Press release

Financial Consulting Software Market 2024 - Size, Share, Forecast, and Analysis of Trends Leading up to 2033

The financial consulting software market size has grown rapidly in recent years. It will grow from $5 billion in 2023 to $5.61 billion in 2024 at a compound annual growth rate (CAGR) of 12.3%. The growth in the historic period can be attributed to growth in demand for financial planning software, increased demand for financial consulting services in emerging markets, growth importance of data analytics, rise in demand for mobile financial consulting solutions, growth in demand for personalized financial advice.The financial consulting software market size is expected to see rapid growth in the next few years. It will grow to $8.69 billion in 2028 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to increasing adoption of cloud-based financial consulting software, increasing focus on compliance and risk management, rising demand for mobile financial consulting solutions, rising demand for financial planning software, growing importance of data analytics. Major trends in the forecast period include ongoing technological advancements, increasing use of artificial intelligence and machine learning, development of mobile-friendly interfaces, rising collaboration and client engagement, incorporation of robo-advisory features and automation.

Market Overview -

Financial consulting software refers to a type of computer software that offers expert advice and counselling to clients on financial concerns such as investment strategies, risk management, and financial planning in order to help them accomplish their financial goals and make educated decisions. The software offers automated data consolidation, planning, efficiency, and other benefits.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=12638&type=smp

Financial Consulting Software Market Driven By Surge In Saas Adoption

The rise in the number of software-as-a-service (SaaS) is expected to propel the growth of the financial consulting software market going forward. Software as a service (SaaS) refers to a software delivery platform based on the cloud that allows end users to receive software programs via the internet. Software as a service (SaaS) makes financial consulting software more accessible by providing cloud-based deployment, subscription models, and seamless updates, allowing for greater acceptance and scalability for financial consulting firms while decreasing upfront costs and IT complexity. The rise of SaaS will also drive the use of financial consulting software. For instance, in May 2023, according to a report by BetterCloud, a US-based SaaS management platform, the average number of SaaS applications per company increased from 110 in 2021 to 130 in 2022. Moreover, the utilization of software-as-a-service (SaaS) applications by companies has reached approximately 70% of their overall software usage. This percentage is expected to increase further and reach an estimated 85% by the year 2025. Therefore, the rise in the amount of software as a service (SaaS) is driving the financial consulting software market.

Competitive Landscape -

Major companies operating in the financial consulting software market report are Accen*ture plc, International Business Machines Corporation, Deloitte Consulting LLP, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, KPMG International Limited, SAP SE, BlackRock Inc., The Bank of New York Mellon Corporation, Intuit Inc., Boston Consulting Group, McKinsey & Company, Bloomberg L.P, Thomson Reuters Corporation, Oracle Financial Services Software, Bain & Company Inc., Wolters Kluwer N.V., Broadridge Financial Solutions Inc, FTI Consulting Inc., SEI Investments Management Corp., Envestnet Inc., Temenos AG, QlikTech International AB, SimCorp A/S, Murex S.A.S., Charles River Development Inc., SS&C Advent, Numerix LLC, FinancialCAD Corporation, Turnkey Lender Pte. Ltd.

Emerging Trends In Financial Consulting Software Market

Cloud-based innovation is a key trend gaining popularity in the financial consulting software market. Companies operating in the financial consulting software market are advancing cloud-based solutions to sustain their position in the market. For instance, in September 2023, Snowflake, a US-based data cloud company, launched Financial Services Data Cloud, which brings together Snowflake's industry-tailored platform governance features, snowflake- and partner-delivered solutions, and industry-critical datasets to financial services firms. Snowflake's Financial Services Data Cloud offers customers in banking, insurance, fintech, and investment management industries the opportunity to launch customer-centric products and services, build innovative fintech platforms, and enhance compliance and regulatory practices. This platform enables businesses to leverage data effectively, drive innovation, and ensure adherence to industry regulations.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/financial-consulting-software-global-market-report

Key Segments -

The financial consulting software market covered in this report is segmented -

1) By Offering: Software, Services

2) By Deployment: On-Premise, Hosted

3) By Application: Large Enterprises, Small And Medium Enterprises

4) By End-User: Banks, Wealth Management Firms, Other End-Users

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Consulting Software Market 2024 - Size, Share, Forecast, and Analysis of Trends Leading up to 2033 here

