Press release

EU Commission publishes incorrect VAT rates

• So-called "EU VAT Rates Database" incorrect and incomplete• E-commerce merchants and customers affected throughout Europe as of 1 July

• eClear database VATRules has over 800,000 tax codes

Berlin, 24 June 2021 – The database of VAT rates for the EU-27 published by the EU Commission (Tax-UD department) is partly incomplete and incorrect. This is pointed out by the Berlin-based tax technology specialist eClear AG. “The database has obvious gaps. This is a competitive disadvantage for e-commerce merchants who have to rely on the accuracy of the information and bother customers with the incorrectly reported VAT,” says the CEO and Chairman of the Board of eClear AG, Roman Maria Koidl.

**Reduction of the VAT rate from 19 % to 16 % in Germany not taken into account**

For example, the database did not record the temporary VAT reduction from 19 % to 16 % for Germany. “We pointed this out to the Commission in a conversation last year,” Koidl said. But the incorrect data records remained. The Commission, according to its statement, assumes no liability for its data. On the database’s website, the Commission admits that it does not guarantee that the information provided is up-to-date, error-free and complete.

In addition to erroneous data records due to lack of updates, repeated checks in the tax codes used reveal another weakness or inaccuracy. The “EU VAT Rates Database” published in September only knows the first eight digits of the regular ten to eleven digits of the tax codes. As a result, merchants receive incorrect information that can result in additional or reduced payments to the tax authorities: For example, the ingredients of a product may require the application of the reduced VAT rate. This detailed information is usually assigned following the eighth digit in the tax code.

**ECOFIN Council discusses making the application of reduced VAT rates more flexible for member states**

The EU VAT system is highly complex: children’s clothing is reduced in Luxembourg, fruit juice in Poland; red wine is reduced in Portugal, milk in Germany. At its meeting on 18 June, the ECOFIN Council discussed further guidelines for reforming VAT rates. Among other things, the proposals ask for more flexibility and equality for the member states to apply reduced VAT rates. A further increase in country-specific rules is to be expected.

These rules not only apply to imports from third countries such as China, but they also apply to cross-border mail order within the EU – both for merchants and for marketplaces such as Amazon and eBay. The upcoming EU reform further intensifies the issue. When the EU VAT e-commerce package comes into force on 1 July, previous delivery thresholds will be abolished and replaced by an EU-wide threshold (€10,000). Merchants will then be obliged to register for VAT in the destination countries or participate in the EU’s OSS procedure. And they must apply the country-specific VAT rates.

**VATRules: eClear database with 800,000 up-to-date tax codes**

“VATRules simplifies this process,” says Annett Schaberich, syndic tax advisor and Vice President Tax Compliance at eClear. “With the database, merchants always use the current applicable VAT rates when calculating product prices. Updates or temporary changes are automatically taken into account. VATRules minimises costs and time as corrections are significantly reduced.”

The VATRules database comprises 800,000 tax codes including 50,000 exceptions and knows all VAT rates and rules that have to be applied in the EU-27 countries and the UK. VATRules assigns them to the respective product groups of the online retailer. With the help of a 14-digit code, all exemptions, reductions and VAT regulations applicable in the EU are recorded. Fully automated, the continuously updated VAT rates are delivered on demand, embedded in the order processes and applied.

In addition, eClear, with its full-service solution ClearVAT, takes over the VAT reporting fully automatically in all EU-27 countries. The obligatory VAT registration in the EU member state can then be omitted. The Berlin company pays the VAT amounts directly to the responsible tax office in the EU member state, for which eClear assumes liability and the audit risk.

https://eclear.com/article/eu-commission-publishes-incorrect-vat-rates/

Contact eClear AG

Nadine Städtner, VP Comms

email: comms@eClear.com

eClear Aktiengesellschaft

Französische Straße 56, 10117 Berlin, Germany

eClear AG is Europe's only payment service for tax clearing in cross-border e-commerce. With its full-service solution "ClearVAT", the leading tax technology company takes over the complete processing of VAT obligations from cross-border B2C trade transactions. The cloud-based eClear solutions automate and significantly simplify all VAT, customs and payment processes in e-commerce trade. The company was founded in 2016 by Roman Maria Koidl. The supervisory board of eClear AG includes Peer Steinbrück, Thomas Ebeling and Dr Gerhard Cromme. In May 2021, eClear received the BaFin authorisation as an acquirer, which allows the company to operate as a payment service for cross-border e-commerce trade throughout the EU. eClear AG's processes are certified under Auditing Standard 880 of the Institute of German Certified Public Accountants. Further information can be found at https://eclear.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release EU Commission publishes incorrect VAT rates here

