Press release

Microfinance Market Emerging Trends And Strong Application Scope by 2031

The microfinance market is projected to rise at a notable growth rate during the forecast period from 2021 to 2031. The growing onus on governments in emerging economies to create employment to boost economic growth is a key factor fueling the microfinance market. Microfinance is a phenomenon that entails social and banking inclusion with the provision of small loans to poor clients, microinsurance, savings and checking accounts, and payment systems among other services. The aim of microfinancing institutions is to offer simple services for microloans for the world's unbanked populations, which includes savings, insurance, and payment products. India is the world's largest microfinance market and is projected to grow at a promising pace in the coming years.Read Report Overview at- https://www.transparencymarketresearch.com/microfinance-market.html

The microfinance market is studied on the basis of service type, provider, and region. Key segments into which the microfinance market is divided based on service type are group and individual micro credit, leasing, micro investment funds, insurance, savings and checking accounts, and others. Key segments into which the microfinance market is divided based on provider are banks and non-banks.

To get the perfect launch ask for a custom report- https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=83934

The report on the microfinance market provides a 360-degree analysis of growth trends, opportunities, and competitive landscape of the said market for the 2021 - 2031 forecast period. Analysts identified key segments in the microfinance market along with their projected growth rate for the forecast period from 2021 to 2031. A detailed analysis of the competitive landscape with insights into the growth strategies and market share analysis of key vendors is a highlight of this report.

Microfinance Market - Key trends

Key factors driving the microfinance market include growth of small and medium enterprises and availability of loan facility for low-income economic groups with the objective to benefit economic growth. The role of governments and financial institutions in developing and underdeveloped nations to provide financial services to help encourage entrepreneurs act on their ideas is creating opportunities in the microfinance market.

The increasing awareness of microfinance supported by access to technology is a key trend fueling the microfinance market. With expanding technological infrastructure, microfinance beneficiaries can make transactions without the need of an intermediate personnel such as microfinance credit officer. The availability of microfinance services in the remotest locations via technology have reduced time and cost constraints, and physical distance from the service outlet is no longer a reason for not availing the services.

Download PDF Brochure- https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=83934

Microfinance is increasingly becoming popular among rural women who are engaged in cottage industries with their growing potential toward household income. This is strengthened by government initiatives that promotes equal opportunities of microfinance for all, strengthening of national payment system, and others.

The evolving character of microfinance is another factor attracting growth in the microfinance market. Stakeholders in the microfinance market are engaged in expanding the delivery of microfinance product and services by leveraging the dramatic penetration of mobile technology and mobile payments. With the wide use of smart technologies and professionalism to manage payment, the scope of growth of microfinance market is immense.

Microfinance Market - Competitive Landscape

Some key players operating in the microfinance market are Annapurna Finance Ltd, Bandhan Bank Ltd., CDC Group Plc, IndusInd Bank Ltd., Kotak Mahindra Bank Ltd., Asirvad Microfinance Ltd, BRAC International Holdings B.V., Grameen Foundation USA, Kiva Microfunds, and P.T. Bank Rakyat Indonesia Tbk.

Request a sample to get extensive insights into the Microfinance Market- https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=83934

Microfinance Market - Regional Dynamics

Asia Pacific accounts for leading revenue contribution to the microfinance market. China and India are leading contributors to the microfinance market in the region. The role of financial institutions in India to roll out microfinance schemes for loans for low economic classes makes the nation leading in the microfinance market.

Browse Latest IT & Telecom Industry Research Reports by TMR

Data Erasure Solutions Market- https://www.transparencymarketresearch.com/data-erasure-solutions-market.html

Edge Computing Market- https://www.transparencymarketresearch.com/edge-computing-market.html

Anti-piracy Protection Market- https://www.transparencymarketresearch.com/antipiracy-protection-market.html

Managed Print Services (MPS) Market- https://www.transparencymarketresearch.com/managed-print-services-market.html

Email Marketing Software Market- https://www.transparencymarketresearch.com/email-marketing-software-market.html

Online Project Management Software Market- https://www.transparencymarketresearch.com/online-project-management-software-market.html

Test Automation Market- https://www.transparencymarketresearch.com/test-automation-market.html

Video Analytics Market- https://www.transparencymarketresearch.com/video-analytics-market.html

Contact Us:

