Press release

Mobile Money Market Size, Segmentation, Parameters, and Forecast by 2032

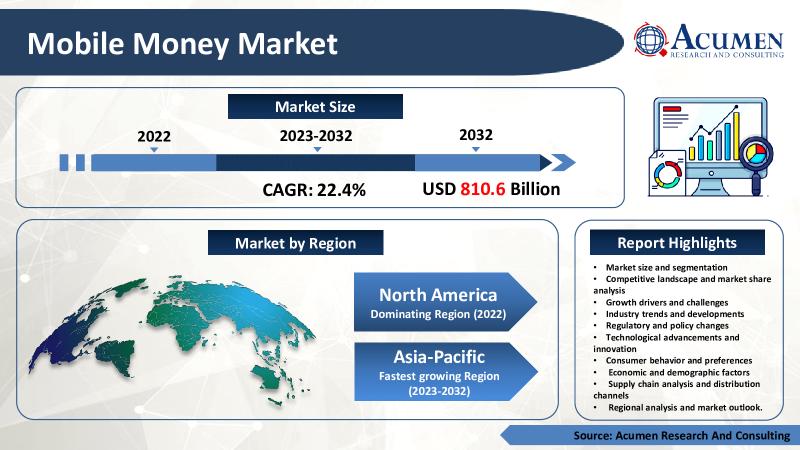

Global Mobile Money Market Size in 2022 was USD 108.6 Billion, Market Value set to touch USD 810.6 Billion at 22.4% CAGR by 2032Mobile Money Market Overview

Mobile Money refers to the use of mobile devices to conduct financial transactions, such as sending and receiving money, paying bills, and accessing banking services. The Mobile Money market has witnessed significant growth in recent years, driven by the increasing penetration of smartphones, rising demand for digital payments, and the growing need for financial inclusion. Mobile Money services offer several advantages over traditional banking methods, such as convenience, accessibility, and security. They have become particularly popular in emerging markets where access to traditional banking services is limited, enabling users to conduct transactions even in remote locations. Mobile Money applications have a diverse range of use cases, from enabling seamless peer-to-peer payments to facilitating e-commerce transactions and offering mobile banking services. With the ongoing shift towards digital payments, the Mobile Money market is expected to continue its growth trajectory in the coming years.

Download Sample Report Copy Of This Report From Here: https://www.acumenresearchandconsulting.com/request-sample/381

Mobile Money Market Research Report Highlights and Statistics

● The global Mobile Money market size in 2022 stood at USD 108.6 Billion and is set to touch USD 810.6 Billion by 2032, growing at a CAGR of 22.4%

● Mobile Money Market growth is primarily driven by the increasing adoption of mobile devices and the rise of digital payments.

● Mobile money services, such as mobile banking, mobile payments, and mobile wallets, offer convenience, security, and accessibility to users, particularly in emerging markets where traditional banking services may be limited.

Trends in the Mobile Money Market

● The rise of digital wallets: Mobile wallets, such as Apple Pay and Google Wallet, are becoming increasingly popular as a way for users to store their payment information securely and make transactions easily.

● Mobile payments in brick-and-mortar stores: Mobile payments are increasingly being used in physical stores, with mobile devices used to make payments at the point of sale.

● Biometric authentication: Mobile money services are adopting biometric authentication methods, such as facial recognition and fingerprint scanning, to provide users with enhanced security and convenience.

● Growth of peer-to-peer (P2P) payments: P2P mobile payment services, such as Venmo and PayPal, are becoming more popular for individuals to make payments to each other.

● Expansion of mobile banking: Mobile banking is becoming increasingly important for financial institutions, allowing customers to check their account balances, transfer funds, and make payments using their mobile devices.

● Integration of mobile money with e-commerce: Mobile money is being integrated with e-commerce platforms, allowing users to make transactions directly from their mobile devices.

● Increasing use of mobile money in remittances: Mobile money is being used to facilitate remittance payments, allowing individuals to send and receive money across borders quickly and securely.

Mobile Money Market Dynamics

● Increasing adoption of smartphones: With the proliferation of smartphones, more people have access to mobile money services, driving growth in the market.

● Growing penetration of mobile internet: As the availability and affordability of mobile internet continues to increase, more people are able to access and use mobile money services.

● Rise of digital payments: The shift towards digital payments and away from cash is driving demand for mobile money services, as they offer a convenient and secure way to make payments.

