Press release

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories such as S-Corp, LLC, and a sole proprietorship, among many others. Let us recognize and understand the most prominent business tax deductions for 2022.Home-office deduction: If you work from home most of the time and have a dedicated office space, you can avail of this deduction. You can list this deduction on your Form 1040 if you utilize a specific part of your home exclusively to run your business. You can also claim associated expenses, including repairs, insurance, and utilities related to this office space. The portion of the house must be used exclusively and regularly for business purposes to avail of a home-office tax deduction.

Real estate taxes for office/ business space: If you have a separate business property, which plays a crucial part in running the business, such as an office, cold storage, or inventory space, you can deduct the real estate taxes related to it. However, documents supporting the payment of these taxes are required.

Cost of business meals: If you have had necessary business meetings with clients, employees, or vendors over a meal, these meals can be deducted. However, for the meal expenses to qualify as a deductible, the meal must have been conducted strictly for business purposes and nothing else.

Cost of goods sold: If your small business manufactures products or resells products manufactured by other companies, there are several costs associated with the goods being sold, which can be listed as deductible on Form 1040. The cost of goods sold consists of expenses such as storage costs, the cost of the raw materials or finished products, and factory overhead, among many others. Some indirect costs related to the goods sold include rents, business taxes, handling charges, and processing costs.

Capital expenses: Capital expenses refer to the money spent on capital assets. These assets take more than a year to complete utilization. Also referred to as CAPEX, these expenses include the cost of vehicles, technological equipment such as computers, manufacturing equipment, and buildings, among countless other assets. You can deduct a part of these costs over the years by recovering the amount spent on capital assets through depreciation, depletion, or amortization, as one cannot obtain a current deduction for such expenses.

Operating expenses: Operating expenses, or OPEX, refer to the money spent on the small business to purchase fully consumed assets within a year. OPEX allows businesses to carry on day-to-day processes and is unavoidable. Some examples of OPEX include the money spent on office supplies and the money spent on paying employee wages.

Business education expenses: Some small businesses accountant near me require special skills and training, which can only be obtained through paid seminars and classes. These costs can also be deducted as a business expense from the business's taxable income, which ultimately brings down the tax bills to a great extent.

Business equipment and internet bills: If an internet connection is necessary for your business to function, the associated fees, such as the monthly subscription and installation fees, can also be listed as a deductible for the small business. Some mandatory equipment such as computers, furniture, and other essentials are also needed to set up a business. Their costs can also be deducted from the tax bill if the business can list out all these expenditures and produce receipts and documentation related to these purchases.

Travel expenses: If you are traveling out of the city, you can list the cost of travel, food, and lodging as tax deductibles on Form 1040. Some travel expenses commonly listed as tax deductibles include hotel stays, airfare, meals, and car rentals necessary to move about. The IRS might ask one to produce the receipts for these expenses. Therefore, it is suggested that small businesses keep the receipts concerned with these expenses safe.

Office supplies and phone expenses: The cost of stationery items required to ensure the smooth functioning of processes within the office can also be listed as business tax deductibles. These expenses include ink, pens, paper, toner, and phone expenses. If your business requires a dedicated phone, the phone's cost and associated charges are also referred to as business expenses, which can be listed as tax deductible.

Employee benefit programs: A business can deduct the money spent on employee benefit programs. These benefit plans can include health insurance plans, education assistance, welfare benefit funds, etc. It is essential to notice that one cannot deduct the cost of life insurance coverage if the small business owner is a direct beneficiary.

Costs of professional services availed: A small business can also list the cost of hiring a professional service, such as a lawyer or an accountant, as a business tax deductible. The cost incurred for legal advice or representation for matters related to the business can also be listed as tax-deductible.

Bad debt incurred by the business: A debt that the business has provided to a party, which has been deemed as uncollectible, can be treated as tax-deductible for small businesses. Bad debts include money owed by vendors or customers which cannot be recovered. The deduction obtained to offset losses incurred due to bad debt must be considered carefully.

