Press release

With 26.1% CAGR, Peer to Peer (P2P) Lending Market to Hit USD 626.5 Billion by 2028 | IMARC Group

IMARC Group, a leading market research company, has recently releases report titled "Peer to Peer (P2P) Lending Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028" The study provides a detailed analysis of the industry, including the global peer to peer (P2P) lending market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.Report Highlights

How big is the peer-to-peer (P2P) lending?

The global peer to peer (P2P) lending market size reached US$ 147.9 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 626.5 Billion by 2028, exhibiting a growth rate (CAGR) of 26.1% during 2023-2028.

What is peer to peer (P2P) lending?

Peer-to-peer (P2P) lending, or marketplace lending, is a financial platform connecting individuals or businesses seeking loans with potential lenders. It is a form of debt financing that eliminates traditional intermediaries, such as banks or financial institutions, by directly connecting borrowers and lenders through online platforms. In P2P lending, borrowers create loan listings stating the amount they need, the purpose of the loan, and other relevant detail, which is reviewed by potential lenders who choose to fund the loans that align with their investment criteria. The lending platform facilitates loan transactions, including origination, repayment, and collection. It also uses technology and data analytics to assess creditworthiness, determine interest rates, and manage risk, which often employs credit scoring models and verification processes to evaluate borrower eligibility and assign appropriate interest rates. Additionally, P2P lending platforms provide transparency by disclosing loan details, borrower information, and repayment terms to lenders. As a result, P2P is gaining immense traction across the globe.

Request for a sample copy of this report: https://www.imarcgroup.com/peer-to-peer-lending-market/requestsample

What are the growth prospects and trends in the peer to peer (P2P) lending industry?

The market is primarily driven by the significant expansion of small and medium-sized enterprises (SMEs). In addition, P2P lending platforms provide an alternative source of financing for individuals and businesses to access funds quickly and conveniently, often with less stringent requirements and paperwork which contributes to market growth. Moreover, several technological advancements in P2P lending platforms to streamline loan origination, credit assessment, and loan servicing processes and enhance operational efficiency, reduce costs, and improve the user experience for borrowers and lenders, represent another major growth-inducing factor. Along with this, the extensive use of smart contracts on blockchain technology has improved the reliability and transparency of borrowing and lending processes, thus fueling market growth. Besides this, the growing consumer preference for online loans to avoid cumbersome documentation and lengthy procedures is also driving market growth. Apart from this, the rising demand for P2P lending, which offers investors the opportunity to diversify their investment portfolios by allocating funds across a range of loans with varying risk profiles that help mitigate the risk and potentially enhance investment returns, is propelling the market growth.

Furthermore, the rapid digitization of the banking, financial services, and insurance (BFSI) sector, the rising real estate lending, and the increasing number of students studying abroad created an escalating demand for educational loans, thus influencing the market growth. Other factors including the growing demand for alternative financing options that offer low fees and convenient repayment choices and the emergence of green financing to connect borrowers seeking funds for sustainable projects, such as renewable energy installations, energy-efficient upgrades, or eco-friendly businesses, with environment-conscious lenders is also creating a positive market outlook.

What is included in market segmentation?

The report has segmented the market into the following categories:

Breakup by Loan Type:

Consumer Lending

Business Lending

Breakup by Business Model:

Marketplace Lending

Traditional Lending

Breakup by End User:

Consumer (Individual/Households)

Small Businesses

Large Businesses

Real Estate

Others

Breakup by Region:

North America (U.S. & Canada)

Europe (Germany, United Kingdom, France, Italy, Spain, Russia, and Others)

Asia Pacific (China, India, Japan, South Korea, Indonesia, Australia, and Others)

Latin America (Brazil, Mexico)

Middle East & Africa

Ask Analyst for Customization and Browse full report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=2551&flag=C

Who are the key players operating in the industry?

The report covers the major market players including:

Avant Inc.

Commonbond Inc.

Funding Circle Ltd.

LendingClub Corporation

Lendingtree Inc. (InterActiveCorp and Tree.com Inc.)

On Deck Capital Inc.

Prosper Marketplace Inc.

Retail Money Market Ltd.

Social Finance Inc.,

Upstart Network Inc.

Zopa Limited.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Related Reports:

https://www.digitaljournal.com/pr/news/imarc/atherectomy-devices-market-size-cross-to-revenue-us-1-260-million-by-2028-cagr-of-5-

https://www.digitaljournal.com/pr/news/imarc/with-14-cagr-smart-sensor-market-size-to-reach-us-107-8-billion-by-2023-2028

https://www.digitaljournal.com/pr/news/imarc/europe-ceramic-tiles-market-size-to-grow-at-3-6-cagr-set-to-reach-us-12-8-billion-by-2028

https://www.digitaljournal.com/pr/news/imarc/china-electric-vehicle-battery-market-a-growth-rate-cagr-of-25-1-during-2023-2028

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Email: sales@imarcgroup.com

Follow us on Twitter: @imarcglobal

LinkedIn: https://www.linkedin.com/company/imarc-group/mycompany/

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release With 26.1% CAGR, Peer to Peer (P2P) Lending Market to Hit USD 626.5 Billion by 2028 | IMARC Group here