● Mobile money for government payments: Governments are increasingly using mobile money to distribute social welfare and other payments to citizens, reducing the need for physical cash transactions.

● Mobile money for micropayments: Mobile money is being used for micropayments, such as for transportation or parking, allowing users to pay for small transactions easily and efficiently.

● Integration with other financial services: Mobile money services are being integrated with other financial services, such as insurance and loans, to provide users with a comprehensive range of financial products.

● Financial inclusion initiatives: Mobile money services are seen as a key tool for increasing financial inclusion, particularly in emerging markets where access to traditional banking services is limited.

Growth Hampering Factors in the market for Mobile Money

● Lack of infrastructure: The growth of the mobile money market can be hampered by a lack of infrastructure, such as access to reliable internet connectivity, electricity, and mobile devices, especially in rural areas.

● Limited regulatory framework: Without proper regulatory frameworks in place, there may be limited consumer trust in the security and stability of mobile money services, which can hinder adoption and usage.

● Cybersecurity risks: Mobile money services are vulnerable to cybersecurity risks, including hacking, phishing, and other forms of fraud, which can impact the trust and adoption of these services.

● Limited interoperability: The lack of interoperability between different mobile money providers can limit the convenience and accessibility of these services, particularly for consumers who need to transfer money between different providers.

● Insufficient agent networks: The availability and quality of agent networks, which provide the physical infrastructure for cash-in and cash-out transactions, can impact the accessibility and adoption of mobile money services.

● Limited financial literacy: A lack of financial literacy and education can limit consumer understanding and trust in mobile money services, particularly in emerging Low levels of financial inclusion: Mobile money services may struggle to gain traction in markets with low levels of financial inclusion, where many people still lack access to formal financial services.

● Competition from traditional financial institutions: Traditional financial institutions may compete with mobile money providers by offering their own digital financial services, limiting the market share of mobile money providers.

● Limited merchant acceptance: Without widespread acceptance at merchants and retailers, mobile money services may not be seen as a viable alternative to cash or traditional payment methods.

Mobile Money Market Key Players

M-PESA (Kenya), WeChat Pay (China), Alipay (China), PayPal (United States), Paytm (India), Google Wallet (United States), Samsung Pay (South Korea), Square Cash (United States), Venmo (United States), Zelle (United States), Cash App (United States), Apple Pay (United States), GCash (Philippines), Tigo Money (Latin America), Orange Money (Africa), Airtel Money (India and Africa), Payoneer (United States), TransferWise (United Kingdom), Skrill (United Kingdom) and PayU (India).

Market Segmentation

● By Mode of Transaction

○ Direct Mobile Billing

○ NFC/Smart Card

○ SMS

○ Mobile Web/WAP Payments

○ Mobile Apps

○ STK/USSD

○ QR Codes

○ IVRS

○ Others

● By Payment Nature

○ Person to Business (P2B)

○ Person to Person (P2P)

○ Business to Business (B2B)

○ Business to Person (B2P)

● By Type of Payments

○ Proximity Payments

○ Remote Payments

● Based on Application

○ Bill Payments

○ Money transfers

○ Travel & Ticketing

○ Airtime Transfer & Top-Ups

○ Coupons

○ Merchandise

● Industry Vertical

○ Telecom and IT

○ BFSI

○ Healthcare

○ Media and entertainment

○ Travel and hospitality

○ Retail

○ Energy and utilities

○ Transportation and logistics

○ Others

Mobile Money Market Overview by Region

● North America's Mobile Money market share is the fastest growing globally, attributed to factors such as a high level of banking penetration and the dominance of traditional payment methods such as credit cards. However, examples of leading mobile money services in the region include Venmo in the US and Interac in Canada.

● The Asia-Pacific region's Mobile Money Market share is the largest, driven by the increasing adoption of mobile devices and the need for more accessible financial services. Examples of leading mobile money services in the region include Paytm in India, WeChat Pay in China, and GCash in the Philippines.

● Europe is another key market for Mobile Money, driven by factors such as the increasing adoption of mobile devices and the need for more accessible financial services. Examples of leading mobile money services in the region include Vodafone Wallet in the UK, Swish in Sweden, and MobilePay in Denmark.

● The South American and MEA regions have a nascent Mobile Money market share. The region's growth can be attributed to several factors, including a large unbanked population, widespread mobile phone penetration, and supportive regulatory frameworks. Examples of leading mobile money services in Africa include M-PESA in Kenya, Airtel Money in Uganda, and EcoCash in Zimbabwe.