Gifts provided to employees or clients: Small businesses often give employees and clients gifts to incentivize them to maintain loyalty to the business. Expenses such as employee perks, bonuses for holidays, and client gifts are also considered deductibles.

Charitable contributions made by the business: The IRS has incentivized Taxpayers to indulge in Charitable contributions by deeming charitable donations to specific charities exempt from taxes as tax deductibles. Businesses can provide money, goods, or services to these charities and deduct the cost of donated resources as a deductible.

Small business owners often need help with the amount of effort and time that goes into business tax planning. This keeps them from focusing on building their business and paying attention to matters directly affecting the revenues generated. Therefore, it is suggested that owners of small businesses reach out to providers of business tax services that are well-versed in effective tax-saving strategies. Having an in-house accountant or tax professional can be very expensive for businesses starting up or growing out of their initial phases. It is therefore suggested that businesses seek help from online business tax service providers such as NSKT Global. NSKT Global can help businesses save loads of tax money with the most efficient tax-saving strategies. Head over to the official website (https://www.nsktglobal.com/)of NSKT Global to find out how our team can help your business save money on taxes.

Source URL:-https://www.nsktglobal.com/top-business-tax-deductions-in-2022

Schedule a Free Consultation:-

https://calendly.com/nskt-global-us-office/30min?month=2022-12

Address

Charlotte City Center, 25 North Tryon Street, Suite 1600, Charlotte, North Carolina, 28202

North Tryon Street

NSKT Global excels in providing Online Accounting & Bookkeeping services, Tax Preparation/Planning services, Virtual CFO services, and Payroll Services while maintaining a track of accounts receivable and payable. It serves as an umbrella for all the financial needs of a business and provides its services at several prices. The monthly rates depend on the number of transactions a company is involved in and are pretty priced to provide its customers with value for money.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Business Tax Deductions in 2022 here

