trend Magazine:

The print edition of the Quest Trend Magazine is published since 2001 and is dispatched to 4,000 personally addressed decision-makers in the automation technology in the machinery industry of Germany, Austria and Switzerland and in the automotive and F&B industries. It has 12,000 readers according to the reader questioning and enjoys a high degree of attention due to its focus on trends in the automation technology from users’ point of view. The Quest Trend Magazine is published by Quest TechnoMarketing.

About Quest TechnoMarketing:

Quest TechnoMarketing, founded 1989, is specialised in market surveys for the automation technology. Locations are Bochum and London.

The market studies of Quest TechnoMarketing discover the demand trends in control technology, drive technology, field buses, Ethernet and sensor technology in the machinery industry and in the automotive and F&B industries. The trends are based on interviews with the users of these technologies.

The customers of Quest TechnoMarketing are the manufacturers of automation technology. The majority of the well-known manufacturers belong to them. The customers use the market studies for their product development and market processing.

Presscontact:

Thomas Quest

Quest Trend Magazine

Hunscheidtstr. 87

44789 Bochum, Germany

Phone +49 234-34777

Fax +49 234-33 22 02

Email: media@quest-trendmagazin.de

Internet: http://www.quest-trendmagazin.de/Home.34.0.html?&no_cache=1&L=1

Quest TechnoMarketing

Thomas Quest

Hunscheidtstr. 87

44789 Bochum, Germany

Phone +49 234-34777

Fax +49 234-33 22 02

Email: info@qtm.de

Internet: http://www.qtm.de/e

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How the Market Structure of the Automation’s Suppliers has been changing - Part 2 of the Series „Automation Trends, Market Structure, Economic Crisis“ in the Quest Trend Magazine here

News-ID: 144396 • Views: …

More Releases from Quest Trend Magazin

Rising world market shares of the 10 largest automakers

From 2011 to 2012 the worldwide motor vehicle production rose by 5.2%. That was connected with a noticeable change of the world market shares among the 10 largest automakers. Three changes are crucial.

Quest TechnoMarketing has investigated the internationalization of the worldwide automobile production since 2000 and published some results in the Quest Trend Magazine.

Now this long-term trend analysis has been amended by the actual changes from 2011 to 2012…

The German machinery industry is divided into three groups - new in the Quest Tr …

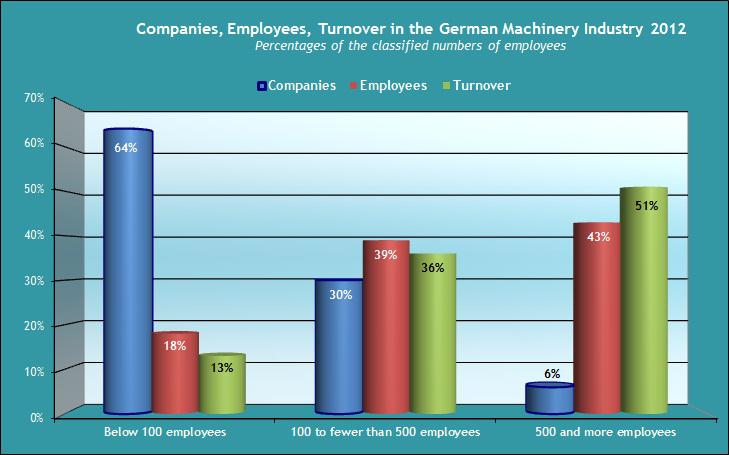

Compared with large industries such as chemistry or motor vehicle industry the machinery industry is rightly considered as medium-sized. However, it is divided into three groups that shift the medium-size character in the background.

Quest TechnoMarketing investigated the industry structure of the German machinery industry and published the result in the Quest Trend Magazine. In particular for the manufacturers of automation technology it may be useful to adjust the products for…

Structural changes in the course of the worldwide industrial production and the …

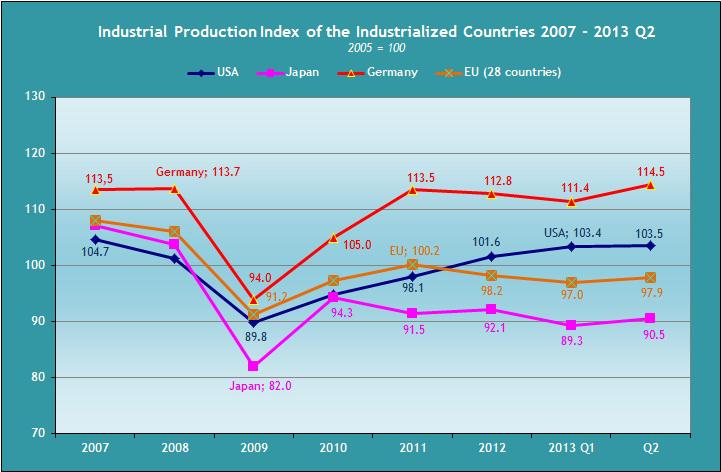

The Quest Trend Magazine has analyzed the course of the worldwide industrial production in the last 30 years. Three structural changes became visible. They are forming the economic situation also these days.

