Press release

Capital Investment and Operating Cost for Polyester Filament Yarn (PFY) Plant Setup in 2025

Introduction:Polyester Filament Yarn (PFY) is a synthetic yarn produced by melting polyester chips and extruding them into long, continuous filaments. These filaments are then cooled, stretched, and wound into yarns that are strong, elastic, and resistant to shrinking and wrinkling. PFY is commonly used in textiles for apparel, upholstery, and industrial fabrics due to its durability and versatility.

Setting up a PFY manufacturing plant requires investment in raw material sourcing, polymerization units, spinning machinery, and quality control systems. Efficient plant layout, skilled workforce, and adherence to environmental regulations are crucial for successful and cost-effective operations.

IMARC Group's report, titled "Polyester Filament Yarn (PFY) Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a Polyester filament yarn (PFY) manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report: https://www.imarcgroup.com/polyester-filament-yarn-manufacturing-plant-project-report/requestsample

Polyester filament yarn (PFY) Industry outlook 2025

The Polyester Filament Yarn (PFY) industry is poised for strong growth in 2025, driven by increasing demand across apparel, home textiles, automotive, and industrial applications. Its advantages-such as durability, elasticity, and cost-effectiveness-make it a preferred choice over natural fibers in many segments. Technological advancements in spinning and texturing processes, coupled with rising interest in recycled and eco-friendly PFY, are further boosting market appeal. With stable raw material availability, growing export opportunities, and government incentives in key manufacturing countries, the PFY sector is expected to maintain a positive outlook through 2025, making it an attractive space for investment and expansion.

Key Cost Components of Setting Up a Polyester Filament Yarn (PFY) Plant

Detailed Process Flow

o Product Overview

o Unit Operations Involved

o Mass Balance and Raw Material Requirements

o Quality Assurance Criteria

o Technical Tests

Project Details, Requirements and Costs Involved:

o Land, Location and Site Development

o Plant Layout

o Machinery Requirements and Costs

o Raw Material Requirements and Costs

o Packaging Requirements and Costs

o Transportation Requirements and Costs

o Utility Requirements and Costs

o Human Resource Requirements and Costs

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

o Capital Investments

o Operating Costs

o Expenditure Projections

o Revenue Projections

o Taxation and Depreciation

o Profit Projections

o Financial Analysis

Profitability Analysis:

o Total Income

o Total Expenditure

o Gross Profit

o Gross Margin

o Net Profit

o Net Margin

Key Cost Components of Setting Up a Polyester filament yarn (PFY) Plant

• Raw Materials: Major inputs like purified terephthalic acid (PTA) and monoethylene glycol (MEG) form a significant portion of recurring production costs.

• Machinery & Equipment: Costs include polymerization units, spinning lines, texturizing machines, and filtration systemsoften the most capital-intensive part.

• Land & Infrastructure: Expenses for land acquisition, factory construction, power systems, water supply, and effluent treatment facilities.

• Utilities: High energy consumption (electricity and thermal energy) for continuous operations is a major operational expense.

• Labor: Skilled and semi-skilled workforce for operations, maintenance, and quality control.

• Environmental Compliance: Costs for installing pollution control equipment and meeting regulatory standards.

• Packaging & Storage: Yarn packaging machines, warehouse setup, and inventory management systems.

• Logistics: Initial setup of transport infrastructure for raw material procurement and finished goods distribution.

• Technology & Automation: Investments in digital monitoring systems, SCADA, or ERP for efficient plant management.

• Working Capital: Funds required to cover initial operational costs such as raw material stock, salaries, and utility bills until the plant becomes cash-flow positive.

Economic Trends Influencing Polyester filament yarn (PFY) Plant Setup Costs 2025

• Raw Material Volatility: Fluctuating PTA and MEG prices impact both capital and operational expenditure.

• Rising Energy Costs: High electricity and gas prices increase daily running costs significantly.

• Environmental Regulations: Stricter emission norms raise compliance and pollution control equipment costs.