News-ID: 2896672 • Views: …

More Releases from NSKT Global

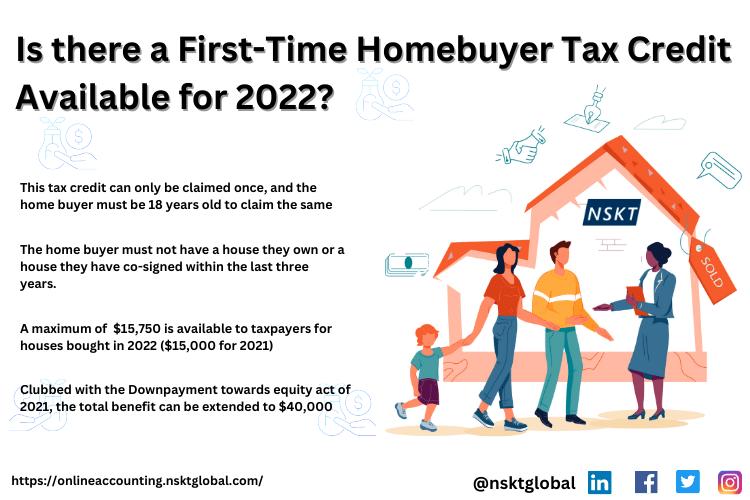

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

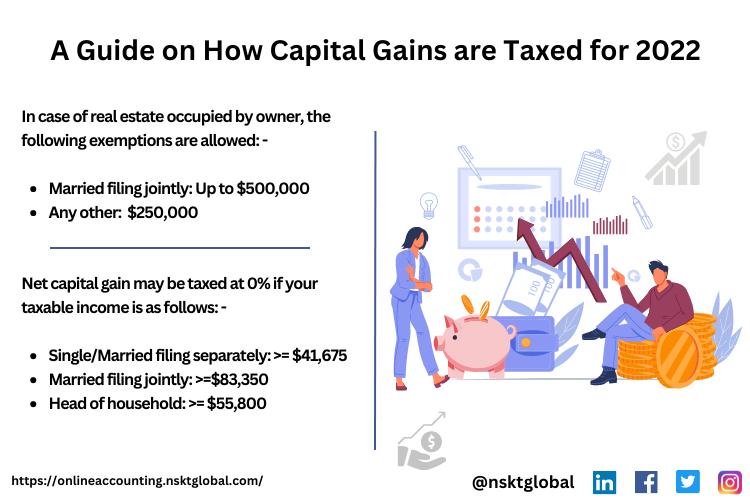

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

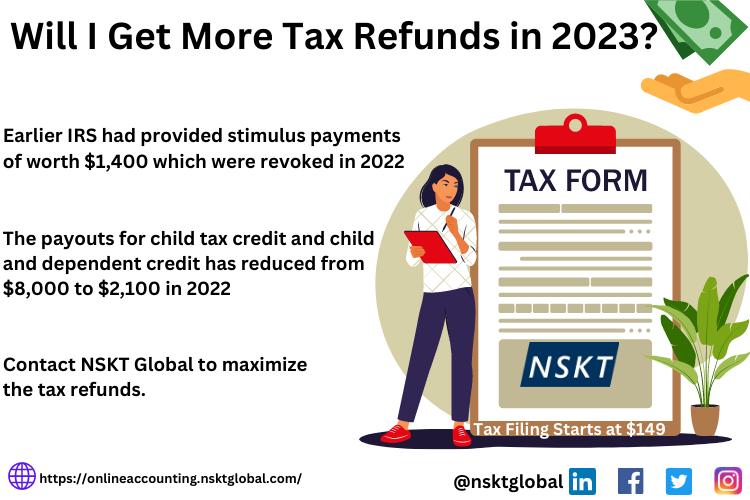

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Small

Succeeding Small Launches Small Business Give-Back Giveaway in Celebration of Sm …

Succeeding Small Launches Small Business Give-Back Giveaway in Celebration of Small Business Month

Honoring Local Colorado Springs Businesses That Make a Difference in Their Community

COLORADO SPRINGS, CO - Succeeding Small, a go-to guide for small business success in small business marketing, is celebrating Small Business Month with the launch of its Small Business Give-Back Giveaway - a contest aimed at honoring the small, service-based businesses that make a meaningful difference in…

Small Molecules, Big Impact: The Rise of the Small Molecule Immunomodulators Mar …

Small Molecule Immunomodulators Market worth $270.8 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Small Molecule Immunomodulators Market - (By Product (Disposable, Reusable), By Application (Colorectal, Thoracic, Orthopedic, Ophthalmology, Neurosurgery, Cardiac Surgery, Gynecology, Others), By End User (Hospitals, Ambulatory Surgical Centers, Clinics, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to…

Powering Small: Small Gas Engines Market Advances (2023-2032)

"According to the research report, the global small gas engines market was valued at USD 2.75 billion in 2022 and is expected to reach USD 4.23 billion by 2032, to grow at a CAGR of 4.4% during the forecast period."

Polaris Market Research has recently published the latest update on Small Gas Engines Market: By Size, Latest Trends, Share, Huge Growth, Segments, Analysis and Forecast, 2030 that offers detailed market analysis,…

Small Batch Freeze Dryer Market: Increasing Demand for Small-scale Freeze Drying …

Global Small Batch Freeze Dryer Market Overview:

The Small Batch Freeze Dryer market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Small Batch Freeze Dryer market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and…

Global Small Gas Engines Market, Global Small Gas Engines Industry, Covid-19 Imp …

The Small Gas Engines market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Small Gas Engines Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Small Gas Engines market. The report focuses on well-known providers…

Small Appliances Market: Strategic Assessment of Emerging Technologies in Small …

Small appliances market is forecasted to grow substantially in all market segments through 2016 owing to the rise in living standards and need for more comfort. Small appliance industry consists of home appliances that are movable or partially movable and can be used on tables, counters, or other platforms. The growth of small appliances market is expected to be driven by product innovation, upgradation of existing products, and value-added features…