Press release

Step-by-Step Process for Setting Up a Blue Ammonia Manufacturing Plant

Setting up a blue ammonia manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.IMARC Group's report titled "Blue Ammonia Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a paper plate manufacturing plant, covering everything from product overview and production processes to detailed financial insights.

Get blue ammonia plant cost estimate report: https://www.imarcgroup.com/blue-ammonia-manufacturing-plant-project-report/requestsample

A blue ammonia manufacturing plant is a feature designed to produce ammonia (NH) using natural gas using natural gas to reduce greenhouse gas emissions, incorporating carbon capture and storage (CCS) techniques. In traditional ammonia production, significant carbon dioxide is released during the improvement of natural gas to produce hydrogen, which is an important step in synthesizing ammonia. However, in blue ammonia production, this CO is captured and either underground stored or renovated for industrial use, which reduces the carbon footprint of the plant significantly. This makes blue ammonia a more durable option for traditional ammonia, especially in the context of dekbonization goals. The resulting product is similar to traditional ammonia in terms of chemical properties, but its lower life cycle is considered "blue" due to carbon emissions. Blue ammonia can be used as a carrier for fertilizer production, energy storage and hydrogen in global energy transport. Its role is expanding into low-carnory energy systems, especially in areas in search of infections in fossil fuels without compromising industrial productivity. Integration of CCS technologies and adherence to environmental regulations are important components of blue ammonia plant operations, keeping these features in the form of an important bridge between current industrial practices and future pure-zero emission goals.

Blue ammonia is motivated to reduce market carbon emissions for manufacturing plants and increase global efforts for infection towards cleaner energy systems. As industries and governments try to meet ambitious net-zero targets, blue ammonia offers a practical solution for decarbonatizing areas such as power generation, marine transport and fertilizer production. The ability to produce low carbon ammonia using existing infrastructure-carbon capture and increased storage techniques with increased cost and time compared to ammonia, which requires renewable hydrogen. Additionally, the increasing demand for hydrogen in the form of a clean fuel is indirectly increasing the blue ammonia markets, as ammonia acts as a stable carrier for hydrogen transport and storage. Policy incentives, such as carbon pricing, tax credit, and government -backed dekbonization roadmaps, blue ammonia further stimulate investment in infrastructure. Major areas including North America, Middle East and Asia-Pacific are looking at important project announcements and cooperation aimed at increasing the production of blue ammonia. In addition, international trade interests are increasing, especially in markets such as Japan and South Korea, demanding safe import of low carbon fuel. Overall, blue ammonia manufacturing plants are becoming central for global clean energy strategies due to their ability to cut immediate emissions, supporting long -term infections in Green Technologies.

Buy Now: https://www.imarcgroup.com/checkout?id=28242&method=1911

Key Steps Required to Set Up a Blue Ammonia Plant

1. Market Analysis

The report provides insights into the landscape of the blue ammonia industry at the global level. The report also provides a segment-wise and region-wise breakup of the global blue ammonia industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of blue ammonia, along with the industry profit margins.

• Segment Breakdown

• Regional Insights

• Pricing Analysis and Trends

• Market Forecast

2. Product Manufacturing: Detailed Process Flow

Detailed information related to the process flow and various unit operations involved in the blue ammonia manufacturing plant project is elaborated in the report. These include:

• Land, Location, and Site Development

• Plant Layout

• Plant Machinery

• Raw Material Procurement

• Packaging and Storage

• Transportation

• Quality Inspection

• Utilities

• Human Resource Requirements and Wages

• Marketing and Distribution

3. Project Requirements and Cost

The report provides a detailed location analysis covering insights into the plant location, selection criteria, location significance, environmental impact, and expenditure for blue ammonia manufacturing plant setup. Additionally, the report also provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Machinery and Equipment

• List of machinery needed for blue ammonia production

• Estimated costs and suppliers

Raw Material Costs

• Types of materials required and sourcing strategies

Utilities and Overheads

• Electricity, water, labor, and other operational expenses

4. Project Economics

A detailed analysis of the project economics for setting up a blue ammonia manufacturing plant is illustrated in the report. This includes the analysis and detailed understanding of capital expenditure (CAPEX), operating expenditure (OPEX), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis.