Get TOC's From Here@ https://www.acumenresearchandconsulting.com/table-of-content/mobile-money-market

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/381

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Money Market Size, Segmentation, Parameters, and Forecast by 2032 here

News-ID: 2980187 • Views: …

More Releases from Acumen Research and Consulting

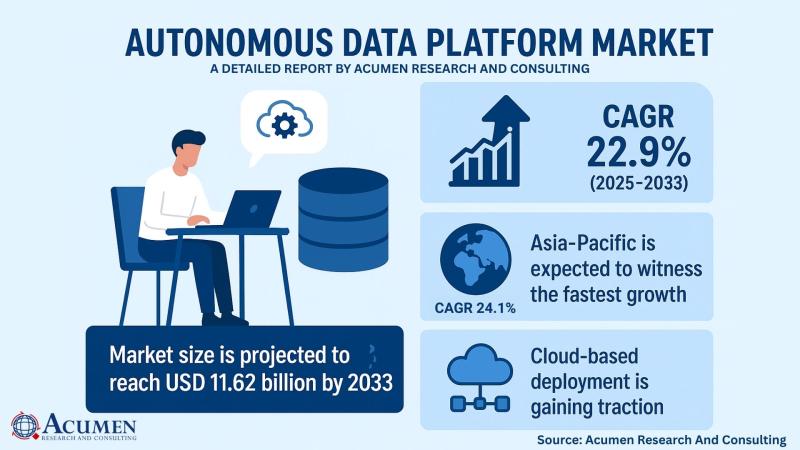

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

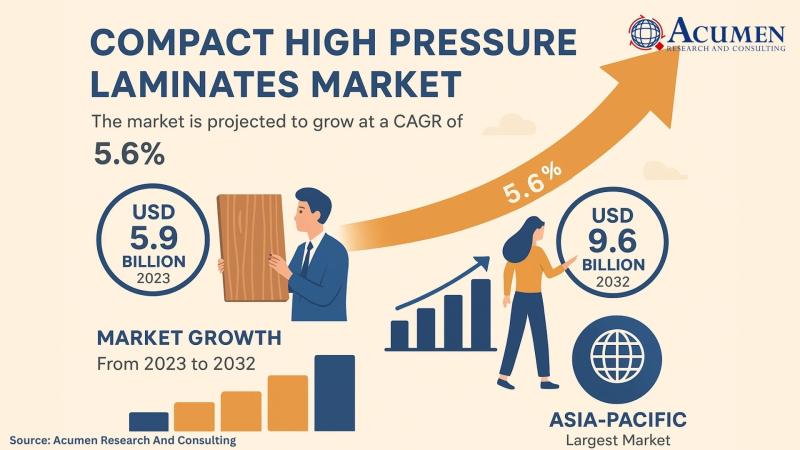

Compact High Pressure Laminates Market to Reach USD 9.6 Billion by 2032, Driven …

The Compact High Pressure Laminates Market is gaining remarkable momentum as industries across construction, interior design, healthcare, and commercial applications increasingly adopt durable, stylish, and sustainable surfacing solutions. Valued at USD 5.9 Billion in 2023, the market is projected to reach USD 9.6 Billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 5.6%.

Get Free PDF Sample Pages of This Report: https://www.acumenresearchandconsulting.com/request-sample/3646

Compact High Pressure Laminates, or Compact HPL,…

Culture Media Market Set to Surge Beyond USD 17.32 Billion by 2032, Driven by Ad …

Culture Media Market Poised for Robust Expansion Amid Biotechnology Boom

The Culture Media Market has emerged as a cornerstone of modern life sciences, enabling researchers and manufacturers to cultivate, identify, and preserve microorganisms and cells for critical applications. From drug discovery to diagnostic testing, culture media plays an indispensable role in advancing human health and biotechnology.

According to Acumen Research and Consulting, the global Culture Media Market size was valued at USD…

Green Energy Market Size to Hit USD 2.41 Trillion by 2032 | Key Trends, Share & …

The global Green Energy Market is experiencing unprecedented momentum. According to Acumen Research & Consulting, the market reached USD 1.15 trillion in 2023 and is forecast to grow at a CAGR of 8.7% from 2024 to 2032, reaching approximately USD 2.41 trillion by 2032. This Green Energy Market Analysis highlights the sweeping scale of investment and innovation driving the sector forward.

Green Energy Market Size & Growth Snapshot

• 2023 market size: USD…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…