Rohit Bhisey

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Blog: https://tmrblog.com

Email: sales@transparencymarketresearch.com

About Transparency Market Research

Transparency Market Research is a global market research reports company providing business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microfinance Market Emerging Trends And Strong Application Scope by 2031 here

News-ID: 2689029 • Views: …

More Releases from Transparency Market Research

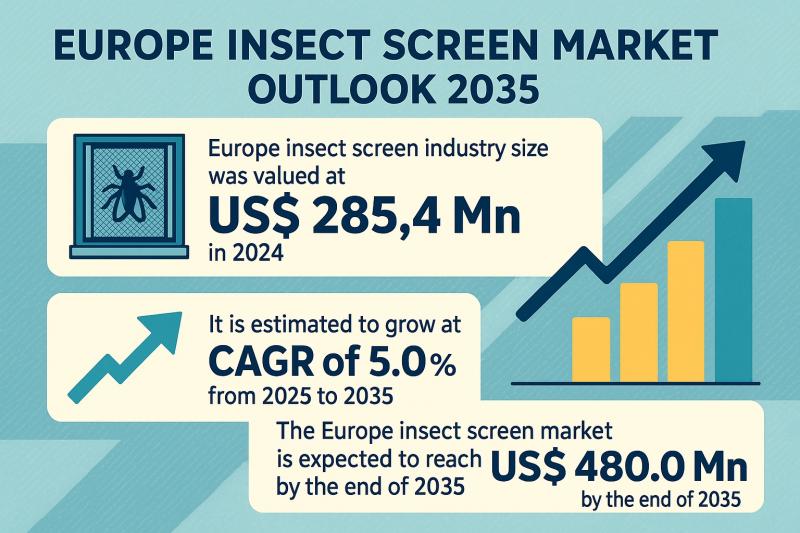

Europe Insect Screen Market Poised for Steady Growth on the Back of Rising Healt …

The Europe Insect Screen Market continues to gain momentum, driven by heightened emphasis on public health, energy efficiency, and sustainable building solutions. Valued at US$ 285.4 Mn in 2024, the market is set to grow consistently and reach US$ 480.0 Mn by 2035, expanding at a CAGR of 5.0% during the forecast period.

Increasing focus on maintaining hygienic indoor environments, coupled with advancements in building technologies, is accelerating the adoption of…

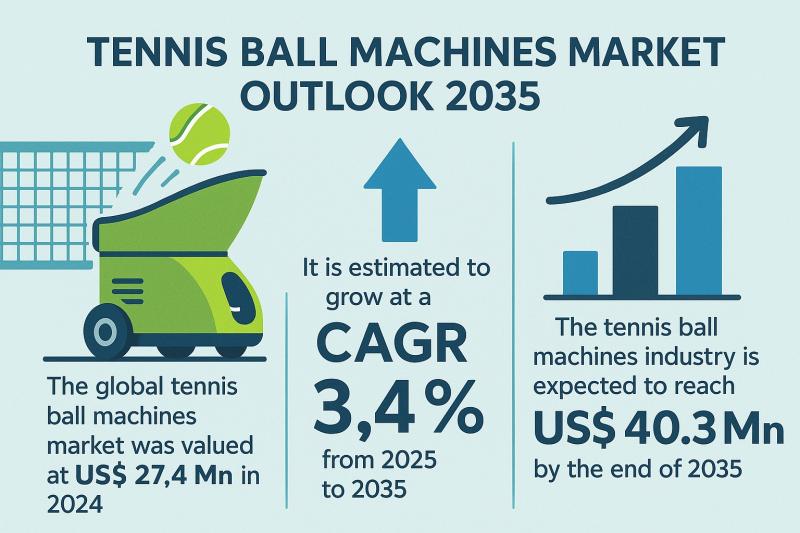

Tennis Ball Machines Market to Reach USD 40.3 Million by 2035, Driven by Rising …

According to a new research report published by Transparency Market Research, the global tennis ball machines market was valued at US$ 27.4 Mn in 2024 and is projected to reach US$ 40.3 Mn by 2035, expanding at a CAGR of 3.4% from 2025 to 2035. The market is witnessing steady expansion driven by a surge in tennis participation, rising adoption of advanced training tools, and strong consumer preference for lightweight,…

