Press release

Lithium Carbonate Production Plant Cost Report 2025: Project Details, Capital Investments and Expenses

Lithium Carbonate is an inorganic compound with the chemical formula Li2CO3, widely recognized as a critical raw material in the production of lithium-ion batteries used in electric vehicles, energy storage systems, and portable electronics. It also finds applications in the glass and ceramics industry, aluminum production, and pharmaceuticals. As the global transition to clean energy accelerates, the demand for lithium carbonate is rapidly increasing due to its essential role in battery technology.Setting up a lithium carbonate production plant requires access to lithium-rich brine or spodumene ore, advanced purification systems, and chemical processing infrastructure. Key considerations include environmental compliance, water and energy availability, proximity to mining sources, and integration with battery-grade refining technologies.

IMARC Group's report, titled "Lithium Carbonate Production Cost Analysis 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a lithium carbonate production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report: https://www.imarcgroup.com/lithium-carbonate-manufacturing-plant-project-report/requestsample

Lithium carbonate Industry Outlook 2025

The lithium carbonate market in 2025 is characterized by a delicate shift from persistent oversupply toward tighter market balance. Following years of surplus, production cuts in key producing regions such as China and Australia are beginning to narrow the gap. Fastmarkets projects a surplus of roughly 33,000 tonnes in 2025, tightening to a 1,500-tonne deficit by 2026. Demand from electric vehicle (EV) adoption and grid energy storage remains strong forecasted to reach approximately 1.46 million tonnes of lithium carbonate equivalent (LCE) by year-end 2025, up from about 1.15 Mt in 2024. Although lithium prices have plunged from their 2022 peak-dropping over 80%-recent demand upticks are prompting cautious optimism for stabilization and potential recovery later in the year. Major industry players are adjusting strategy: Albemarle posted unexpected profit in Q2 2025 by tightening operations and focusing on higher-volume segments like energy storage and specialty chemicals. Technological innovations-especially direct lithium extraction (DLE)-are gaining traction, with U.S. projects backed by ExxonMobil and Rio Tinto targeting more efficient, sustainable refining options and spurring diversification efforts outside of China. The European Union is also promoting strategic lithium projects globally through its Critical Raw Materials Act, signaling broader geopolitical support for supply chain resilience.

Key Insights for setting up a Lithium Carbonate Production Plant

Detailed Process Flow

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Buy now: https://www.imarcgroup.com/checkout?id=10048&method=1911

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Key Cost Components

• Raw Material Costs

• Major inputs include lithium-rich ores (e.g., spodumene) or brine solutions from salt flats.

• Cost varies significantly based on source (hard rock vs. brine), lithium concentration, and global commodity prices.

• Mining and Extraction Costs

• Includes costs of ore mining, brine pumping, crushing, grinding, and pre-treatment.

• For spodumene, energy-intensive roasting adds to the cost; for brine, longer evaporation periods influence operating costs.

• Processing and Conversion Costs

• Involves chemical conversion (e.g., with sulfuric acid, soda ash) and precipitation steps to produce lithium carbonate.

• Equipment like reactors, centrifuges, filters, and dryers are required.

• Utilities and Energy Consumption

• Lithium carbonate production is energy-intensive, particularly in high-temperature processes and drying.

• Electricity, steam, and water usage are significant contributors to operating expenses.

• Capital Expenditure (CapEx)

• Covers plant construction, specialized equipment (kilns, leach tanks, crystallizers), land development, and infrastructure.

• Plants using hard rock feedstock typically have higher CapEx than brine-based facilities due to added processing stages.

• Operating and Maintenance Costs (OpEx)

• Includes labor, equipment maintenance, chemicals, reagents, and process monitoring systems.

• Continuous maintenance of high-purity processing systems adds to recurring costs.

• Environmental Compliance & Waste Management

• Costs related to effluent treatment, solid waste disposal, air emission control, and regulatory monitoring.

• Brine extraction projects also face costs linked to water usage and sustainability audits.

• Packaging, Storage, and Transportation

• Lithium carbonate must be stored under specific conditions to maintain purity.

• Packaging (bags, drums) and logistics to battery manufacturers or chemical users contribute to overall cost.

• Licensing, Permits, and Insurance

• Includes environmental and mining permits, operating licenses, safety certifications, and insurance coverage.

