Press release

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.Download Free Reverse Factoring Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart) https://www.acumenresearchandconsulting.com/request-sample/3426

Market Trends Driving Growth:

Several key trends are fueling the expansion of the reverse factoring market:

Increasing Demand for Working Capital Solutions: Companies are increasingly seeking efficient working capital management solutions to optimize cash flow and improve financial stability. Reverse factoring offers an effective way to achieve these goals by allowing suppliers to receive early payments on their invoices.

Digital Transformation: The integration of digital technologies in financial services has revolutionized the reverse factoring market. Advanced platforms and automated processes have made reverse factoring more accessible, efficient, and transparent.

Global Supply Chain Expansion: As businesses expand their global supply chains, the need for flexible and reliable financing options becomes critical. Reverse factoring provides a robust solution to manage international transactions and mitigate risks associated with cross-border trade.

Regulatory Support: Favorable regulatory frameworks in various regions are encouraging the adoption of reverse factoring. Governments are recognizing the benefits of reverse factoring in supporting small and medium-sized enterprises (SMEs) and enhancing overall economic growth.

Drivers and Restraints:

Drivers:

Enhanced Cash Flow Management: Reverse factoring allows suppliers to receive payments earlier than the due date, improving their cash flow and reducing the risk of late payments.

Strengthened Supplier-Buyer Relationships: By offering reverse factoring, buyers can support their suppliers' financial health, leading to stronger and more stable supply chain relationships.

Increased Liquidity: Reverse factoring provides liquidity to suppliers without adding debt to their balance sheets, making it an attractive financing option.

Restraints:

High Implementation Costs: The initial setup and integration of reverse factoring platforms can be costly, particularly for smaller organizations.

Complexity in Adoption: Some businesses may find the adoption of reverse factoring complex due to the need for process changes and stakeholder alignment.

Credit Risk: The financial health of the buyer is crucial in reverse factoring. If the buyer faces financial difficulties, it can impact the entire supply chain.

Opportunities in the Reverse Factoring Market

SME Sector: SMEs often face challenges in securing traditional financing. Reverse factoring presents a significant opportunity for these businesses to improve their cash flow and financial stability.

Technological Advancements: Continued advancements in blockchain and artificial intelligence can further streamline reverse factoring processes, making them more secure and efficient.

Emerging Markets: The adoption of reverse factoring is growing in emerging markets where traditional financing options are limited. These regions offer substantial growth potential for reverse factoring service providers.

Competitive Landscape:

The competitive landscape of the reverse factoring market is characterized by the presence of several key players and financial institutions. These companies are focusing on technological innovations, strategic partnerships, and mergers and acquisitions to strengthen their market positions. Some of the largest market players include:

Greensill Capital: Known for its innovative supply chain finance solutions, Greensill Capital is a prominent player in the reverse factoring market.

PrimeRevenue: PrimeRevenue offers a comprehensive suite of working capital solutions, including reverse factoring, and is a leader in this space.

Taulia Inc.: Taulia provides a robust platform for reverse factoring and has established a strong presence in the market.

Demica: Demica specializes in providing working capital solutions and has a significant market share in reverse factoring.

CRX Markets: CRX Markets offers a digital marketplace for supply chain finance, including reverse factoring, and is rapidly growing its footprint.

Future Growth Prospects:

The future of the reverse factoring market looks promising, with several factors contributing to its sustained growth:

Technological Innovations: Ongoing advancements in technology will continue to enhance the efficiency and accessibility of reverse factoring solutions.

Regulatory Developments: Supportive regulatory frameworks will further drive the adoption of reverse factoring, particularly in emerging markets.

Focus on SME Financing: As SMEs seek more reliable financing options, the demand for reverse factoring will increase, presenting significant growth opportunities.

Global Economic Recovery: As the global economy recovers from recent disruptions, businesses will seek flexible financing solutions like reverse factoring to stabilize and grow their operations.

Table Of Content:

CHAPTER 1. Industry Overview of Reverse Factoring Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Reverse Factoring Market By Category

CHAPTER 6. Reverse Factoring Market By Financial Institution

CHAPTER 7. Reverse Factoring Market By End-use

CHAPTER 8. North America Reverse Factoring Market By Country

CHAPTER 9. Europe Reverse Factoring Market By Country

CHAPTER 10. Asia Pacific Reverse Factoring Market By Country

CHAPTER 11. Latin America Reverse Factoring Market By Country

CHAPTER 12. Middle East & Africa Reverse Factoring Market By Country

CHAPTER 13. Player Analysis Of Reverse Factoring Market

CHAPTER 14. Company Profile

Reverse Factoring Market Segmentation:

The global Reverse Factoring Market segmentation is based on category, financial institution, end-use, and geography.

