Press release

Smart Debt Good Credit Explains Why Maintaining Good Credit is Still Important

Image: https://www.getnews.info/wp-content/uploads/2024/08/1722626829.pngUnlocking Financial Opportunities

A good credit score is not just a number; it is a powerful financial asset that can open doors to various opportunities. However, many individuals find themselves facing the consequences of a poor credit history, which can limit their access to credit, loans, housing, and even employment. This is where credit repair becomes crucial. In this article, we will explore the importance of credit repair and how it can positively impact your financial well-being.

Access to Better Interest Rates and Loan Options:

Repairing your credit allows you to qualify for better interest rates and loan options. Lenders use credit scores to assess your creditworthiness, and a higher credit score signifies lower lending risk. By improving your credit, you increase the chances of securing loans with favorable terms, saving you money on interest payments and reducing your overall debt burden.

Improved Housing Opportunities:

A good credit score is often a prerequisite for renting a home or obtaining a mortgage. Landlords and mortgage lenders use credit scores to evaluate the financial responsibility of applicants. By repairing your credit, you enhance your chances of securing the housing you desire, whether it's a rental property or your dream home.

Enhanced Employment Prospects:

Employers in various industries often conduct background checks, including credit checks, during the hiring process. A negative credit history can raise concerns about an individual's financial responsibility and affect their employment prospects. Repairing your credit can help you present a more favorable financial profile to potential employers, increasing your chances of landing the job you want.

Lower Insurance Premiums:

Many insurance companies consider credit scores when determining insurance premiums. A poor credit history may result in higher premiums for auto, home, or other types of insurance coverage. By repairing your credit, you can potentially qualify for lower insurance premiums, saving you money in the long run.

Financial Peace of Mind:

Repairing your credit not only provides financial benefits but also offers peace of mind. It allows you to regain control of your financial situation and reduces the stress and worry associated with poor credit. With improved credit, you can have greater confidence in your ability to manage your finances and plan for the future.

Credit repair is not a quick fix, but a strategic and long-term process that can have a significant impact on your financial well-being. By taking the necessary steps to repair your credit, you can unlock a world of opportunities, from better loan options and lower interest rates to improved housing prospects and enhanced employment opportunities. Remember, repairing your credit requires patience, discipline, and responsible financial habits. Seek guidance from professionals in the field, and take proactive steps towards improving your credit score. Start today and pave the way for a brighter financial future.

Media Contact

Company Name: Smart Debt Good Credit

Contact Person: Antoine Miller

Email: Send Email [http://www.universalpressrelease.com/?pr=smart-debt-good-credit-explains-why-maintaining-good-credit-is-still-important]

Phone: 414-219-1976

Country: United States

Website: http://www.smartdebtgoodcredit.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smart Debt Good Credit Explains Why Maintaining Good Credit is Still Important here

News-ID: 3609276 • Views: …

More Releases from Getnews

Dan Herbatschek CEO of Ramsey Theory Group Announces New Enhancements to Its AI- …

Los Angeles County, one of the fastest-growing telehealth markets according to the American Hospital Association, also saw an uptick in adoption this year of the firm's healthcare delivery system

Ramsey Theory Group, the applied-mathematics-driven software and AI innovation firm, today announced new enhancements to its flagship healthcare delivery platform, Erdos Medical. CEO Dan Herbatschek [https://danherbatschek.com/author/dan-herbatschek/] stated that the update introduces advanced interoperability, AI-assisted patient engagement, and expanded compliance architecture designed to…

Anu Shah: The Amazon & Meta Tech Leader Behind The Talk Lane Reframing Innovatio …

Some stories begin with privilege; others begin with inheritance. But a rare few - the ones that shape global leadership narratives - begin with almost nothing except an inner conviction that life can be rewritten. Anu Shah (also known professionally as Anuja Shah or Anuja Sharad Shah) belongs firmly in that final category. Today, she is an Amazon Ads Principal Product Manager - Tech, a former Meta Product Leader, an…

Jonathan Haber Advocates for Human-Centered Technology in Montreal's Startup Sce …

Montreal Entrepreneur Encourages Startups to Prioritize People in Innovation

Jonathan Haber, a leading technology entrepreneur and founder of Haber Strategies Inc., is raising awareness about the importance of human-centered technology in startups. In a recent interview, Haber shared insights on how soft-tech solutions, tools that focus on user experience, collaboration, and accessibility, are transforming Montreal's tech ecosystem and redefining how businesses operate.

"As a technology entrepreneur, I've learned that success is not…

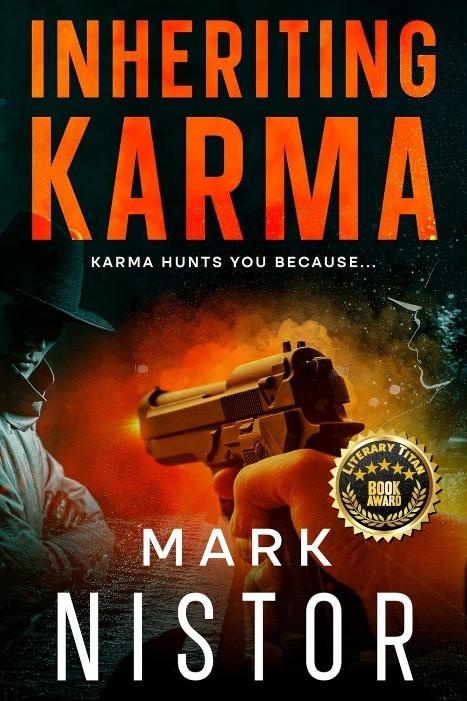

"Inheriting Karma" Receives Esteemed Literary Titan Book Award for Its Bold and …

Image: https://www.globalnewslines.com/uploads/2025/11/1764356714.jpg

Mark Nistor's gripping psychological thriller, Inheriting Karma , has been honored with the highly regarded Literary Titan Gold Book Award, recognizing its bold storytelling, innovative structure, and haunting exploration of guilt, identity, and fate. This accolade celebrates works that demonstrate exceptional writing, emotional depth, and creative originality. Inheriting Karma delivers all three with striking intensity.

The third installment in the expanding Where's Your Karma? series, Inheriting Karma follows Wilson O'Reilly,…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…