Press release

Global Bancassurance Market Analysis Size, Share, Growth, Key Trends and Forecast 2025-2033

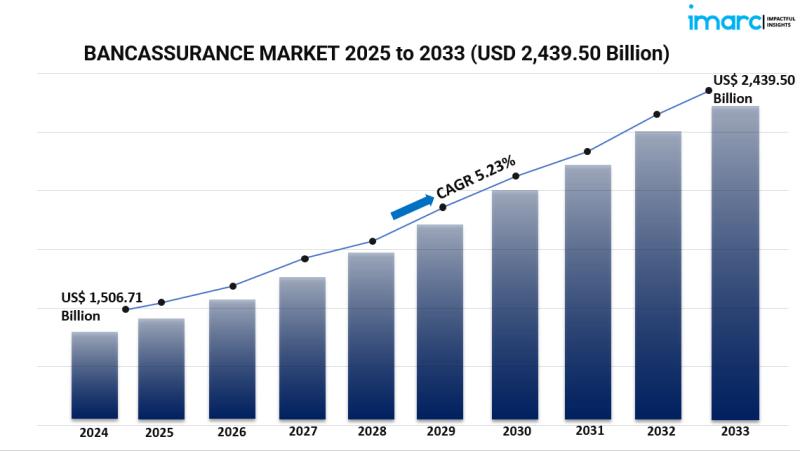

The global bancassurance market reached a value of USD 1,506.71 billion in 2024 and is projected to expand to USD 2,439.50 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.23% during 2025-2033. Bancassurance, the collaboration between banks and insurance companies to offer insurance products through bank channels, has experienced significant growth in recent years. This model leverages banks' extensive customer bases and established networks to provide convenient, integrated financial solutions.Study Assumption Years:

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Global Bancassurance Market Key Takeaways:

Market Size and Growth: The global bancassurance market was valued at USD 1,506.71 billion in 2024 and is anticipated to reach USD 2,439.50 billion by 2033, growing at a CAGR of 5.23% during the forecast period.

Product Type Dominance: Life bancassurance products hold the largest market share, driven by increasing consumer awareness about financial security and life planning.

Preferred Distribution Model: The pure distributor model is the most popular, allowing banks to distribute insurance products without underwriting risks, leading to cost efficiencies and expanded customer reach.

Regional Leadership: Asia Pacific leads the market, accounting for over 45.9% of the global share in 2024, attributed to a burgeoning middle class and increasing financial literacy.

Technological Integration: Advancements in digital technologies, including AI and data analytics, are enhancing personalized offerings and operational efficiencies within bancassurance.

Regulatory Support: Favorable regulatory changes in various regions have facilitated collaborations between banks and insurance companies, promoting market growth.

Consumer Demand: There is a growing consumer preference for integrated financial services, seeking convenience and comprehensive solutions, which is boosting the bancassurance market.

Request for a sample copy of this report: https://www.imarcgroup.com/bancassurance-market/requestsample

Market Growth Factors:

1. Technology Advancements and Digitization

The speed of digitization is a prominent factor in growth across the bancassurance industry. Innovations in data analytics, artificial intelligence (AI), and machine learning allow banks and insurance companies to be either more tailored or efficient with what they offer to the market. For instance, with predictive analytics, banks can identify those segments of customers that have increased interest in specific products; such targeted marketing activity is facilitated by the identified segment information. These digital platforms also enable clients to access insurance services, compare policies and apply online, and facilitate the claims process. All this technological development leads to customer satisfaction and operational efficiency and further strengthens bancassurance as a more profitable and attractive model for financial institutions.

2. Regulatory Environment

A conducive regulatory environment plays a major role in fostering the growth of the bancassurance industry. For instance, many countries have recently adopted reforms to relax their regulatory restrictions on collaboration between banks and insurance companies to provide more integrated financial services. Very significant, for example, are those policies that allow for cross-selling of financial products, where banks sell insurance policies directly to consumers, thus creating new revenue streams for them. However, such arrangements must comply with various regulations aimed at protecting consumers' interests, such as data privacy and anti-money laundering regulations. Necessary, it would be for an otherwise conducive regulatory environment to promote innovations and competition while ensuring consumer trust and transparency in bancassurance products.

3. Economic Growth and Increasing Financial Literacy

It is through economic development that incomes rise, thereby enabling a larger proportion of consumers to afford insurance products. Also advancing financial literacy through various campaigns of their governments and corporate organizations is gradually increasing consumer awareness about the relevance and importance of insurance in financial planning. Using already existing relationships with their customers, banks are most likely to become great agents of cross-selling. Banks usually conduct a lot of cross-selling with their customers because they have well-known clients in the marketplace. In developing economies, where penetration levels are grossly low, banks will be the main channel through which people access insurance products. Economic growth and increased financial awareness thus form the catalyst for the expansion of the bancassurance industry.

