Press release

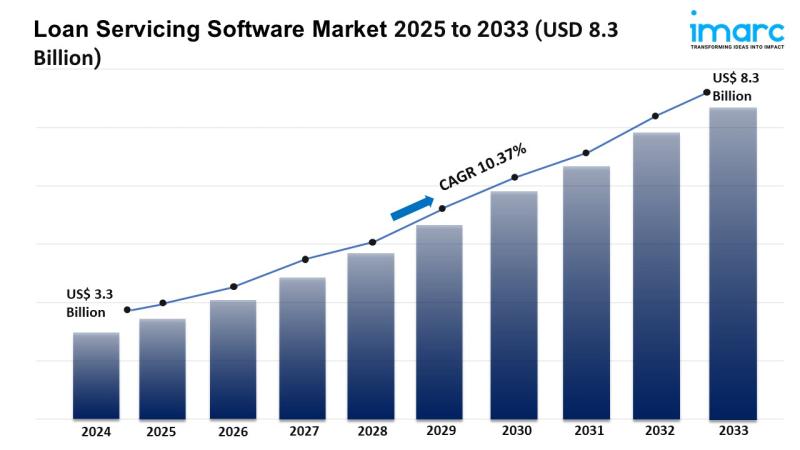

Loan Servicing Software Market Size To Exceed USD 8.3 Billion By 2033 | CAGR of 10.37%

Market Overview:The loan servicing software market is experiencing rapid growth, driven by automation driving efficiency, cloud-based solutions surge, and focus on customer experience. According to IMARC Group's latest research publication, "Loan Servicing Software Market by Component (Software, Services), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End User (Banks, Credit Unions, Mortgage Lenders and Brokers, and Others), and Region 2025-2033", The global loan servicing software market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/loan-servicing-software-market/requestsample

Our report includes:

• Market Dynamics

• Market Trends and Market Outlook

• Competitive Analysis

• Industry Segmentation

• Strategic Recommendations

Factors Affecting the Growth of the Loan Servicing Software Industry:

• Automation Driving Efficiency

Loan servicing software is changing how financial operations work through automation of repetitive processes such as payment processing and compliance reporting. Automation means fewer human errors, better consistency and speed, and greater accuracy, giving lenders more time to focus on what matters most. The use of loan servicing software and workforce automation tools is particularly timely given increasing loan volumes and complex regulatory issues, so lenders are looking for ways to automate these processes. The combination of automation and analytics has strengthened their decision-making capabilities with real-time visibility into portfolio performance and risk. Financial institutions want to eliminate inefficient workflows and reduce unnecessary costs associated with manual processes. As a result, we are seeing more and more sophisticated, automated solutions that are reshaping the nature of the lending business with greater precision and speed.

• Cloud-Based Solutions Surge

The popularity of cloud-based loan servicing software is continuing to grow due to the flexibility, scalability, and cost-effective nature of these easily-accessible online platforms. Many financial institutions are using these platforms to cut expenses on IT infrastructure, and to also achieve a level of remote access that meets the demands of the digital-first world we now live in. These software platforms remain up to date in real-time, and their ability to seamlessly integrate with other technologies/banking systems improves capacity for agile operational responses. The transition to cloud platforms is fueled by a general consensus, in particular, among fintech companies and SMEs that loan management should be geographically and temporally no longer constrained. As customer attitudes change, cloud-based software ensures lenders will maximize their ability to provide quick, safe, and scalable services that will increase borrowing activity in the marketplace.