• Depreciation and Financing

• Long-term costs associated with capital asset depreciation and interest on financing or project loans.

• Significantly impacts project ROI and payback period.

Economic Trends Influencing Lithium Carbonate Plant Setup Costs 2025

• Volatile Lithium Prices

• Global lithium prices remain unstable due to fluctuating demand in electric vehicles (EVs) and energy storage systems. This volatility impacts long-term investment decisions and raw material sourcing costs for lithium carbonate plants.

• High Inflation and Interest Rates

• Elevated inflation continues to drive up the prices of construction materials, equipment, and skilled labor. Additionally, higher interest rates are increasing the cost of capital, making project financing more expensive.

• Rising Equipment and Technology Costs

• Advanced processing technologies (e.g., ion exchange, solvent extraction, calcination) required for battery-grade lithium carbonate are expensive and often imported. Global supply chain disruptions have also inflated machinery costs and delayed deliveries.

• Geopolitical and Supply Chain Risks

• Lithium supply chains are vulnerable to geopolitical tensions and export restrictions, especially between key producing and consuming countries. This increases feedstock uncertainty and shipping costs for spodumene or lithium brine.

• Environmental and Regulatory Compliance

• Stricter ESG (Environmental, Social, Governance) requirements and licensing procedures are increasing costs related to water use, land access, carbon footprint tracking, and waste disposal.

• Feedstock Availability and Competition

• Global competition for high-grade spodumene and brine feedstock is tightening supply and pushing prices higher, particularly as more projects compete for limited lithium reserves.

• Currency Exchange Fluctuations

• For plants that rely on imported technology or feedstock, currency volatility (especially USD, CNY, and local currencies) can significantly affect setup and operational costs.

Speak to an Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=10048&flag=C

Challenges and Considerations for Investors

• High Capital Investment

• Lithium carbonate plants, especially battery-grade ones, require substantial investment in extraction, purification, and refining technologies.

• Feedstock Supply Risks

• Reliable access to spodumene ore or lithium-rich brines is critical. Geopolitical tensions, mining limitations, or climate issues (like water scarcity in salt flats) can disrupt supply.

• Market Volatility

• Lithium prices are highly cyclical, driven by shifts in EV demand, government policies, and speculative trading, affecting revenue predictability.

• Technological Complexity

• Producing high-purity, battery-grade lithium carbonate involves complex chemical processes and precision engineering, increasing the risk of operational inefficiencies.

• Environmental and Social Compliance

• Projects must meet stringent environmental standards (e.g., water usage, carbon footprint) and obtain social license to operate, especially in ecologically sensitive or indigenous regions.

• Long Development Timelines

• From exploration to production, lithium projects can take 4-7 years to become operational, delaying returns and increasing exposure to market changes.

• Regulatory Uncertainty

• Changing regulations regarding mining rights, export bans, or ESG disclosures can alter cost structures or limit market access.

• Infrastructure Limitations

• Many lithium reserves are in remote areas with underdeveloped roads, ports, or power infrastructure, requiring additional investment.

• Skilled Workforce Shortage

• There's a growing global shortage of experienced talent in lithium extraction, chemical processing, and battery materials engineering.

• Global Competition

• Rapid capacity expansions in China, Australia, and Latin America are intensifying competition, which could pressure margins in the medium term.

Conclusion

The lithium carbonate industry is rapidly evolving as a cornerstone of the global clean energy transition, driven by surging demand from electric vehicles, battery storage, and advanced electronics. While 2025 presents promising growth opportunities supported by technological innovation and strategic policy initiatives, investors must navigate a complex landscape of rising capital costs, feedstock competition, regulatory scrutiny, and market volatility. Establishing a lithium carbonate production plant demands substantial financial, technical, and environmental planning. Success will depend on securing reliable raw material sources, adopting efficient processing technologies, and aligning operations with sustainability goals and geopolitical trends. With the right strategy, lithium carbonate investments can offer strong long-term returns in the global energy shift.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Carbonate Production Plant Cost Report 2025: Project Details, Capital Investments and Expenses here