Capital Expenditure (CAPEX)

• Initial setup costs: land, machinery, and infrastructure

Operating Expenditure (OPEX)

• Recurring costs: raw materials, labor, maintenance

Revenue Projections

• Expected income based on production capacity, target market, and market demand

Taxation

Depreciation

Financial Analysis

• Liquidity Analysis

• Profitability Analysis

• Payback Period

• Net Present Value (NPV)

• Internal Rate of Return

• Profit and Loss Account

Uncertainty Analysis

Sensitivity Analysis

Economic Analysis

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=28242&flag=C

5. Legal and Regulatory Compliance

• Licenses and Permits

• Regulatory Procedures and Approval

• Certification Requirement

6. Hiring and Training

• Total human resource requirement

• Salary cost analysis

• Employee policies overview

The report also covers critical insights into key success and risk factors, which highlight the aspects that influence the success and potential challenges in the industry. Additionally, the report includes strategic recommendations, offering actionable advice to enhance operational efficiency, profitability, and market competitiveness. A comprehensive case study of a successful venture is also provided, showcasing best practices and real-world examples from an established business, which can serve as a valuable reference for new entrants in the market.

About Us:

IMARC is a global market research company offering comprehensive services to support businesses at every stage of growth, including market entry, competitive intelligence, procurement research, regulatory approvals, factory setup, company incorporation, and recruitment. Specializing in factory setup solutions, we provide detailed financial cost modelling to assess the feasibility and financial viability of establishing new manufacturing plants globally. Our models cover capital expenditure (CAPEX) for land acquisition, infrastructure, and equipment installation while also evaluating factory layout and design's impact on operational efficiency, energy use, and productivity. Our holistic approach offers valuable insights into industry trends, competitor strategies, and emerging technologies, enabling businesses to optimize operations, control costs, and drive long-term growth.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Step-by-Step Process for Setting Up a Blue Ammonia Manufacturing Plant here

News-ID: 4084262 • Views: …

More Releases from IMARC Group

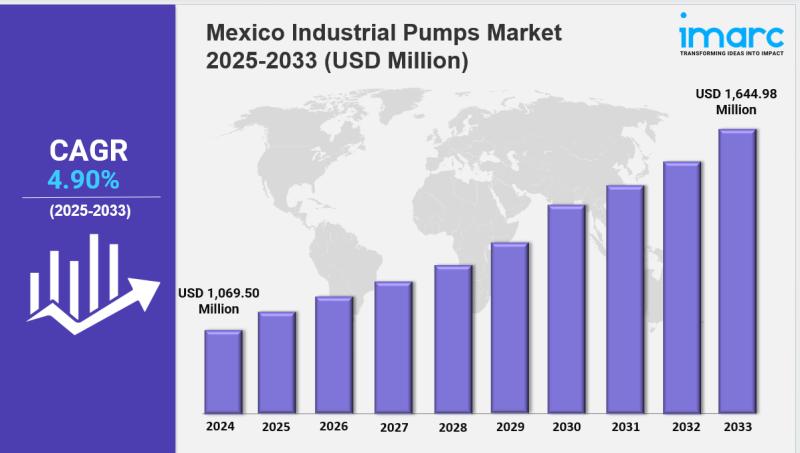

Mexico Industrial Pumps Market Share, Size, In-Depth Analysis and Forecast 2025- …

IMARC Group has recently released a new research study titled "Mexico Industrial Pumps Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico industrial pumps market size reached USD 1,069.50 Million in 2024 and is expected to reach USD 1,644.98…

Vietnam Hospitality Market 2025 - Top Regions, Latest Technology, Investment Opp …

The Vietnam hospitality market was valued at USD 7.0 Billion in 2024 and is projected to reach USD 20.7 Billion by 2033, growing at a CAGR of 12.20% during the forecast period from 2025 to 2033. The market growth is driven by improved tourism infrastructure, increasing international air connectivity, rising domestic travel, and foreign investment in hotel chains. Government initiatives such as visa reforms and destination marketing enhance the country's…

India Automotive Sensors Market Valuation to Reach USD 4.5 Billion by 2033 - Exp …