Market Segmentation:

Breakup by Product Type:

Life Bancassurance: Products offering life insurance coverage, including term life, whole life, and endowment policies.

Non-Life Bancassurance: Products covering general insurance needs such as health, property, and casualty insurance.

Breakup by Model Type:

Pure Distributor: Banks act solely as distributors of insurance products without underwriting risks, leveraging existing customer relationships.

Exclusive Partnership: Banks collaborate exclusively with a single insurance company to offer tailored insurance products to their customers.

Financial Holding: A parent company owns both banking and insurance entities, facilitating integrated financial services under one corporate umbrella.

Joint Venture: Banks and insurance companies form a jointly owned entity to offer combined financial products and services.

Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Regional Insights

Asia Pacific dominates the global bancassurance market, accounting for over 45.9% of the total market share in 2024. The region's strong performance is attributed to a rising middle-class population, increasing disposable incomes, and enhanced financial literacy. Countries such as China and India are witnessing a surge in bancassurance adoption due to government initiatives promoting financial inclusion and digital banking solutions. The expanding presence of multinational banks and insurance providers further strengthens the region's growth potential.

Recent Developments & News

The bancassurance market has witnessed significant developments, particularly in digital transformation. Leading banks and insurers are leveraging AI-driven customer insights to offer personalized insurance solutions. Insurtech collaborations have gained traction, with companies integrating blockchain and big data analytics to streamline policy issuance and claims processing. Additionally, regulatory changes across various regions have facilitated smoother partnerships between financial institutions, driving market expansion and increasing insurance penetration worldwide.

Key Players

ABN AMRO Bank N.V.

The Australia and New Zealand Banking Group Limited

Banco Bradesco SA

The American Express Company

Banco Santander, S.A.

BNP Paribas S.A.

The ING Group

Wells Fargo & Company

Barclays plc

Intesa Sanpaolo S.p.A.

Lloyds Banking Group plc

Citigroup Inc.

Crédit Agricole S.A.

HSBC Holdings plc

NongHyup Financial Group

Société Générale

Nordea Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=982&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Bancassurance Market Analysis Size, Share, Growth, Key Trends and Forecast 2025-2033 here

News-ID: 3949283 • Views: …

More Releases from IMARC Group

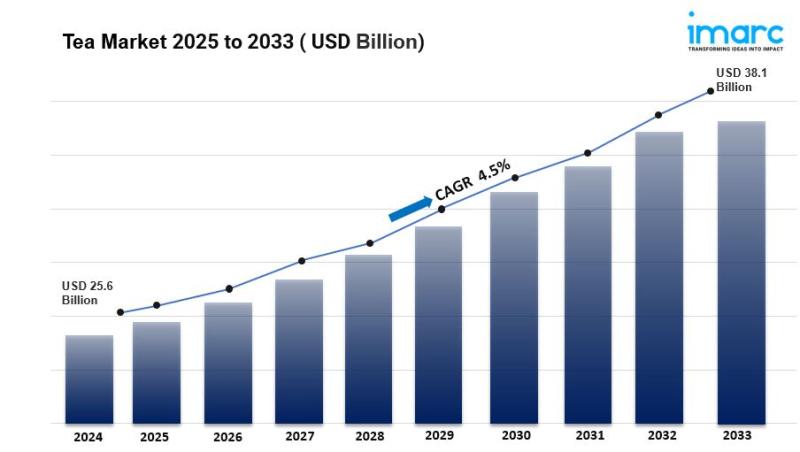

Tea Market is Projected to Grow USD 38.1 Billion by 2033 | At CAGR 4.5%

Tea Market Overview:

The global tea market was valued at USD 55.8 Billion in 2024 and is projected to reach USD 78.4 Billion by 2033, exhibiting a CAGR of 3.9% during the 2025-2033 forecast period. Growing consumer awareness about health benefits, rising demand for specialty and premium teas, and expanding café culture are driving this growth. The tea market size is expanding rapidly due to increasing consumer preference for natural and…