• Carbon Penalties: Global carbon taxes push up setup costs for non-green technologies.

• Import Tariffs: Duties on raw materials and machinery increase total capital investment.

• Currency Fluctuations: Exchange rate volatility affects machinery imports and raw material sourcing.

• Labor Cost Inflation: Rising skilled labor wages add to long-term operational expenses.

• Supply Chain Disruptions: Delays in equipment or material deliveries raise initial setup costs.

• Oversupply Concerns: Market saturation lowers PFY prices, affecting plant profitability forecasts.

• Sustainability Demands: Demand for eco-friendly production adds cost for upgraded machinery and certifications.

Speak to an Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9389&flag=C

Challenges and Considerations for Investors

• High Capital Investment: Significant upfront costs for machinery, infrastructure, and utilities.

• Feedstock Dependency: Reliance on volatile raw material markets like PTA and MEG.

• Regulatory Compliance: Stringent environmental and safety standards require ongoing investment.

• Technology Upgradation: Need for modern, efficient machinery to stay competitive.

• Market Volatility: PFY prices fluctuate due to global supply-demand dynamics.

• Skilled Labor Requirement: Shortage of trained technical staff may hinder operations.

• Energy Consumption: High power usage can strain operational budgets.

• Sustainability Pressure: Growing demand for recycled or green PFY raises production costs.

• Logistics & Distribution: Efficient supply chain needed to manage raw materials and finished goods.

• Return on Investment (ROI): Long gestation period before profitability is realized.

Buy Now: https://www.imarcgroup.com/checkout?id=9389&method=1911

Conclusion

In conclusion, while the Polyester Filament Yarn (PFY) industry presents strong growth potential driven by rising demand and evolving textile applications, investors must navigate a range of challenges. High setup costs, raw material dependency, regulatory pressures, and the need for technological advancement demand careful planning and risk mitigation. Success in this sector hinges on strategic investments in efficient machinery, sustainable practices, skilled workforce, and robust supply chains. With thoughtful execution, investors can capitalize on the long-term profitability and resilience of the PFY market.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Capital Investment and Operating Cost for Polyester Filament Yarn (PFY) Plant Setup in 2025 here

News-ID: 4085398 • Views: …

More Releases from IMARC Group

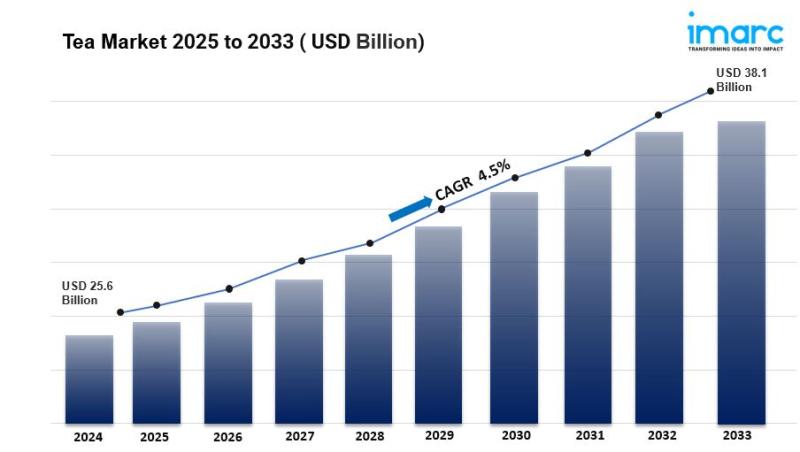

Tea Market is Projected to Grow USD 38.1 Billion by 2033 | At CAGR 4.5%

Tea Market Overview:

The global tea market was valued at USD 55.8 Billion in 2024 and is projected to reach USD 78.4 Billion by 2033, exhibiting a CAGR of 3.9% during the 2025-2033 forecast period. Growing consumer awareness about health benefits, rising demand for specialty and premium teas, and expanding café culture are driving this growth. The tea market size is expanding rapidly due to increasing consumer preference for natural and…