News-ID: 3474113 • Views: …

More Releases from The Business research company

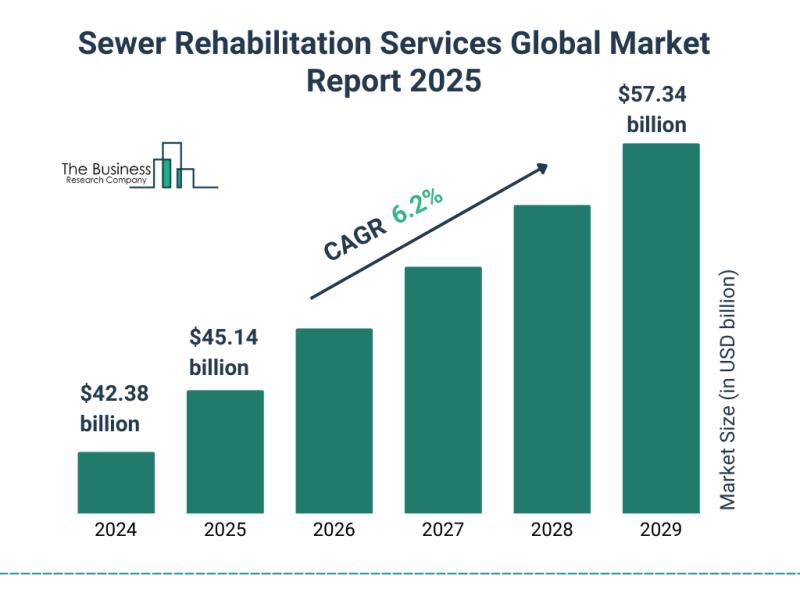

Emerging Innovations Set to Redefine the Sewer Rehabilitation Services Market La …

How Large Is the Sewer Rehabilitation Services Market Anticipated to Become by 2025?

The global market for sewer rehabilitation services has experienced robust expansion lately, projected to increase from a valuation of $42.38 billion in 2024 to $45.14 billion in the subsequent year, reflecting a compound annual growth rate (CAGR) of 6.5%. This historical upward trajectory is primarily fueled by several key factors: escalating levels of urbanization, the ever-aging condition of…

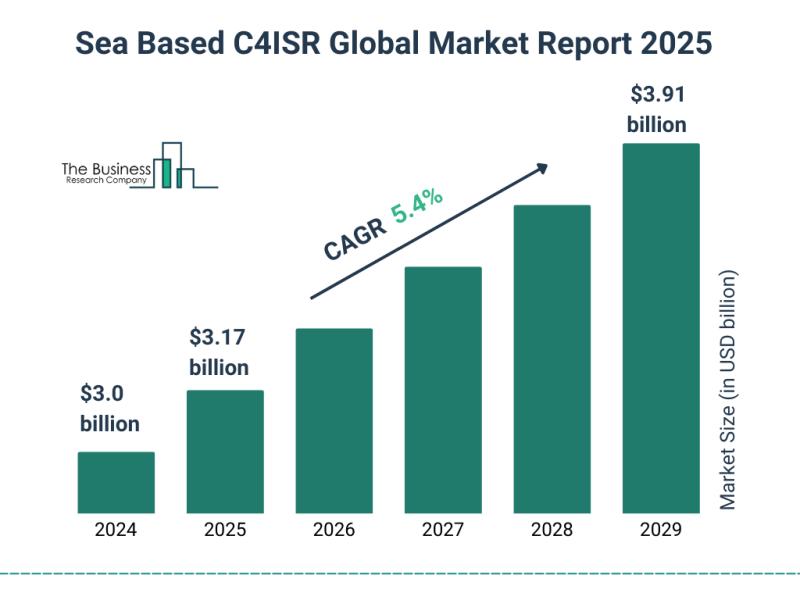

2025-2034 Sea Based C4ISR Market Outlook: Emerging Drivers, Growth Barriers, and …

What Market Size Will the Sea Based C4ISR Sector Reach by 2025?

