Press release

New Report - HNWI in Singapore Wealth Management Industry – Trends, Analysis and Forecast (2010-2015) Published by MarketsandMarkets

The ‘HNWI in Singapore Wealth Management Industry – Trends, Analysis and Forecast (2010-2015)’ analyzes the needs and behavior of HNWIs in Singapore and provides a detailed analysis of factors driving the wealth of HNWIs and challenges faced by the wealth management firms in Singapore.Browse market data tables and in-depth TOC on HNWI in Singapore Wealth Management Industry – Trends, Analysis and Forecast

http://www.marketsandmarkets.com/Market-Reports/singapore-hnwi-282.html

Early buyers will receive 10% customization of reports.

The wealth of HNWIs in Singapore is growing at 35.6%, whereas wealth of HNWIs is growing at 17.1% globally and 25.8% in APAC. The population of HNWIs is growing at 35.6% in Singapore, whereas it is growing at 18.9% globally and at 30% in APAC. The growing wealth and population of HNWIs in Singapore provides a huge opportunity for wealth management companies to increase their revenues and customer base.

HNWIs in Singapore are demanding frequent personal interactions with their wealth managers. They want their managers to possess better product knowledge, be open to new ideas, and personally interact with them on a regular basis. They want them to understand their needs and the risk associated with a particular investment product. One of the major reasons why HNWIs change their wealth managers is their failure to understand the needs of clients.

The main purpose of this report is to study the changing needs and behavior of HNWIs in Singapore. It also aims to study their investing patterns and the factors, which will drive HNWIs wealth and the challenges faced by wealth management firms.

Key Findings

HNWIs are giving more importance to personal interactions.

Equities to be the preferred asset class

Past performance and transparency in operations are the major criteria for selecting wealth managers.

HNWIs are more dependant on their financial advisors for making decisions about investment.

Wealth management firms adopting better customer relationship management solution and gaining expertise in third party and in-house products will lead the race.

Scope of the report

Market Overview

This section discusses the market size and segmentation of the wealth management industry as a whole, and segmentation of the wealth of HNWIs in Singapore based on the way they have accumulated it, the different asset classes and the different geographies in which they invest it.

Market Dynamics

This section discusses the trends related to changes in the needs and demands of HNWIs in Singapore as well as the factors that are driving wealth creation in the country. It also discusses the investments made by HNWIs in different asset classes and the challenges faced by the wealth management firms.

Trends of HNWIs in Singapore

This section discusses the varying demands of HNWIs based on their age group and the criteria they follow to choose their wealth managers. This section also discusses what asset classes are favored by HNWIs in Singapore.

Business case study

The case study discusses the measures taken by Oversea-Chinese Banking Corporation (OCBC) Bank based in Singapore, to improve customer service by streamlining its operations and save time on managing client information.

Company Profiles

This section describes companies offering wealth management services in Singapore, and includes an overview, primary business, wealth management operations in Singapore, strategies followed by them and recent developments related to wealth management operations in India

About MarketsandMarkets

MarketsandMarkets (M&M) is a global market research and consulting company based in the U.S. We publish strategic advisory reports and serve as a business intelligence partner to Fortune 500 companies across the world. MarketsandMarkets also provides multi-client reports, company profiles, databases, and custom research services.

M&M Banking and Financial Services practice recognizes the challenges that financial institutions face bringing the right products to market. Our reports and consulting practice provide a unique perspective allowing the financial institution to see and experience the best way to achieve their product goals. Through a mix of case studies, primary research, and business modeling we provide a 360° view to identify how you can create, capture, and keep the value of your product and out think the competition.

Contact:

Ms. Sunita

7557 Rambler road,

Suite 727, Dallas, TX 75231

Tel: +1-888-989-8004

Email: sales@marketsandmarkets.com

http://www.marketsandmarkets.com

MarketsandMarkets (M&M) is a global market research and consulting company based in the U.S. We publish strategic advisory reports and serve as a business intelligence partner to Fortune 500 companies across the world. MarketsandMarkets also provides multi-client reports, company profiles, databases, and custom research services.

Ms. Sunita

7557 Rambler road,

Suite 727, Dallas, TX 75231

Tel: +1-888-989-8004

Email: sales@marketsandmarkets.com

http://www.marketsandmarkets.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Report - HNWI in Singapore Wealth Management Industry – Trends, Analysis and Forecast (2010-2015) Published by MarketsandMarkets here

News-ID: 152424 • Views: …

More Releases from MarketsandMarkets.com

Medical Robots Market Worth $33.8 billion | MarketsandMarkets™

Medical Robots Market in terms of revenue was estimated to be worth $16.0 billion in 2024 and is poised to reach $33.8 billion by 2029, growing at a CAGR of 16.1% from 2024 to 2029 according to a new report by MarketsandMarkets™. The growth in the medical robots market is driven by the aging population and rising chronic diseases, improving reimbursement scenario, and subsequent advancements in healthcare funding & infrastructure.…