The industrial production of the USA, Japan, Germany and the European Union showed an altogether continuous growth in the 20 years from 1980 to 2000. Economic crises with a decline in industrial production occurred in an interval of…

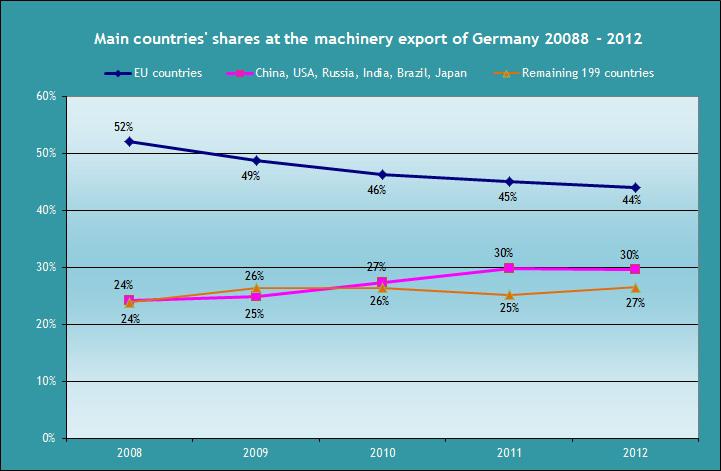

German machine-builders have been shifting their export markets since the world …

The still dominating role of the European Union countries for the machine export has dramatically been relativized since 2008. And even the export shares into the BRIC countries show up noticeable shifts.

The turnover of the German machinery industry achieved its crisis low with 67.5 index points (value index of the German Federal Statistical Office) at the beginning of 2010. Then started a rapid upward movement slightly exceeding with 137.6 at…

More Releases for TechnoMarketing

Latest Feedback of the German Machinery Industry on Industry 4.0 - New Report in …

Along the market survey from Quest TechnoMarketing about the engineering of the machine automation until 2017 the machine-builders also assessed “what Industry 4.0 is supposed to mean for the engineering of the machine until 2017”.

80% of the investigated machine-builders in the ten sectors of the German machinery industry provided their feedback to this question. The following numbers refer to these machine-builders.

The open question without further specifications invited to a…

Electric linear actuators have been growing for 10 years

Bochum, July 14, 2010. During the last 10 years from 2001 to 2010 the use of electric linear actuators in the German machinery industry has increased fivefold.

So the portion of the machine-builders using electric linear actuators at the machines increased from 3,5% to 19%.

Linear actuators produce a straight-line resp. translational motion. So e.g. the hot glue nozzle of a packaging machine can be guided straight-lined across a paper…

RFID - constantly and throughout the machinery industry implemented

Bochum, July 5, 2010. This year 14% of the machine-builders intend to implement RFID at the machines.

RFID stands for radio frequency identification and provides the wireless identification of goods, semi-manufactures or workpieces in the industrial sector.

Last year 15% of the machine-builders wanted to implement RFID at the machines. So RFID shows a constant implementation during the last two years.

This implementation is taking place with all or almost all of…

Intensified interest in application-optimised I/O modules

Bochum, June 15, 2010. The machine-builders are intensified interested in application-optimised I/O modules this year. This confirms the trend to fine-tuning the control and drive technologies that determines the changes in the automation technology this year.

With 11% each tenth machine-builders intend to change to application-optimised I/O modules this year. That is an increase in relation to the previous year by more than one third as this value was 8%.

What application-optimised…

Panel PC benefits from the current trend to fine-tuning the control technology

Bochum, 7th June 2010. Machine-builders prefer fine-tuning the control technology this year. This means to improve the consisting control technology at the machines instead of changing the control technology. The Panel PC benefits from this current trend.

Panel PC means operator panel with integrated control system. Compared with other control technologies such as PLC, PC, microprocessor control, CNC or contactor-based control technology the Panel PC shows the highest portion with new…

The trends in the automation - start of the serial „automation, supplier struc …

Bochum, May 25, 2010. The Quest Trend Magazine has recently published the first part of a three-part series of articles to the topic „automation, supplier structure, economic crisis“. It concerns the connection between automation technology, its suppliers and the economic crisis.

By now two main trends in the automation technology have been appearing. The first main trend of the automation substituted the electro-mechanics by microelectronics. The second main trend consists of…