Reverse Factoring Market By Category

International

Domestic

Reverse Factoring Market By Financial Institution

Banks

Non-banking Financial Institutions

Reverse Factoring Market By End-use

Manufacturing

Information Technology

Transport & Logistics

Construction

Healthcare

Others

Regional Insights:

North America: The North American reverse factoring market is mature, with high adoption rates among large enterprises and increasing interest from SMEs. The presence of advanced financial infrastructure supports the market's growth.

Europe: Europe is witnessing robust growth in the reverse factoring market, driven by strong regulatory support and the increasing need for supply chain financing solutions. Countries like Germany, France, and the UK are leading the adoption.

Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in reverse factoring, fueled by expanding supply chains and increasing digitalization. China, India, and Southeast Asian countries are key markets.

Latin America: The reverse factoring market in Latin America is growing steadily, with rising awareness among businesses about the benefits of reverse factoring. Brazil and Mexico are the major contributors to the market's growth.

Middle East and Africa: The adoption of reverse factoring in this region is in its early stages, but it holds significant potential due to the increasing focus on SME development and economic diversification.

Market Players;

Some of the top reverse factoring market companies offered in the professional report include Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH.

Buy the premium market research report here: https://www.acumenresearchandconsulting.com/buy-now/0/3426

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864

Browse for more Related Reports: https://www.globenewswire.com/news-release/2023/10/18/2762598/0/en/Reverse-Factoring-Market-Soaring-Envisioned-USD-1-452-Billion-by-2032-with-10-8-CAGR.html#:~:text=The%20Global%20Reverse%20Factoring%20Market,share%20of%2092%25%20in%202022

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reverse Factoring Market here

