Press release

Digital Banking Platforms Market I Analysis by Size, Business Strategies, Revenue, Share, Trends, Growth, Developments Forecast by 2029

The global Digital Banking Platforms market study includes an assessment of the various factors that are driving the market. Analysts at Fairfield Market Research have included a thorough analysis of the market to present a comprehensive research report. The research report highlights drivers, restraints, opportunities, and threats present in the global Digital Banking Platforms market. With a focus on every aspect, the report suggests the right time to invest in its readers. The report begins with an executive summary, which gives a brief description of the market holds for every enthusiast during the forecast period.Get a TOC of Global Digital Banking Platforms Market: https://www.fairfieldmarketresearch.com/report/digital-banking-platforms-market/request-toc

Complete with global market figures and detailed estimation of every segment, the global Digital Banking Platforms market research report aims to take a clear stand on the market's trajectory. For the same purpose, the researchers have thoroughly segmented the market, thus unveiling the most profitable opportunities.

Segment analysis includes sub-segmentation to determine value and volume share. Analysts have highlighted BPS, revenue, and other important factors. The research study on the global Digital Banking Platforms market shows the contribution of segment to the global market during the forecast period. It offers detailed information about emerging trends and upcoming ones.

Global Digital Banking Platforms Market: Competition Landscape

Appway (Switzerland), Alkami (US), Apiture (US), Backbase (Netherlands), EdgeVerve (India), ebankIT (England), BNY Mellon (US), CR2 (Ireland), Finastra (UK), Mambu (Germany), MuleSoft (US), Fiserv (US), Intellect Design Arena (India), nCino (US), Oracle (US), SAP (Germany), NCR (US), NETinfo (Cyprus), Sopra Banking Software (France), Temenos (Switzerland), Velmie (US), Worldline (France) TCS (India), and Technisys (US).

Key questions answered in the report:

What will be the size of the global Digital Banking Platforms market by 2025?

What are the drivers in the market?

Which is the leading segment in the global Digital Banking Platforms market?

Which region will emerge as the leading one?

Who are the top players in the global Digital Banking Platforms market?

Fairfield Market Research aims to provide complete product mapping and evaluation of all the possible market scenarios to turn threats into opportunities. Researchers also include a chapter on company profiles, which shares information about the financial status of the companies, their product launches, investment plans, research and development, and product pipelines. The report ends with analysts opinion, which is our unique selling point to help the reader make a well-informed decision about investments.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.fairfieldmarketresearch.com/report/digital-banking-platforms-market/request-customization

Table of Contents

Executive Summary: This covers industry trends and gives a brief account of what the report holds. It includes global market figures, market size, and information about leading segments.

Market Dynamics: It includes an explanation about analysis of regional marketing, supply chain analysis, challenges, opportunities, and drivers analyzed in the report.

DROT: This chapter includes a thorough evaluation of the drivers, restraints, opportunities, and threats. This helps in understanding the direction this market is likely to take in the next five years and why.

Segmentation: The chapter on segmentation includes comprehensive segmentation of the market on the basis of product, application, end use, and geography. This gives the reader an insight into the leading segments, their shares, and the trends that will remain consistent.

SWOT: The report is complete with a SWOT analysis of the market to help readers make well-informed decisions about investments.

Porter's Five Forces: In addition to an explanation, this chapter includes a graph to give the reader a clear picture of the aspects that are being studied

Key Players: This chapter includes an assessment of the key companies in the global market. It tracks their movements such as mergers and acquisitions, expansions, establishment date of companies, and areas served, manufacturing base, products in the pipeline, and revenue of key players.

Contact

Fairfield Market Research

London, UK

UK +44 (0)20 30025888

USA +1 (844) 3829746 (Toll-free)

Email: sales@fairfieldmarketresearch.com

Web: https://www.fairfieldmarketresearch.com/

Follow Us: https://bit.ly/3voYIm9

About Us

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values an eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market I Analysis by Size, Business Strategies, Revenue, Share, Trends, Growth, Developments Forecast by 2029 here

News-ID: 2848954 • Views: …

More Releases from Fairfield Market Research

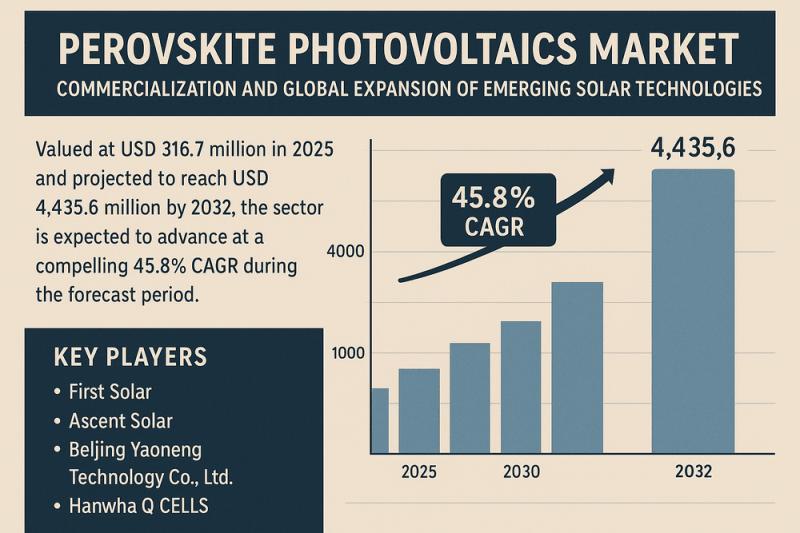

Perovskite Photovoltaics Market Set for Transformational Growth Through 2032

The Perovskite Photovoltaics Market is entering a pivotal phase of commercialization and global expansion as emerging solar technologies gain momentum across residential, commercial, and utility-scale applications. Valued at USD 316.7 million in 2025 and projected to reach USD 4,435.6 million by 2032, the sector is expected to advance at a compelling 45.8% CAGR during the forecast period. This remarkable growth trajectory reflects rising demand for low-cost, high-efficiency solar modules, continued…

