Press release

FinTech Blockchain Market Size, Share, Growth Forecast 2023-2032

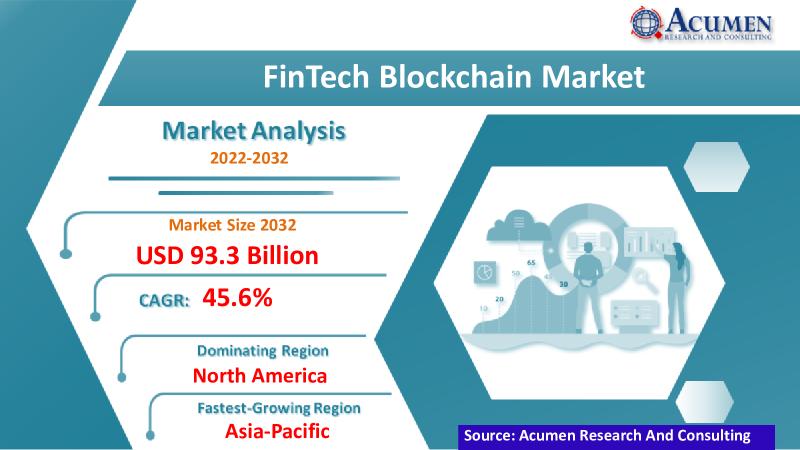

The FinTech blockchain market has emerged as a disruptive force in the financial landscape, revolutionizing traditional financial services with its decentralized and secure infrastructure. With a significant market size of USD 2.2 billion in 2022, and a projected exponential growth, reaching USD 93.3 billion by 2032 at a staggering CAGR of 45.6%, the sector showcases immense potential and opportunities. This article delves into the current trends, market drivers, restraints, opportunities, regional insights, competitive scenario, and the future growth prospects of the FinTech blockchain market.Download Free FinTech Blockchain Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart) https://www.acumenresearchandconsulting.com/request-sample/3447

Market Trends:

The FinTech blockchain market is witnessing several notable trends driving its growth trajectory. One prominent trend is the increasing adoption of blockchain technology by financial institutions to streamline operations, enhance security, and reduce costs. Additionally, the rise of decentralized finance (DeFi) platforms leveraging blockchain is reshaping the financial landscape by offering innovative solutions such as lending, borrowing, and trading without intermediaries.

Market Drivers:

Several factors are fueling the growth of the FinTech blockchain market. One of the primary drivers is the growing demand for secure and transparent transactions in the financial sector. Blockchain's immutable ledger technology ensures trust and transparency, mitigating the risk of fraud and enhancing accountability. Moreover, the increasing digitization of financial services and the need for real-time payments are driving the adoption of blockchain technology to facilitate faster and more efficient transactions.

Market Restraints:

Despite the promising growth prospects, the FinTech blockchain market faces certain challenges that could hinder its expansion. Regulatory uncertainty and compliance issues pose significant hurdles for market players, particularly in navigating complex regulatory landscapes across different jurisdictions. Moreover, scalability and interoperability concerns remain key challenges for blockchain technology, limiting its widespread adoption in mainstream financial applications.

Opportunities:

Amidst the challenges, the FinTech blockchain market presents lucrative opportunities for innovation and growth. The integration of blockchain with emerging technologies such as artificial intelligence (AI) and Internet of Things (IoT) opens up new possibilities for developing advanced financial solutions. Furthermore, the rising demand for blockchain-based identity management, supply chain finance, and cross-border payments offers untapped opportunities for market players to capitalize on.

Competition Scenario:

The FinTech blockchain market is highly competitive, with a diverse ecosystem of startups, established financial institutions, and technology companies vying for market share. Key players such as IBM, Microsoft, Ripple, and Coinbase are leading the charge with innovative blockchain solutions tailored for the financial sector. Strategic partnerships, mergers, and acquisitions are common strategies employed by market players to gain a competitive edge and expand their market presence.

Future Market Growth Potential:

Looking ahead, the FinTech blockchain market is poised for exponential growth, driven by ongoing technological advancements, increasing digitalization, and evolving consumer preferences. The integration of blockchain technology into core financial processes, coupled with the proliferation of decentralized finance (DeFi) platforms, will fuel market expansion in the coming years. Moreover, growing investments in blockchain research and development, along with supportive regulatory frameworks, will further propel the market towards achieving its projected market size of USD 93.3 billion by 2032.

Table Of Content:

CHAPTER 1. Industry Overview of FinTech Blockchain Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. FinTech Blockchain Market By Provider

CHAPTER 6. FinTech Blockchain Market By Application

CHAPTER 7. FinTech Blockchain Market By Organization Size

CHAPTER 8. FinTech Blockchain Market By Verticals

CHAPTER 9. North America FinTech Blockchain Market By Country

CHAPTER 10. Europe FinTech Blockchain Market By Country

CHAPTER 11. Asia Pacific FinTech Blockchain Market By Country

CHAPTER 12. Latin America FinTech Blockchain Market By Country

CHAPTER 13. Middle East & Africa FinTech Blockchain Market By Country

CHAPTER 14. Player Analysis Of FinTech Blockchain Market

CHAPTER 15. Company Profile

FinTech Blockchain Market Segmentation:

The global FinTech Blockchain Market segmentation is based on provider, application, organization size, verticals, and geography.