The maritime C4ISR market experienced substantial expansion lately, projected to climb from a value of $3.0 billion in 2024 to $3.17 billion the following year, reflecting a compound annual growth rate of 5.7%. This upward trend observed over the historical period stems from several factors, including the intensification of naval modernization initiatives, escalating maritime security perils, augmentation in defense…

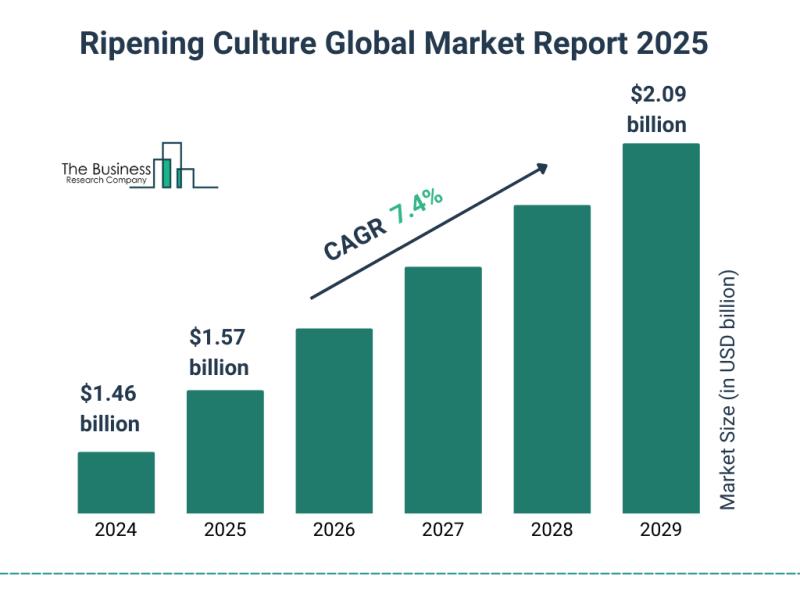

The Impact of Rapid Urbanization on the Ripening Culture Market: A Key Force Sha …

What Is the Forecasted Size of the Ripening Culture Market by 2025?

The market for ripening cultures has experienced substantial expansion lately, projected to increase from a valuation of $1.46 billion in 2024 to $1.57 billion a year later, demonstrating a consistent yearly growth rate (CAGR) of 7.7%. This upward trajectory during the past period stems from several key factors, including heightened demand for fermented dairy items, greater recognition of the…

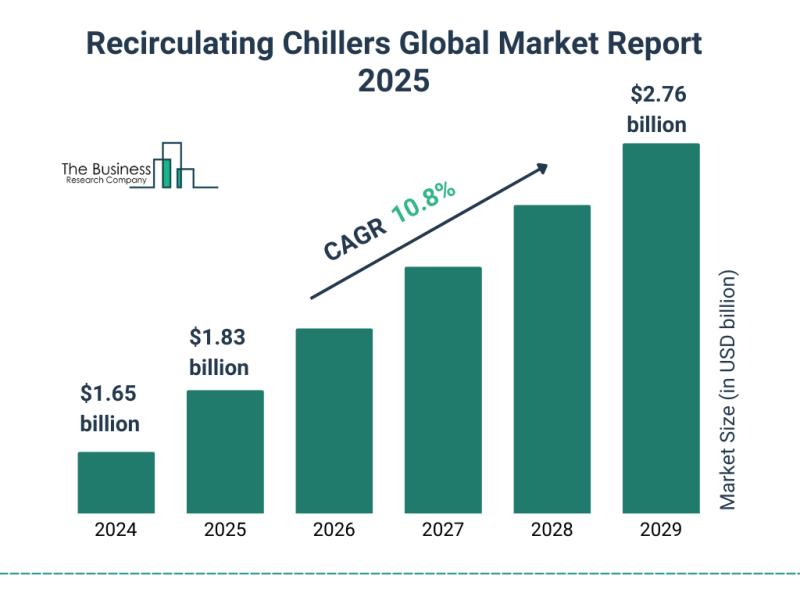

Strong Demand Anticipated to Drive Recirculating Chillers Market Toward $2.76 Bi …

How Much Expansion Is Expected in the Recirculating Chillers Market by 2025?

The market encompassing recirculating chillers has seen swift expansion lately, projected to escalate from a value of $1.65 billion in 2024 to $1.83 billion by the ensuing year, reflecting an impressive compound annual growth rate (CAGR) of 11.2%. This upward trajectory during the historical timeframe stems from several factors, including the proliferation of automated systems in industrial procedures, escalating…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…