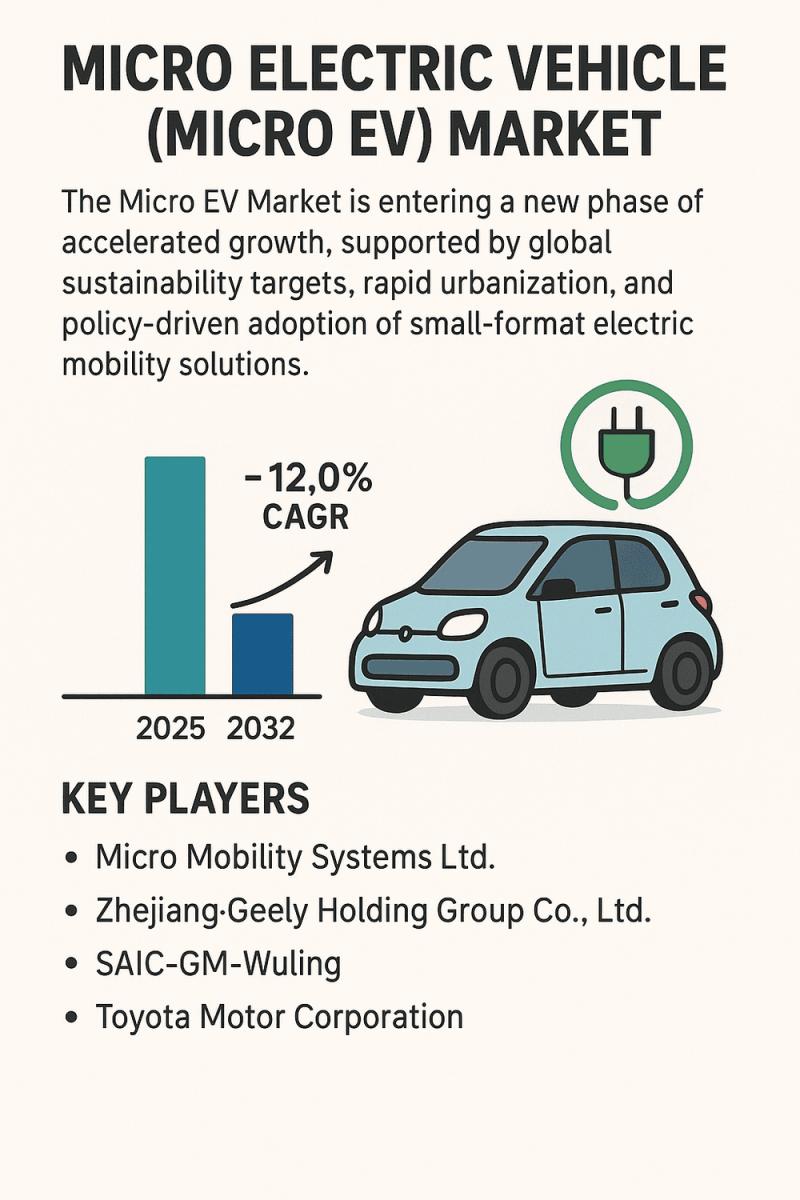

Micro EV Market Accelerates Toward a Sustainable Urban Mobility Future Through 2 …

The Micro Electric Vehicle (Micro EV) Market is entering a new phase of accelerated growth, supported by global sustainability targets, rapid urbanization, and policy-driven adoption of small-format electric mobility solutions. Valued at USD 12.1 billion in 2025 and projected to reach USD 26.8 billion by 2032, the industry expands at a 12.0% CAGR, reflecting strong market confidence in compact, zero-emission vehicles. These vehicles-ranging from two-seater microcars to lightweight quadricycles-are increasingly…

Micro-LED Displays Market Set for Explosive Growth Driven by Next-Gen Visual Tec …

The Micro-LED Displays Market is witnessing one of the most transformative growth trajectories in the global display technology landscape. Valued at USD 1.0 billion in 2025 and projected to reach USD 21.8 billion by 2032, the industry is set to expand at a remarkable CAGR of 55.3% during the forecast period. This rapid rise reflects the technology's superior performance advantages, expanding application base, and accelerated commercialization efforts by leading display…

UK Last Mile Delivery Market Demonstrates Strong Growth Outlook as E-commerce Ac …

The UK Last Mile Delivery Market is undergoing a transformative shift driven by rapidly evolving consumer expectations, the surging influence of e-commerce, and increasing pressure on supply chains to provide faster, more flexible, and more efficient delivery services. As digital retail penetration accelerates and omnichannel fulfillment becomes a competitive necessity, the last-mile segment has emerged as the most critical and value-defining component of the UK logistics ecosystem. The market is…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…