According to the latest report by IMARC Group, titled "India Automotive Sensors Market Report by Type (Level/Position Sensors, Temperature Sensors, Pressure Sensors, Speed Sensors, Gas Sensors, Magnetic Sensors, and Others), Vehicle Type (Passenger Cars, Commercial Vehicles), Application (Powertrain, Chassis, Vehicle Body Electronics, Safety and Security, Telematics, and Others), Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket), and Region 2025-2033," the report presents a thorough review featuring the India Automotive Sensors Market…

Portugal E-Commerce Market Outlook: Trends, Growth, and Future Opportunities 202 …

Market Overview

The Portugal e-commerce market size was USD 74.24 Million in 2024. It is projected to reach USD 585.43 Million by 2033, growing at a CAGR of 25.79% during the forecast period 2025-2033. The market growth is primarily driven by robust digital infrastructure, favorable government policies, and mobile-first innovation, which together enhance user trust, financial inclusion, and competitiveness.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Portugal E-Commerce Market Key Takeaways

Current…

More Releases for Blue

Shaping the Blue Cheese Market in 2025: Plant-Based Innovations In Blue Cheese S …

"How Big Is the Blue Cheese Market Expected to Be, and What Will Its Growth Rate Be?

In the last few years, the blue cheese market has seen a solid expansion. It is projected to increase from $1.52 billion in 2024 to $1.61 billion in 2025, reflecting a compound annual growth rate (CAGR) of 6.1%. The growth during the historical period can be credited to several factors such as the emergence…

Rehab Seekers Blue Cross Blue Shield's Prescription Drug Coverage: Tips For Cost …

The task of management of prescription medication can be overwhelming, but it's more like decoding a secret code to success!

You shouldn't overlook this critical aspect of healthcare plan. Blue cross blue shield provides a wide variety of insurance plans which offer different prescription drug [https://www.samhsa.gov/medications-substance-use-disorders] coverage. You can select the best plan that covers your health needs and finance status.

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXdpXY80C8VF11aXaUvUACnczHh3BDyQHK2J_2agHIfffWzCHxryAie1ZarzBlv6gJOzO8mTrIKF0WQQlE4qC-2w8H9BhDCQ3dLpsihQ7SpcOiAKa86saR4aOZpJcrKW-L-w0zed8AUcmtl96FPSOEs_8JfV?key=dSHNEzjCaj_wW0rDbef_sw

You no longer have to worry about the expensive drugs…

Blue Ocean Enters Metaverse

Blue Ocean Corporation recently launched a Metaverse platform for its Training and Conferences services. The introduction of its Metaverse-enabled services was announced earlier in June 2022 at the Blue Ocean-hosted International Human Resource Conference (IHRC) in Dubai which took place under the patronage of His Excellency Sheikh Nahayan bin Mabarak Al Nahayan, UAE Cabinet Member and Minister of Tolerance and Coexistence.

Themed on Metaverse, the Conference explored the technological and…

Pet Food Market Touching Impressive Growth| Blue Buffalo, BLUE Life, Nestlé, Sp …

HTF MI published a new industry research that focuses on Pet Food market and delivers in-depth market analysis and future prospects of Global Pet Food market. The study covers significant data which makes the research document a handy resource for managers, analysts, industry experts and other key people get ready-to-access and self-analyzed study along with graphs and tables to help understand market trends, drivers and market challenges. The study is…

Blue Vault Partners and Blue Springs Capital Launch BDC Review

Blue Vault Partners, first with online performance reporting for nontraded REITs, is expanding its research services by partnering with Blue Springs Capital to launch a new publication focused on nontraded Business Development Companies.

Atlanta, GA, August 20, 2013 -- Blue Vault Partners is pleased to announce the formation of a strategic alliance with Blue Springs Capital to launch a new report that will analyze and monitor the performance of nontraded Business…

Blue Moves - The Blue Economy Video Competition 2011

At the beginning of 2011, one of the most interesting international video competitions of the year will be starting: – The Blue Economy Video Competition 2011.

Blue Moves – With this slogan, Blue Economy will present a total of 4 competitions during 12 months, inviting professional and non-professional film producers from all over the world to develop visualizations of ecological innovations regarding the following areas of interest:

• Water & Waste

• Energy

•…