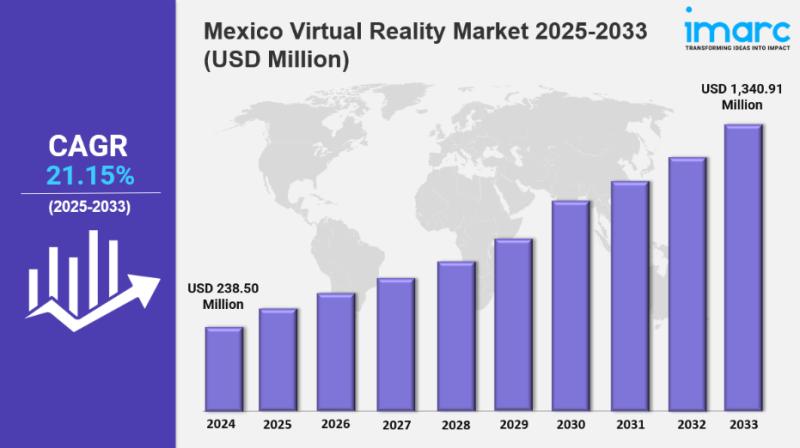

Mexico Virtual Reality Market 2025 : Industry Size to Reach USD 1,340.91 Million …

IMARC Group has recently released a new research study titled "Mexico Virtual Reality Market Size, Share, Trends and Forecast by Device Type, Technology, Component, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico virtual reality market size reached USD 238.50 Million in 2024 and is projected to grow to USD…

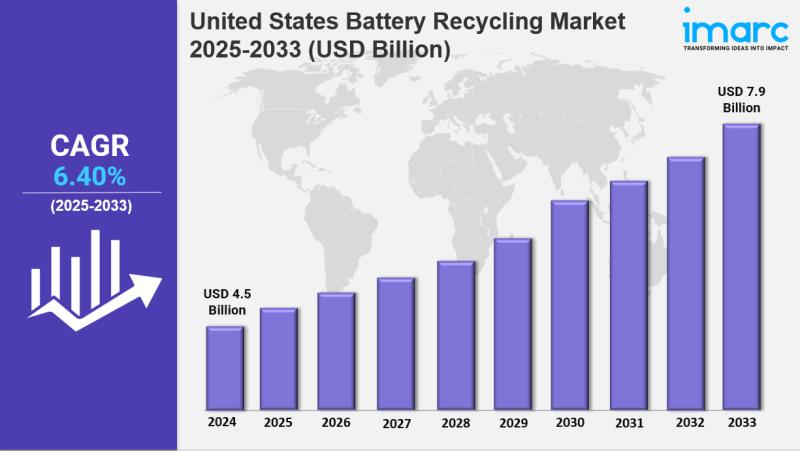

United States Battery Recycling Market Size to Hit USD 7.9 Billion by 2033: Tren …

IMARC Group has recently released a new research study titled "United States Battery Recycling Market Size, Share, Trends and Forecast by Type, Source, End Use, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States battery recycling market was valued at USD 4.5 Billion in 2024 and is projected to reach…

Magnesium Tungstate Production Plant Cost Report: Feasibility Study and Setup Re …

Introduction

Magnesium tungstate is an inorganic compound composed of magnesium, tungsten, and oxygen, typically represented by the chemical formula MgWO4. It is recognized for its robust crystalline structure and notable luminescent properties, making it valuable in various optical and electronic applications. The compound exhibits high density, chemical stability, and strong resistance to thermal stress, enabling effective performance under demanding environmental conditions. Magnesium tungstate is commonly used in scintillation detectors, phosphor materials,…

More Releases for Cost

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Acetaminophen Production Cost Analysis Report: Manufacturing Process, Raw Materi …

The latest report titled "Acetaminophen Production Cost Report" by Procurement Resource a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Acetaminophen. Read More: https://www.procurementresource.com/production-cost-report-store/acetaminophen

Report Features - Details

Product Name - Acetaminophen

Process Included - Acetaminophen Production From Phenol

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…