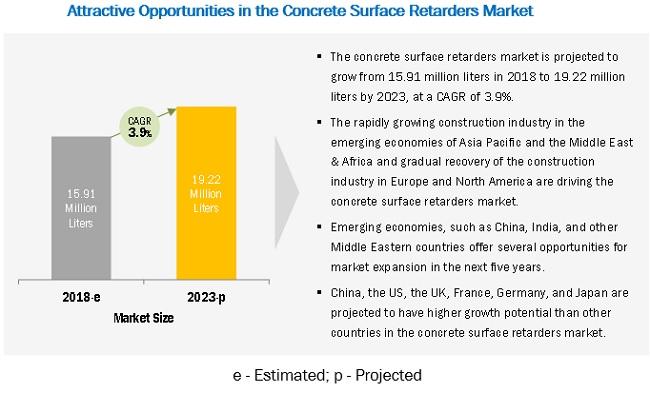

Concrete Surface Retarders Market worth $89.4 million by 2023 : Major Players ar …

The report "Concrete Surface Retarders Market by Raw Material (Organic Agents and Inorganic Agents), Type (Water-based and Solvent-based), Application (Residential and Commercial), and Region (North America, Europe, Asia Pacific) - Global Forecast to 2023", The concrete surface retarders market is projected to grow from USD 72.7 million in 2018 to USD 89.4 million by 2023, at a CAGR of 4.2% between 2018 and 2023. Increase in urban population, demand for…

Precast Concrete Market worth $174.1 billion by 2025 | Major Players are Lafarge …

The report "Precast Concrete Market by Element (Columns & Beams, Floors & Roofs, Girders, Walls & Barriers, Utility Vaults, Pipes, Paving Slabs), Construction Type, End-use Sector (Residential, Non-residential) - Global Forecast to 2025" The global precast concrete market size is projected to grow from USD 130.6 billion in 2020 to USD 174.1 billion by 2025, at a CAGR of 5.9% from 2020 to 2025. The market is projected to grow…

Fire Stopping Materials Market worth $2.4 billion by 2026 : Major Players are Hi …

The report "Fire Stopping Materials Market by Type (Sealants, Mortar, Boards, Putty &Putty Pads, Cast-in Devices), by Application (Electrical, Mechanical, Plumbing), End-Use (Commercial, Industrial & Residential), and Region - Global Forecast to 2026" MarketsandMarkets: The fire stopping materials market is projected to reach USD 2.4 billion by 2026, at a CAGR of 11.6% from USD 1.4 billion in 2021. Fire stopping is a fire protection system for sealings of any…

More Releases for HNWI

Develop business strategies Of Insurance for HNWIs Current State and Future Pros …

Latest industry research report on: Insurance for HNWIs Current State and Future Prospects Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

Request For Sample Report @http://www.marketresearchreports.biz/sample/sample/690241

Timetrics 'Insight Report: Insurance for HNWIs Current State and Future Prospects' analyzes insurance products and services market for HNWIs.

As the HNWI insurance market is constantly evolving, insurers are developing new products and services, with customization a key strategy to meet…

HNWI Asset Allocation : HNWI Wealth and Population - Competitor Strategy, Produc …

ALBANY, NY, April 7, 2017 : This report looks at a detailed breakdown from WealthInsight’s proprietary country report model of HNWI population and wealth.

It provides an analysis of HNWI demographics based on a unique analysis of HNWI dossier database. It analyses trends in HNWIs investment by asset class and looks at a breakdown of foreign and alternative investments.

It provides an in-depth analysis of competitor product strategy, mergers and acquisitions, and…

HNWI Asset Allocation 2020

MarketResearchReports.Biz presents this most up-to-date research on "HNWI Asset Allocation 2020"

Description

This report looks at a detailed breakdown from WealthInsight’s proprietary country report model of HNWI population and wealth.

It provides an analysis of HNWI demographics based on a unique analysis of HNWI dossier database. It analyses trends in HNWIs investment by asset class and looks at a breakdown of foreign and alternative investments.

It provides an in-depth analysis of competitor product strategy,…

The U.S. Vacation Ownership (Timeshare) Market to Gain Significantly during 2017 …

According to a recent research market study focusing on the U.S. market of vacation ownership witnessed an expansion at a significant CAGR during the span of 5 years, which is 2011-2016. Analysts have also made predictions that the market would rise in the next five years enormously. To explore the market status and exact results for future growth, researchers have prepared this study titled “The U.S. Vacation Ownership (Timeshare) Market…

HNWI Asset Allocation provides an model of population and wealth 2020 - Product …

ResearchMoz added Latest Research Report titled " HNWI Asset Allocation 2020 " to it's Large Report database.

Synopsis

This report looks at a detailed breakdown from WealthInsight’s proprietary country report model of HNWI population and wealth.

It provides an analysis of HNWI demographics based on a unique analysis of HNWI dossier database. It analyses trends in HNWIs investment by asset class and looks at a breakdown of foreign and alternative investments.

It provides an…

Switzerland HNWI Wealth Projected to Grow by 18.6% to Reach US$1.7 Trillion

Albany, New York, August 25, 2016: Market Research HUB has announced the addition of the "Switzerland Wealth Report 2016" report to their huge collection of market research reports. This report is the result of extensive research covering the high net worth individual (HNWI) population and wealth management market in Switzerland.

Browse Full Report with TOC - http://www.marketresearchhub.com/report/switzerland-wealth-report-2016-report.html

Summary

Report reviews the performance and asset allocations of HNWIs and ultra-HNWIs in Switzerland. It…