News-ID: 4133694 • Views: …

More Releases from IMARC Group

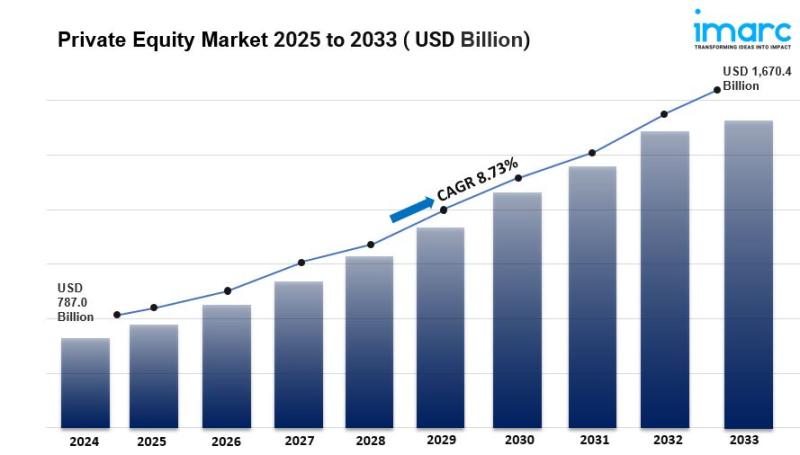

Private Equity Market is Expected to Grow USD 1,670.43 Billion by 2033 | At CAGR …

Overview Private Equity Market Outlook:

The private equity market plays a crucial role in the global financial ecosystem, providing capital to privately held companies or acquiring public companies to restructure them for long-term value creation. Unlike public markets, private equity investments are typically illiquid and made by institutional investors, high-net-worth individuals, and private equity (PE) firms seeking higher returns. The market's growth is driven by increasing corporate restructuring activities, demand for…

Technical Textiles Business Plan 2025: Setup Costs, Revenue & Profitability

Overview:

IMARC Group's "Technical textiles Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful Technical textiles business. This in-depth report covers critical aspects such as market trends, investment opportunities, revenue models, and financial forecasts, making it an essential tool for entrepreneurs, consultants, and investors. Whether assessing a new venture's feasibility or optimizing an existing business, the report provides a deep dive into all components necessary for…

Setting Up GaN Power Devices Plant in Saudi Arabia: A Comprehensive Guide for En …

IMARC Group's "GaN Power Devices Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a detailed roadmap for establishing a GaN power devices manufacturing plant in Saudi Arabia. The report offers every critical aspect of the setup process, such as unit operations, raw material requirements, utility supply, infrastructural needs, machinery models, labour necessities, transportation timelines, packaging costs, etc.

In addition to the…

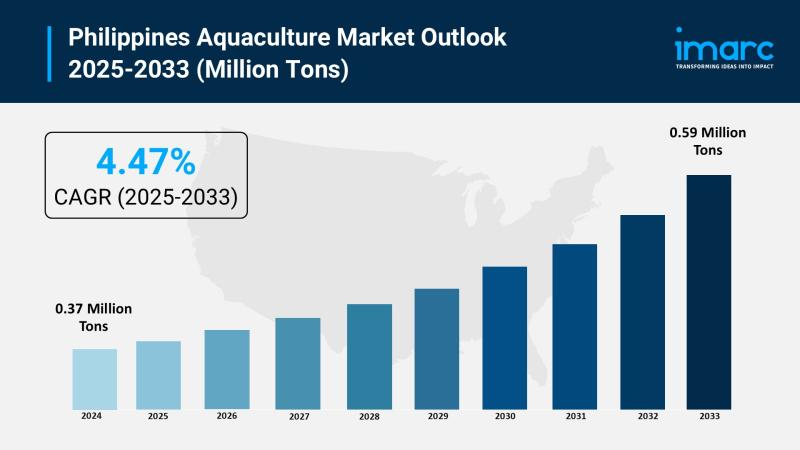

Philippines Aquaculture Market 2025 | Expected to Reach 0.59 Million Tons by 203 …

The latest report by IMARC Group, "Philippines Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033," provides an in-depth analysis of the Philippines aquaculture market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines aquaculture market size reached 0.37 million tons in 2024 and is projected to grow to 0.59 million tons by…

More Releases for Cost

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Acetaminophen Production Cost Analysis Report: Manufacturing Process, Raw Materi …

The latest report titled "Acetaminophen Production Cost Report" by Procurement Resource a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Acetaminophen. Read More: https://www.procurementresource.com/production-cost-report-store/acetaminophen

Report Features - Details

Product Name - Acetaminophen

Process Included - Acetaminophen Production From Phenol

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…