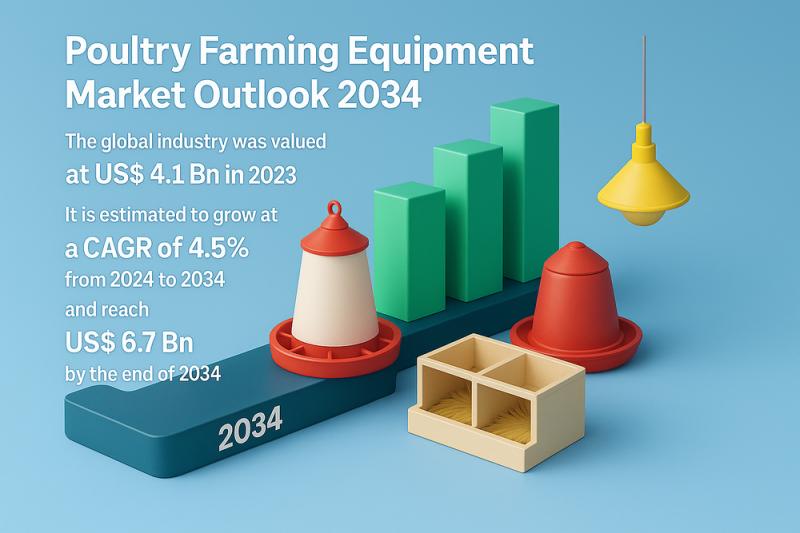

Global Poultry Farming Equipment Market to Reach USD 6.7 Bn by 2034, Driven by A …

The global poultry industry is entering a new era of modernization as farms worldwide adopt advanced, automated equipment to meet soaring demand for poultry products. According to the latest market assessment, the global poultry farming equipment market was valued at US$ 4.1 Bn in 2023 and is projected to expand steadily at a CAGR of 4.5% from 2024 to 2034, reaching US$ 6.7 Bn by 2034. This growth is fueled…

Europe External Blinds Market Set to Reach USD 22.9 Billion by 2034, Driven by S …

The Europe External Blinds Market is positioned for steady growth over the next decade, with market value expected to rise from US$ 15.2 billion in 2023 to US$ 22.9 billion by 2034, expanding at a CAGR of 3.9% from 2024 to 2034. Increasing adoption of smart home solutions, rising environmental consciousness, and strong government regulations supporting energy efficiency are key factors contributing to this growth.

Introduction: External blinds have emerged as…

More Releases for Microfinance

How Microfinance Services Market Is Reshaping Rural Credit & Microfinance Adopti …

HTF MI just released the Global Microfinance Services Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Microfinance Services Market are:

Grameen Bank (Bangladesh), Kiva…

Microfinance Industry to Witness Massive Growth (2024-2031) | Grameen Bank, SKS …

Microfinance Industry Analysis, according DataM Intelligence. Although data provides an overview, the research explores the hidden aspects of the sector, breaking down its intricate dynamics, charting regional dominance, spotting demand patterns, and spotting prospective breakthroughs that could influence how businesses operate in the future.

Will the Microfinance market emerge as the sector's next great thing? To discover the answer, look at the Microfinance market analysis and projections. In-depth insight of the…

Microfinance Market 2024 Size, Global Report till 2031 | Grameen Bank, SKS Micro …

A new Report by DataM Intelligence, titled "Microfinance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2031,"" offers a comprehensive analysis of the industry, which comprises insights on the Microfinance market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts, as well as insightful analysis. The Microfinance market has been growing significantly…

Big Boom in Digital Transformation in Microfinance Market 2020-2027 | MicroFinan …

According to a report on Digital Transformation in Microfinance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Digital Transformation in Microfinance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This…

Digital Transformation In Microfinance Market (impact of COVID-19) with Top Play …

Global Digital Transformation In Microfinance Market: Trends Estimates High Demand by 2027

The “Digital Transformation In Microfinance Market” 2020 report includes the market strategy, market orientation, expert opinion and knowledgeable information. The Digital Transformation In Microfinance Industry Report is an in-depth study analyzing the current state of the Digital Transformation In Microfinance Market. It provides a brief overview of the market focusing on definitions, classifications,…

Trust Microfinance and loans Market Impressive Gains including key players: Equi …

Trust Microfinance and loans Market

The Global Trust Microfinance and loans Market 2020 Research Report is a professional and in-depth study on the current state of the Trust Microfinance and loans Market industry.

Global Trust Microfinance and loans Market - Global Drivers, Restraints, Opportunities, Trends, and Forecasts up to 2027. Market Overviewing the present digitized world, 80% of the data generated is unstructured. Organizations are using Trust Microfinance and loans technology…