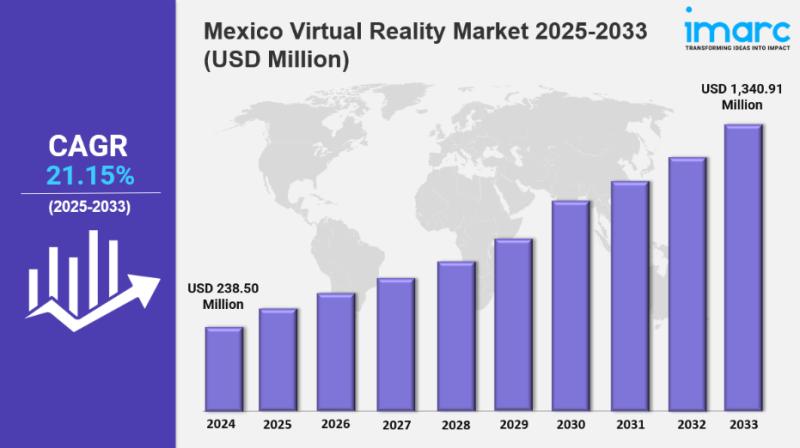

Mexico Virtual Reality Market 2025 : Industry Size to Reach USD 1,340.91 Million …

IMARC Group has recently released a new research study titled "Mexico Virtual Reality Market Size, Share, Trends and Forecast by Device Type, Technology, Component, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico virtual reality market size reached USD 238.50 Million in 2024 and is projected to grow to USD…

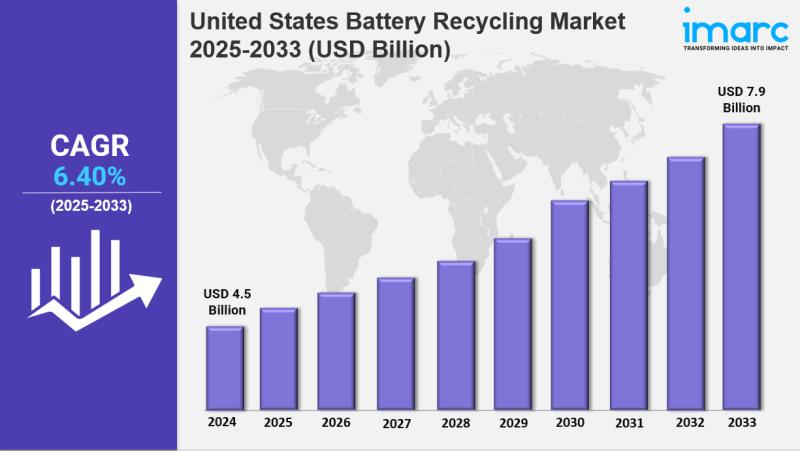

United States Battery Recycling Market Size to Hit USD 7.9 Billion by 2033: Tren …

IMARC Group has recently released a new research study titled "United States Battery Recycling Market Size, Share, Trends and Forecast by Type, Source, End Use, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States battery recycling market was valued at USD 4.5 Billion in 2024 and is projected to reach…

Magnesium Tungstate Production Plant Cost Report: Feasibility Study and Setup Re …

Introduction

Magnesium tungstate is an inorganic compound composed of magnesium, tungsten, and oxygen, typically represented by the chemical formula MgWO4. It is recognized for its robust crystalline structure and notable luminescent properties, making it valuable in various optical and electronic applications. The compound exhibits high density, chemical stability, and strong resistance to thermal stress, enabling effective performance under demanding environmental conditions. Magnesium tungstate is commonly used in scintillation detectors, phosphor materials,…

More Releases for Bancassurance

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

Bancassurance Products Market 2025: A Decade of Phenomenal Growth Ahead

The Bancassurance Products Market 2025-2033 report provides a comprehensive analysis of Types (Life Insurance, Non-life Insurance), Application (Aldult, Child, Others), Analysis of Industry Trends, Growth, and Opportunities, R&D landscape, Data security and privacy concerns Risk Analysis, Pipeline Products, Assumptions, Research Timelines, Secondary Research and Primary Research, Key Insights from Industry Experts, Regional Outlook and Forecast, 2025-2033.

Major Players of Bancassurance Products Market are:

ABN AMRO Bank, ANZ, Banco Bradesco, American Express, Banco Santander,…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…

Bancassurance Technology Market To Incur Rapid Extension During 2020-2025

Global Bancassurance Technology Market essentials: an introduction of the market, characterizations, types, applications and supply chain scenario; Bancassurance Technology industry approaches and designs; type details; producing forms; cost structures. It also informs global fundamental regions economic situations, including the Bancassurance Technology product value, benefit, restraints, generation, demand and supply, and Bancassurance Technology industry development rate and so on. The report presents SWOT and Bancassurance Technology PESTEL analysis, speculation plausibility, and…