News-ID: 3178531 • Views: …

More Releases from IMARC Group

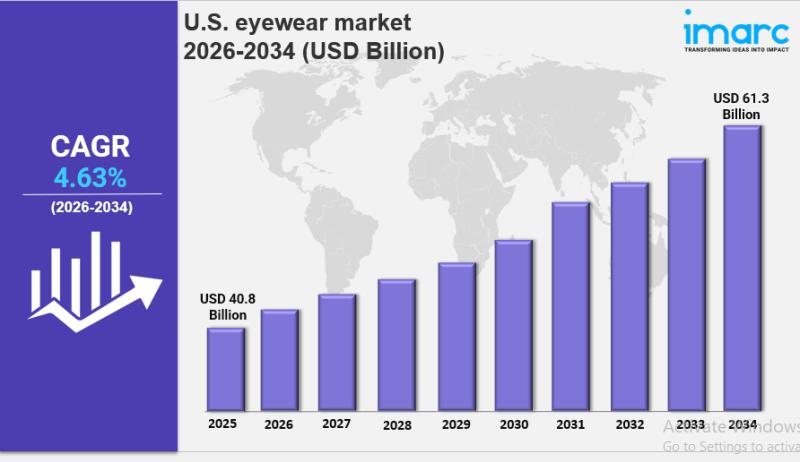

U.S. eyewear market: Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "U.S. Eyewear Market Report by Product (Spectacles, Sunglasses, Contact Lenses), Gender (Men, Women, Unisex), Distribution Channel (Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. eyewear market size reached USD 40.8 Billion…

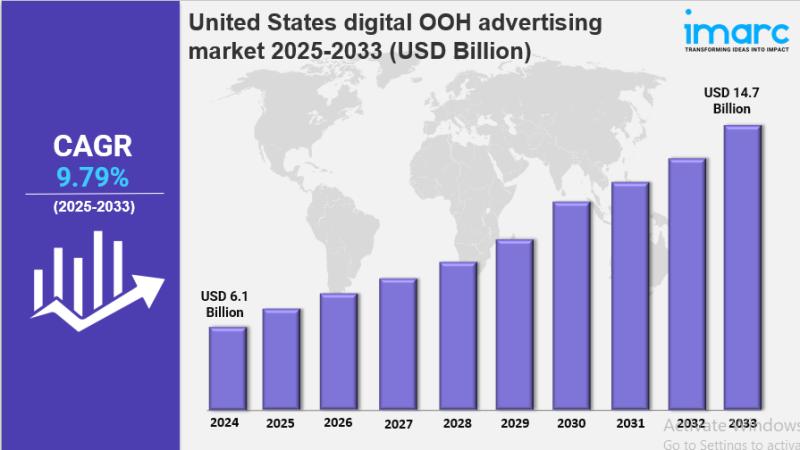

United States digital OOH advertising market: Size, Growth, Latest Trends and Fo …

IMARC Group has recently released a new research study titled "United States Digital OOH Advertising Market Report by Format Type (Digital Billboards, Video Advertising, Ambient Advertising, and Others), Application (Outdoor, Indoor), End Use Industry (Retail, Recreation, Banking, Transportation, Education, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States…

Mexico Grid Modernization Market Share, Size, In-Depth Analysis and Forecast 202 …

IMARC Group has recently released a new research study titled "Mexico Grid Modernization Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico grid modernization market size was valued at USD 568.18 Million in 2024. The market is projected to reach…

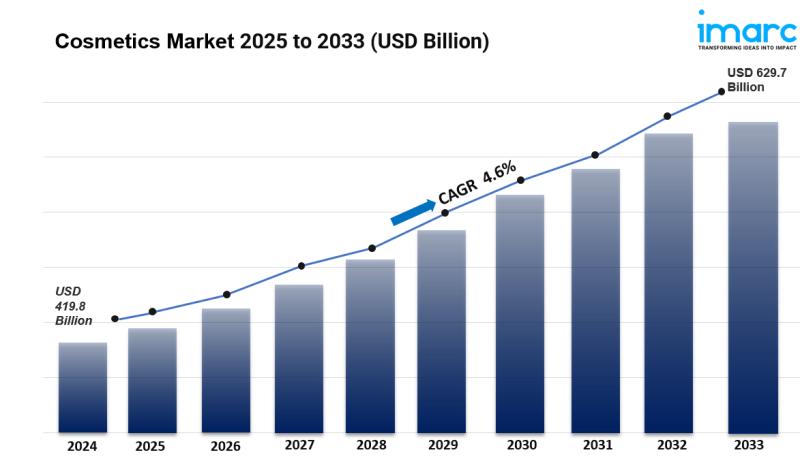

Cosmetics Market is Expected to Reach USD 629.7 Billion by 2033 | At CAGR 4.6%

Cosmetics Market Overview:

The global Cosmetics Market was valued at USD 419.8 Billion in 2024 and is projected to reach USD 629.7 Billion by 2033, growing at a CAGR of 4.6% during 2025-2033. The market is propelled by growing personal grooming trends, the advent of advanced product variants, rising demand for vegan cosmetics, and expanded product availability on e-commerce platforms.

The global cosmetics market size continues to grow steadily, driven by rising…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…