News-ID: 2312801 • Views: …

More Releases from eClear AG

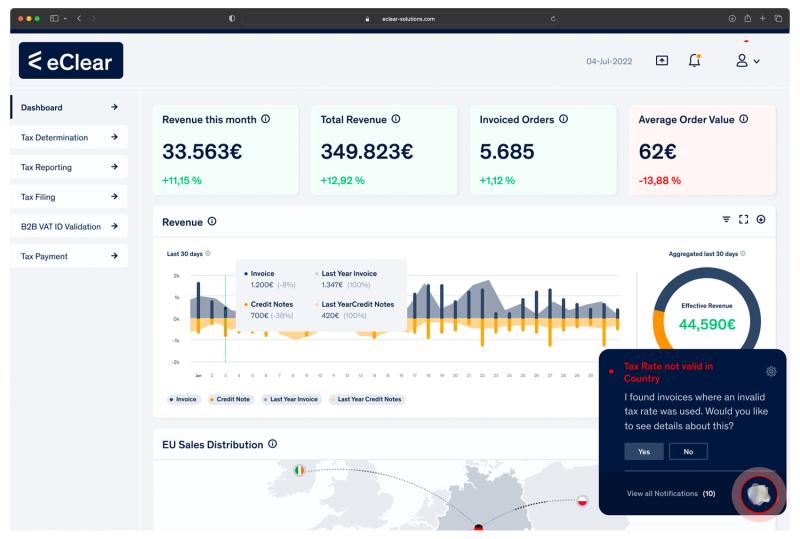

SPOT: The Revolutionary Tool That Alerts You to Incorrect Tax Rates in Real-Time

eClear, a leading VAT and customs compliance solutions provider, is proud to announce the release of its latest innovation - SPOT. SPOT is the first tool that uses real-time invoice data to identify incorrect tax rates, giving businesses the power to prevent costly errors and stay compliant.

SPOT is designed to streamline financial operations, reduce compliance risks, and increase accuracy. With its Automated VAT Audit and Reporting assistant (AVATAR), it can…

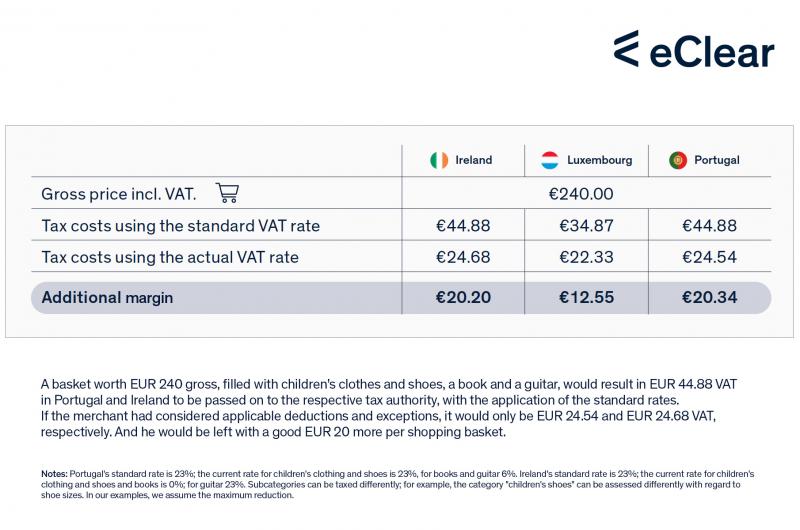

E-Commerce merchants could pay up to EUR 3.8 billion too much VAT in 2022

• Merchants underestimate losses due to VAT exceptions

• Online tool "VAT Optimiser" warns of possible VAT overpayment

Berlin, 16 February 2022 - VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions. It is up to each…

eClear becomes a payment institution

BaFin has granted the Berlin-based start-up eClear permission to act as a payment service for cross-border e-commerce trade throughout the EU for its VAT payment solution "ClearVAT", which is unique in Europe.

Berlin, 3 May 2021 - Berlin-based tax technology specialist eClear AG has been granted a licence to provide payment services by the German Federal Financial Supervisory Authority (BaFin). The licence is valid for the whole of Europe in the…

VAT cut ended in Germany - eClear keeps shop systems up to date

From July to December 2020, the German government had reduced VAT to 16% and 5% respectively. On January 1, 2021, Germany reverted to the previously applicable rates of 19% and 7%. eClear keeps merchant's shop systems in the EU 27 up to date with its automation solutions for tax compliance.

For retailers, an effort is being repeated that was already described as "immense" and "torture" in June 2020 (Handelsblatt, June 5,…

More Releases for VAT

Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerati …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

VAT Dyes Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The VAT dyes market size has grown rapidly in recent years. It will grow from $1.98 billion in 2024 to $2.22 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

VAT Calculator UK - Simplifying VAT Calculations for Businesses and Consumers

Understanding and calculating Value Added Tax (VAT) in the UK has never been easier, thanks to VAT Calculator UK - a free and user-friendly online VAT calculator. This innovative tool allows individuals and businesses to quickly add or remove VAT, calculate VAT-inclusive and exclusive prices, and work out VAT backwards with just a few clicks.

As VAT remains a crucial part of the UK's tax system, having a reliable and accurate…

Steinbrück launches EU VAT engine

"This is something European politicians have been trying to do for more than ten years without success," commented Peer Steinbrück on the stage of the online retailer congress "Plentymarkets" in Kassel before he symbolically put the result of several years of development work into operation together with host Jan Griesel and eClear founder Roman Maria Koidl.

What neither the European Commission nor other institutions can currently demonstrate, the Berlin start-up eClear…

VAT Enabled ERP Software - AxolonERP

VAT Complaint ERP in UAE

The end of the fiscal year of 2016-17 brought a novel taxation scheme in the UAE and Saudi Arabia – VAT. The VAT or Value Added Tax changed the way enterprises of all types and scales worked as far as accounting and finance management is concerned. The invoicing; inventory management; investment and asset planning and billings of all kinds experienced changes and the need of the…

VAT Updates: China, Czech Republic, Romania, Portugal

China Plans to Extend VAT Pilot Scheme to Beijing in July

China’s pilot scheme for VAT which is intended to replace the current business tax in Shanghai is likely to be extended to Beijing in July, this year. Currently, VAT is being applied only to the manufacturing industry. The pilot VAT rates of 11% and 6% are mainly being introduced to support the services sector such as transportation. China commenced the…