Press release

Banks, Stablecoins, and the New Trust Layer: How Mozafx Aligns with the U.S. Financial Shift

As the U.S. financial system undergoes one of its most significant shifts since the repeal of Glass-Steagall, a new era is emerging-driven by stablecoins, tokenized deposits, and programmable money. Underlying this transformation is a recalibration of trust, control, and capital velocity. Leading this evolution are not only major financial institutions, but also companies like Mozafx, a U.S.-registered forex and multi-asset brokerage navigating the digital transformation of finance.The Rise of Digitally Issued Stablecoins

Since 2019, when a major U.S. financial institution launched a pilot digital token, many banks have accelerated efforts to implement dollar-pegged digital payment solutions. Institutions are building internal payment networks using digitally denominated cash equivalents to enable real-time settlement across geographies.

While blockchain is the underlying technology, the benefits are practical: 24/7 liquidity, near-instant settlement, and audit-grade ledger integrity. These advancements contrast sharply with traditional infrastructure, which is increasingly perceived as outdated.

Policy Evolution and Regulatory Clarity

In July 2025, a legislative framework-referred to as the GENIUS Act-was introduced to provide legal clarity around stablecoins. However, note: as of publication, this act has not been enacted into law. Any reference to its provisions should be interpreted as proposed or conceptual rather than enforceable statutes.

The policy blueprint suggests that, if implemented, stablecoins issued by regulated entities would need to meet strict reserve and compliance standards, signaling a direction toward federal oversight of privately issued digital dollars.

Monetary Incentives and Strategic Shifts

With interest rates remaining high, short-duration assets are yielding attractive returns. Stablecoin operators can derive earnings from assets such as short-term U.S. government securities that back their tokens. This shift redirects economic value traditionally captured by banks toward new digital finance intermediaries.

As tokenized assets evolve into credible money market alternatives, new players-including fintechs and trading platforms-are entering the space. These digital instruments are reshaping balance sheet strategies and payment ecosystems alike.

Reimagining Cross-Border Payments and FX

The greatest immediate impact is in foreign exchange and remittance. Stablecoins offer a programmable alternative to traditional systems, potentially reducing costs and settlement times from days to seconds. Platforms that merge traditional FX capabilities with digital currency infrastructure are poised to lead.

Mozafx: Connecting Regulated Markets with Digital Assets

Mozafx is a forex and multi-asset brokerage platform incorporated in Colorado on November 9, 2021, under company number 20211612747. As a U.S.-registered financial services firm, Mozafx operates in accordance with applicable U.S. regulatory requirements, offering access to global markets including forex, commodities, indices, and select digital assets. The firm is headquartered at 370 17th St, Denver, CO 80202.

Key differentiators:

Regulatory oversight: Mozafx is registered in the United States and adheres to applicable U.S. financial regulations, ensuring operational transparency and client protections.

Technology architecture: Built for real-time execution and integration, Mozafx supports both traditional fiat flows and stablecoin-based settlement mechanisms.

International readiness: As stablecoins gain traction in emerging economies, Mozafx is positioned as a gateway for regulated digital transactions across diverse jurisdictions.

Through its website www.mozafx.com and contact email info@mozafx.com, the firm is building global client relationships at a moment when the very concept of "money in motion" is being redefined.

Reconstructing Financial Trust

Stablecoins are transforming from experimental tools to foundational components of financial infrastructure. In this new trust protocol, firms like Mozafx act not only as intermediaries but also as enablers of secure and interoperable capital flows.

As financial systems evolve, blending software, regulation, and liquidity, Mozafx is building the bridge between tradition and transformation.

Visit www.mozafx.com to learn more.

The post Banks, Stablecoins, and the New Trust Layer: How Mozafx Aligns with the U.S. Financial Shift appeared first on Insights News Wire.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banks, Stablecoins, and the New Trust Layer: How Mozafx Aligns with the U.S. Financial Shift here

News-ID: 4121377 • Views: …

More Releases from Binary News Network

Verto Secures DFSA Authorization, Launches UAE Operations to Support Cross-Borde …

● UAE now has a payment partner that unlocks Africa's growing economic opportunity

Verto today announced its official launch in the UAE. With over $25 billion processed annually for clients such as Unilever, and Maersk, the company's platform is designed to address the unique challenges of cross-border payments between UAE and emerging market currency corridors (particularly in Africa), offering businesses a faster, more secure, and cost-effective way to handle high-value, time-sensitive transactions.