FinTech Blockchain Market By Provider

Middleware Providers

Infrastructure and Protocol Providers

Application and Solution Providers

FinTech Blockchain Market By Application

Payments, Clearing, and Settlement

Smart Contract

Exchanges and Remittance

Compliance Management/ KYC

Identity Management

Other

FinTech Blockchain Market By Organization Size

Large Enterprises

SMEs

FinTech Blockchain Market By Verticals

Banking

Insurance

Non-Banking Financial Services

Regional Insights:

The FinTech blockchain market exhibits varied dynamics across different regions. North America dominates the market, driven by the presence of key market players, favorable regulatory frameworks, and significant investments in blockchain technology. Europe follows closely, with initiatives such as the European Blockchain Partnership fostering collaboration and innovation in the region. Meanwhile, Asia-Pacific is poised for substantial growth, fueled by increasing adoption in countries like China, Japan, and Singapore.

Buy the premium market research report here: https://www.acumenresearchandconsulting.com/buy-now/0/3447

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864

Browse for more Related Reports: https://www.acumenresearchandconsulting.com/industry-5-0-market

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Blockchain Market Size, Share, Growth Forecast 2023-2032 here

News-ID: 3532898 • Views: …

More Releases from Acumen Research and Consulting

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

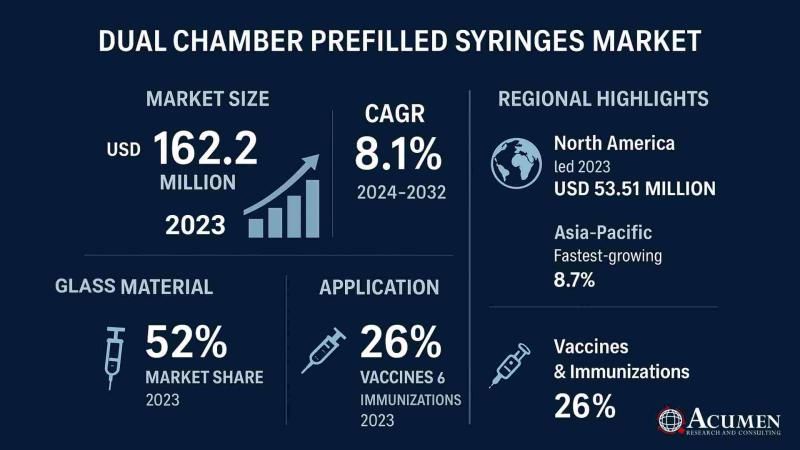

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

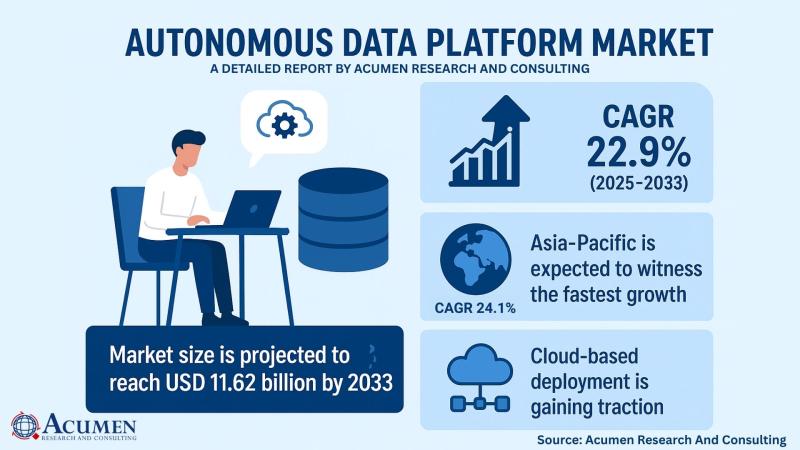

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

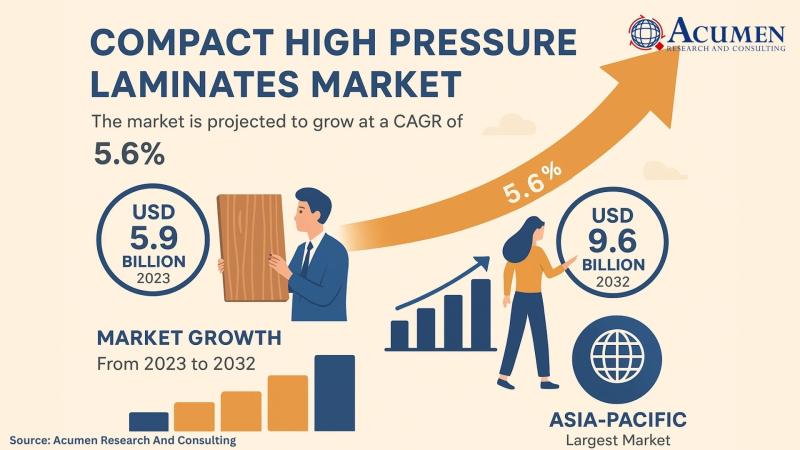

Compact High Pressure Laminates Market to Reach USD 9.6 Billion by 2032, Driven …

The Compact High Pressure Laminates Market is gaining remarkable momentum as industries across construction, interior design, healthcare, and commercial applications increasingly adopt durable, stylish, and sustainable surfacing solutions. Valued at USD 5.9 Billion in 2023, the market is projected to reach USD 9.6 Billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 5.6%.

Get Free PDF Sample Pages of This Report: https://www.acumenresearchandconsulting.com/request-sample/3646

Compact High Pressure Laminates, or Compact HPL,…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…