• Focus on Customer Experience

Loan servicing software developers are increasingly prioritizing features focused on the experience of the customer by developing tools like self-service portals and mobile apps that enhance borrower experience and satisfaction. Self-service portals and mobile apps provide borrowers with tools that allow them to manage their loans, make payments, access real-time data when they want, and the convenience of a mobile device where they can get their borrower questions answered spaces similar to messaging chat on other applications they use, thus creating loyalty. Financial institutions are embracing AI and machine learning to personalize borrower interactions, which satisfies a modern consumer's desire for seamless digital experiences and streamlined communication. As lenders face increased competitive pressure to be more accessible in the lending space, need for loan servicing software that enhances borrower engagement by helping them avoid conflict while n the loan servicing space is growing. The focus on enhancing the customer experience is a contributor to growth in the market as lenders look to differentiate their loan servicing software with more innovative tools that can enhance the lending client experience and potentially lead to stronger client relationships.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6773&method=1670

Leading Companies Operating in the Loan Servicing Software Industry:

• Altisource

• Applied Business Software

• Bryt Software LCC

• C-Loans Inc.

• Emphasys Software (Constellation Software)

• Financial Industry Computer Systems Inc.

• Fiserv Inc.

• GOLDPoint Systems Inc.

• Graveco Software Inc.

• LoanPro

• Nortridge Software LLC

• Q2 Software Inc. (Q2 Holdings Inc.)

• Shaw Systems Associates LLC.

Loan Servicing Software Market Report Segmentation:

By Component :

• Software

• Services

The loan servicing software market is primarily composed of software and services, with software being the largest segment.

By Deployment Mode:

• On-premises

• Cloud-based

The market analysis reveals that cloud-based deployment holds the largest market share compared to on-premises solutions.

By Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Large enterprises dominate the loan servicing software market, as highlighted in the analysis of enterprise size.

By End User:

• Banks

• Credit Unions

• Mortgage Lenders and Brokers

• Others

Banks represent the largest segment among end users in the loan servicing software market, followed by credit unions and mortgage lenders.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America, driven by growth in the BFSI sector and technology integration, is the largest market for loan servicing software, encompassing the United States and Canada, along with other global regions.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=6773&flag=C

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Software Market Size To Exceed USD 8.3 Billion By 2033 | CAGR of 10.37% here

News-ID: 4048232 • Views: …

More Releases from IMARC Group

Bamboo Pellets Manufacturing Plant Cost 2025: Setup Details, Capital Investments …

Bamboo pellets are renewable biofuels produced by compressing bamboo biomass into small, dense, and energy-rich pellets. They serve as an eco-friendly alternative to coal, oil, and natural gas, offering high calorific value, low emissions, and cost efficiency. Due to bamboo's fast growth and widespread availability, bamboo pellets are considered a sustainable energy solution for heating, power generation, and industrial applications, as well as for use in biomass boilers and stoves.

Establishing…

EPDM Rubber Global Prices Analysis August 2025 Report

Northeast Asia EPDM Rubber Prices Movement August 2025

In August 2025, EPDM rubber prices in Northeast Asia stood at 2.44 USD/KG, marking a 1.8% increase. The rise was driven by robust demand from the automotive and construction industries. Improved feedstock supply and steady manufacturing activity supported market stability, while regional export opportunities provided additional upward momentum for producers.

Note: The analysis can be tailored to align with the customer's specific needs.

Get the…

Ayurvedic Medicine Manufacturing Plant Setup Cost 2025: Feasibility and Profitab …

Ayurvedic medicine is a traditional system of healthcare originating in India, focusing on natural remedies, herbal formulations, and holistic treatments to maintain physical, mental, and spiritual well-being. It uses plant-based ingredients, minerals, and lifestyle practices to prevent and treat diseases, emphasizing balance among the body's energies (doshas) and promoting long-term health naturally.

Setting up an Ayurvedic medicine plant involves procuring raw herbs, minerals, and other natural ingredients, installing processing units like…

Spain POS Terminals Market Size, Share, and Forecast 2025-2033

Spain POS Terminals Market Overview

Market Size in 2024: USD 1.37 Billion

Market Forecast in 2033: USD 2.71 Billion

Market Growth Rate (CAGR) 2025-2033: 7.90%

The Spain POS terminals market size reached USD 1.37 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.71 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033.

Spain POS Terminals Market Trends and Drivers:

The Spain POS terminals market is experiencing a major…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…