"The…

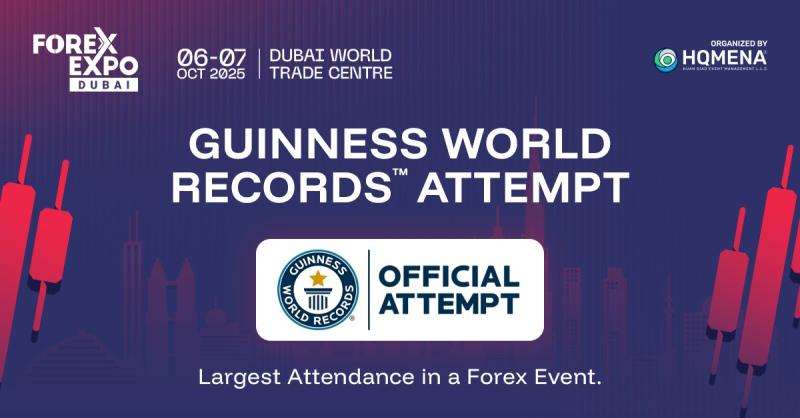

Guinness World RecordsTM Attempt in Forex Industry is announced

Share Share Share Email

Dubai, UAE - [4th October, 2025] - Forex Expo Dubai, the Middle East's largest gathering for traders, investors, and financial technology leaders, is proud to announce an official Guinness World RecordsTM attempt for the "Largest Attendance in a Forex Event."

For the first time in the history of the global forex industry, an event or expo of this scale will not only bring together professionals from across…

TR.ENERGY announces platform upgrade: lower fees on TRON and improved staking

Sharjah, UAE, 4th October 2025, ZEX PR WIRE, TR.ENERGY, a decentralized service built on the TRON blockchain, has released a significant update to its ecosystem. The upgrade makes TRC-20 transactions, including USDT transfers, even more cost-efficient and expands the functionality of the TR.ENERGY Wallet with new staking and asset management features.

Highlights of the update

Reduced fees: users now save up to 63% on TRC-20 transfers.

Flexible energy rental: instant access to TRON…

Cenex Unveils Advanced CenexPro App to Redefine AI-Powered Stock Market Insights

London, UK, 3rd October 2025, ZEX PR WIRE, Cenex Consultancy Services Limited today announced the launch of CenexPro, a new AI-powered application developed to provide automated scanning and analysis of equity markets.

The company, headquartered at Cenex Hollywell Park, Ashby Road, Loughborough, Leicestershire, LE11 3UZ, has invested several years in research and development to bring this platform to market. CenexPro is designed as a data-driven software solution that integrates advanced algorithms…

More Releases for Mozafx

Global Volatility Fuels Gold and Forex Opportunities MOZAFX Empowers Retail

The global economy is entering a turbulent phase. The International Monetary Fund (IMF) has issued warnings that inflation may remain elevated longer than expected, with service-sector costs slowing the pace of disinflation. Meanwhile, the looming threat of a U.S. government shutdown has weakened the dollar and reignited demand for safe-haven assets. In this environment, gold has surged to fresh highs, reaffirming its role as a core hedge for retail investors.

Inflation…

Mozafx: Pioneering the Future of Multi-Asset Trading in the Digital Era

Vision & Market Positioning Mozafx positions itself as the "Next-Generation Borderless Brokerage", redefining how traders and institutions interact with the global markets. Specializing in high-leverage international spot gold trading and diversified commodities such as crude oil, silver, and agricultural products, Mozafx integrates cutting-edge fintech solutions with institutional-grade security.

Mozafx stands out for its open ecosystem, supporting stablecoin deposits and cryptocurrency settlements, making global transactions faster, cheaper, and more inclusive for traders…

Goldman Sachs Flags Looser Conditions as Fed Tilts Toward Rate Cuts

Financial conditions ease markedly since April, prompting Goldman to caution that a further stock rally and weaker dollar could spur a bond yield surge.

By MOZAFX

The Federal Reserve's path toward possible interest rate cuts is coming into sharper focus, and Goldman Sachs is warning that markets may be getting ahead of themselves. In its latest analysis, the Wall Street firm notes that U.S. financial conditions have eased by roughly 140 basis…