Press release

Global Insurtech Market Insights and Forecast to 2028

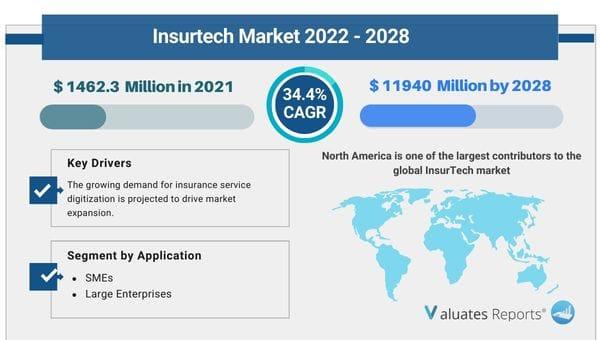

Insurtech Market Statistics 2028The global Insurtech market size is projected to reach US$ 11940 million by 2028, from US$ 1462.3 million in 2021, at a CAGR of 34.4% during 2022-2028. Insurtech market growth is expected to be fueled by rising demand for insurance service digitization. Insurance purchase and claims processes are made easier with the help of insurtech.

VIEW FULL REPORT

https://reports.valuates.com/market-reports/QYRE-Auto-35M2175/global-insurtech

Major factors driving the growth of the Insurtech Market are

Insurtech assists in the development of new routes that giant insurance companies are less motivated to pursue, such as social insurance and ultra-customized coverage. To price premiums, these systems employ fresh streams of data from internet-enabled devices.

Insurtech is far more cost-effective than the old model since it lowers acquisition expenses by offering clients a digital interface and adopting a direct methodology.

When compared to the current insurance arrangement, there is a significant improvement in inefficiency.

Trends Influencing The Growth Of The Insurtech Market

Insurtech companies are striving to bridge the gap between customers and insurance providers by offering digital brokerage and insurance markets. Due to the oversaturation of the insurance market and severe competition among insurers, they have been compelled to adopt digital technologies that focus on the client interface. Insurtech software is designed to help insurers obtain more clients by forming partnerships and streamlining claim processing. The Insurtech market is predicted to be driven by the simplification of the claims process afforded by Insurtech.

Many Insurtech companies are concentrating on using deep learning-capable artificial intelligence (AI) to help agents handle their tasks faster and find the correct mix of policies to complete an individual's coverage. The increased use of applications to consolidate diverse policies into a unified platform for monitoring and management is predicted to propel the Insurtech market forward throughout the forecast period.

Insurtech Market Regional Share

With relatively significant insurance premium spending by people, North America is one of the main contributors to the worldwide InsurTech market. The United States has witnessed significant investments from InsurTech suppliers due to insurers' online presence and digital technologies to track their insurance claims, and it represents a big prospective market. In the United States, several start-ups have formed, realizing the potential for better customer-focused insurance service.

The Asia Pacific, on the other hand, is predicted to develop at the fastest rate due to the existence of a young population in the region as well as a growing tech-savvy generation.

The global Insurtech market is segmented by company, region (country), by Type, and by Application. Players, stakeholders, and other participants in the global Insurtech market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type, and by Application for the period 2016-2027.

Insurtech Market Segments

Insurtech Market by Type

Products

Services

Insurtech Market by Application

SMEs

Large Enterprises

Insurtech Market: Regional Analysis

North America

United States

Canada

Europe

Germany

France

U.K.

Italy

Russia

Nordic

Rest of Europe

Asia-Pacific

China

Japan

South Korea

Southeast Asia

India

Australia

Rest of Asia-Pacific

Latin America

Mexico

Brazil

Middle East & Africa

Turkey

Saudi Arabia

UAE

Rest of Middle East & Africa

The report lists the major players in the regions and their respective market share on the basis of global revenue. It also explains their strategic moves in the past few years, investments in product innovation, and changes in leadership to stay ahead in the competition. This will give the reader an edge over others as a well-informed decision can be made looking at the holistic picture of the market.

INQUIRE FOR SAMPLE

https://reports.valuates.com/request/sample/QYRE-Auto-35M2175/Global_Insurtech_Market_Size_Status_and_Forecast_2020_2026

Major Players in the Insurtech Market

Quantemplate

Slice

Neos

Shift Technology

Lemonade

Oscar Health

Acko General Insurance

ZhongA

SIMILAR REPORTS

https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

https://reports.valuates.com/market-reports/QYRE-Auto-36L2669/global-insurance-big-data-analytics

https://reports.valuates.com/market-reports/ALLI-Auto-2W77/cyber-insurance

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call 1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp: +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

Our team of market analysts can help you select the best report covering your industry. We understand your niche region-specific requirements and that's why we offer customization of reports. With our customization in place, you can request for any particular information from a report that meets your market analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurtech Market Insights and Forecast to 2028 here

News-ID: 3250084 • Views: …

More Releases from Valuates Reports

Optical Fiber Splitter Boxes Market Revenue Share, Insights & Future Outlook

What Are the Key Drivers Fueling the Optical Fiber Splitter Boxes Market?

The global market for Optical Fiber Splitter Boxes was valued at US$ 607 million in 2024 and is projected to reach a revised size of US$ 839 million by 2031, growing at a CAGR of 4.8% during the forecast period. Growth in fiber optic communication networks is a primary driver, as the demand for high-speed data transmission and large…

Semiconductor-Type Combustible Gas Detector Market Revenue Share, Insights & Fut …

What Are the Key Growth Drivers in the Semiconductor-Type Combustible Gas Detector Market?

The global market for Semiconductor-Type Combustible Gas Detector was valued at US$ 1025 million in 2024 and is projected to reach a revised size of US$ 1606 million by 2031, growing at a CAGR of 5.8% during the forecast period.

Download Free Data: https://reports.valuates.com/request/sample/QYRE-Auto-16I19386/Global_Semiconductor_Type_Combustible_Gas_Detector_Market_Research_Report_2025?utm_source=openpr&utm_medium=referral

How Are Regional Markets Influencing the Expansion of Gas Detection Solutions?

• North America: Estimated to increase from…

Bio-based Polymethyl Methacrylate (Bio-PMMA) Market Revenue Share, Insights & Fu …

What Are the Key Growth Drivers in the Bio-PMMA Market?

The global Bio-based Polymethyl Methacrylate (Bio-PMMA) market was valued at US$ million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of % during the forecast period 2024-2030.

Download Free Data: https://reports.valuates.com/request/sample/QYRE-Auto-29A7386/Global_and_Japan_Bio_based_Polymethyl_Methacrylate_Bio_PMMA_Market_Insights_Forecast_to_2027?utm_source=openpr&utm_medium=referral

How Are Regional Markets Contributing to the Expansion of Bio-PMMA?

• North America: The market is estimated to increase from $ million in 2023 to $ million by…

Automotive Engine Coating Market: Revenue Share, Insights & Future Outlook

What Are the Key Growth Drivers in the Automotive Engine Coating Market?

The global market for Automotive Engine Coating was estimated to be worth US$ million in 2023 and is forecast to reach a readjusted size of US$ million by 2030, growing at a CAGR of % during the forecast period 2024-2030. Automotive is a key driver of this industry. According to data from the World Automobile Organization (OICA), global automobile…

More Releases for Insurtech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…