News-ID: 3538092 • Views: …

More Releases from Acumen Research and Consulting

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

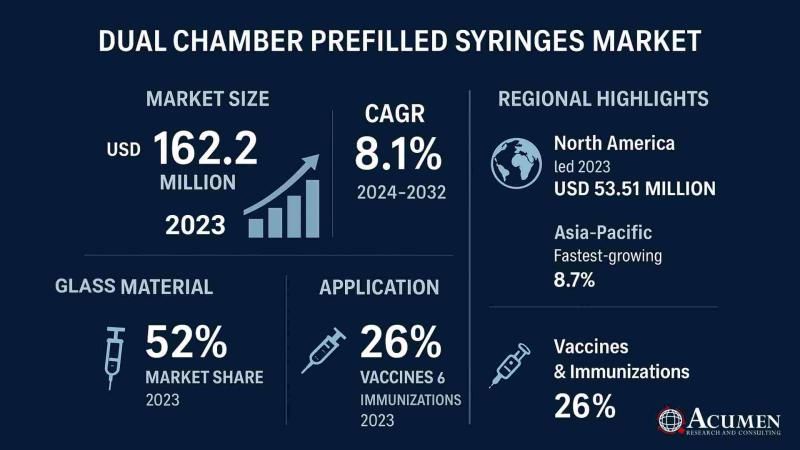

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

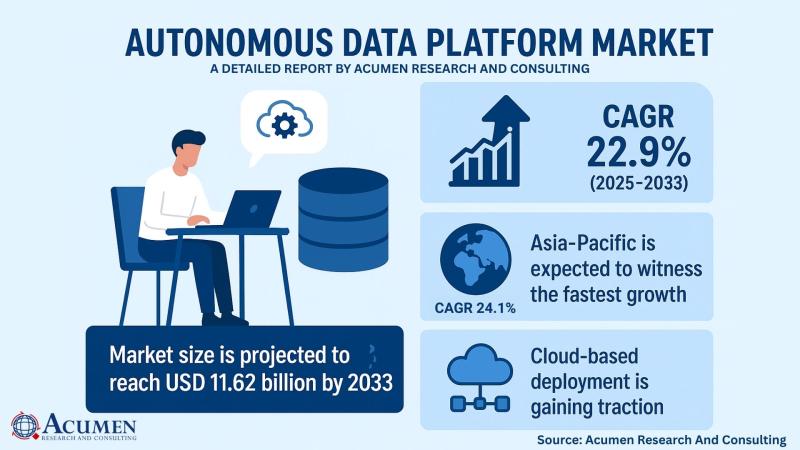

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

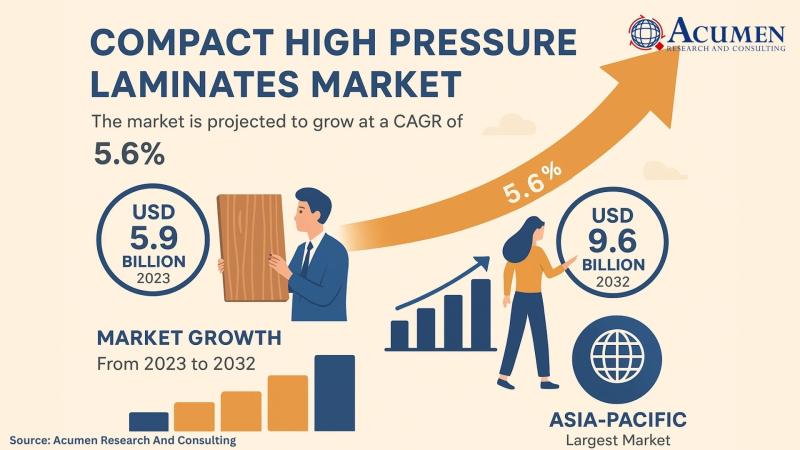

Compact High Pressure Laminates Market to Reach USD 9.6 Billion by 2032, Driven …

The Compact High Pressure Laminates Market is gaining remarkable momentum as industries across construction, interior design, healthcare, and commercial applications increasingly adopt durable, stylish, and sustainable surfacing solutions. Valued at USD 5.9 Billion in 2023, the market is projected to reach USD 9.6 Billion by 2032, reflecting a steady compound annual growth rate (CAGR) of 5.6%.

Get Free PDF Sample Pages of This Report: https://www.acumenresearchandconsulting.com/request-sample/3646

Compact High Pressure Laminates, or Compact HPL,…

More Releases for Reverse

Reverse Mortgage Expert Kevin Guttman Releases Book about the Benefits of Revers …

Reverse mortgages remain one of the most misunderstood financial tools for seniors, often surrounded by confusion and stigma. In his new book, A Reverse Mortgage Changed My Life!!! , Certified Reverse Mortgage Professional (CRMP) and Senior Mortgage Broker Kevin A. Guttman addresses these misconceptions directly. Drawing from real-life stories, Guttman explains how reverse mortgages work, clears up common myths, and highlights how they can provide financial stability and peace of…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

Reverse Mortgage Providers Market Analysis by 2028, Industry Trends, Size, Share …

Reverse Mortgage Providers market Overview: The report focuses on providing corporate insights and advice to help clients make strategic business moves and to grow over a long time in their respective markets. The report on the Reverse Mortgage Providers market assists readers in obtaining useful information and in promoting their growth. The market report covers a thorough study conducted through an overall analysis of the industry. It provides an overview…

Reverse Mortgage Providers Market 2021 - American Advisors Group (AAG), Finance …

Reverse Mortgage Providers Market research report is very indispensable in many ways for business growth and to thrive in the market. Getting well-versed about the trends and opportunities in the industry is a fairly time-consuming process. Nonetheless, this global Reverse Mortgage Providers Market research report solves this problem very quickly and easily. Clients can unearth the best opportunities to be successful in the market with excellent practice models and methods…

Reverse Engineering Bespoke Parts

We use the data gathered during the inspection to replicate the design, create a 3D model from CAD drawings, and generate a functioning part that meets your performance expectations. When this process is complete, the customer has the exact instructions he needs to replicate the part exactly as it needs to be, saving a lot of time and money in retrospect. Reverse engineering enables the duplication of existing parts by…

Reverse Data Appending Services

Reverse Data Appending: Take benefits of matched, updated & verified data with Reverse Data

Appending & Free Reverse Lookup Services provided by B2B Capricorn.

Expand Your Marketing Potentials with Matched Data!!

With Reverse Data Appending services from B2B Capricorn, add more valuable contact information to your existing database. With so much of competition across the industries to draw attention of valuable customers, it has become imperative to possess database that is unique, resourceful…