Press release

Australia Digital Banking Market Projected to Reach USD 569.81 Million by 2033

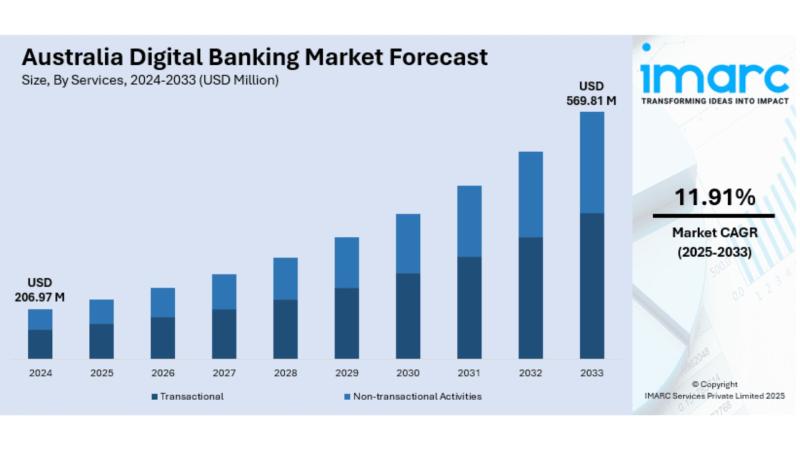

The latest report by IMARC Group, titled "Australia Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industry, and Region, 2025-2033," offers a comprehensive analysis of the Australia digital banking market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia digital banking market size reached USD 206.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 569.81 Million by 2033, exhibiting a growth rate (CAGR) of 11.91% during 2025-2033.Report Attributes:

· Base Year: 2024

· Forecast Years: 2025-2033

· Historical Years: 2019-2024

· Market Size in 2024: USD 206.97 Million

· Market Forecast in 2033: USD 569.81 Million

· Market Growth Rate 2025-2033: 11.91%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-digital-banking-market/requestsample

How Is AI Transforming the Digital Banking Market in Australia?

• AI is driving digital transformation by enhancing user experience and personalization.

• Machine learning models optimize security features like fraud detection and authentication.

• AI-powered chatbots and virtual assistants improve real-time customer engagement.

• Data analytics help banks tailor product recommendations based on consumer behavior.

• Automation accelerates transaction processing and compliance monitoring.

Australia Digital Banking Market Overview

• More people are using smartphones and having faster internet, which makes banking services easier to access.

• There is a bigger need for banking solutions that are easy to use, simple, and designed for mobile devices.

• Government policies like Open Banking and Consumer Data Right are helping to support financial services.

• Banks are working more with fintech companies to create new and better financial products.

• Customers want banking that is convenient, offers personalized options, and uses digital payment methods like wallets.

Key Features and Trends of Australia Digital Banking Market

• Mobile apps have been improved with virtual cards and tools to help manage money.

• Biometric authentication and multiple security layers are now being used.

• Blockchain technology is being used more for safe and clear transactions

• AI is being used to offer personalized experiences, which helps keep customers happy and coming back.

• New banks that only operate online are expanding, especially reaching younger, tech-friendly users.

Growth Drivers of Australia Digital Banking Market

• Many people use smartphones a lot and know how to use them well.

• People want to do their banking quickly and safely.

• There is always new technology coming up and banks are working with fintech companies.

• The government has rules that help protect personal information and allow more competition.

• More people are choosing to pay without touching cash and use online money services.

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-digital-banking-market

Innovation & Market Demand

• Banks are investing in AI-driven tools for financial advice and risk management.

• Cloud migration is improving scalability and cost efficiency.

• Digital onboarding and KYC processes are accelerating client acquisition.

• Expansion of buy now, pay later (BNPL) and embedded finance solutions.

• APIs and open banking frameworks enabling new third-party service integrations.

Australia Digital Banking Market Opportunities

• Rising demand among SMEs for integrated payment and financing solutions.

• Growth of neo-banks and challenger banks with innovative offerings.

• Increasing consumer trust in digital banking security protocols.

• Advancements in blockchain and smart contract applications.

• Cross-industry collaborations creating holistic financial ecosystems.

Australia Digital Banking Market Challenges

• Cybersecurity risks and evolving threat landscapes.

• Resistance among some demographics to fully digital banking.

• Regulatory compliance costs and complexity.

• Intense competition driving margin pressures.

• Rapid technology changes requiring ongoing investment.

Australia Digital Banking Market Analysis

• Segmentation by services (transactional and non-transactional).

• Deployment models including on-premises and cloud solutions.

• Technology segmentation covering internet banking, digital payments, and mobile banking.

• Industry verticals including media, retail, banking, manufacturing, and healthcare.

• Regional analysis of Australian states and territories.

Australia Digital Banking Market Segmentation:

1. By Services:

• Transactional (cash deposits/withdrawals, fund transfers, loans)

• Non-Transactional (information security, risk management, financial planning)

2. By Deployment Type:

• On-Premises

• Cloud

3. By Technology:

• Internet Banking

• Digital Payments

• Mobile Banking

4. By Industry:

• Media and Entertainment

• Manufacturing

• Retail

• Banking

• Healthcare

5. By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Digital Banking Market News & Recent Developments

• 2025: Bankwest launches revamped digital banking app featuring virtual cards and 24/7 support.

• 2024: Commonwealth Bank introduces CommBiz Gen AI for AI-powered business banking communications.

Australia Digital Banking Market Key Players

• Commonwealth Bank of Australia

• Westpac Banking Corporation

• ANZ Banking Group

• National Australia Bank (NAB)

• Bankwest

• ING Bank Australia

• Bendigo and Adelaide Bank

• Rabobank Australia

• Macquarie Group

• Suncorp Group

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact Analysis

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Emerging Market Trends

7. Growth Drivers and Success Factors

8. SWOT Analysis

9. Market Structure and Value Chain

10. Competitive Landscape Overview

11. Regional and Segment Insight

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=35387&flag=E

Contact:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Digital Banking Market Projected to Reach USD 569.81 Million by 2033 here

News-ID: 4153078 • Views: …

More Releases from IMARC Services Private Limited

Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2033

The latest report by IMARC Group, titled "Australia Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033," offers a comprehensive analysis of the Australia private equity market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia private equity market size reached USD 22.0 Billion in 2024. Looking forward, IMARC Group expects the market to…

Australia Robotics Market Projected to Reach USD 6.7 Billion by 2033

The latest report by IMARC Group, titled "Australia Robotics Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033," offers a comprehensive analysis of the Australia robotics market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia robotics market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.7…

Australia Healthcare IT Market Projected to Reach USD 31.03 Billion by 2033

The latest report by IMARC Group, titled "Australia Healthcare IT Market Size, Share, Trends and Forecast by Product and Services, Component, Delivery Mode, End-User, and Region, 2025-2033," offers a comprehensive analysis of the Australia healthcare IT market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia healthcare IT market size reached USD 10.17 Billion in 2024. Looking forward, IMARC…

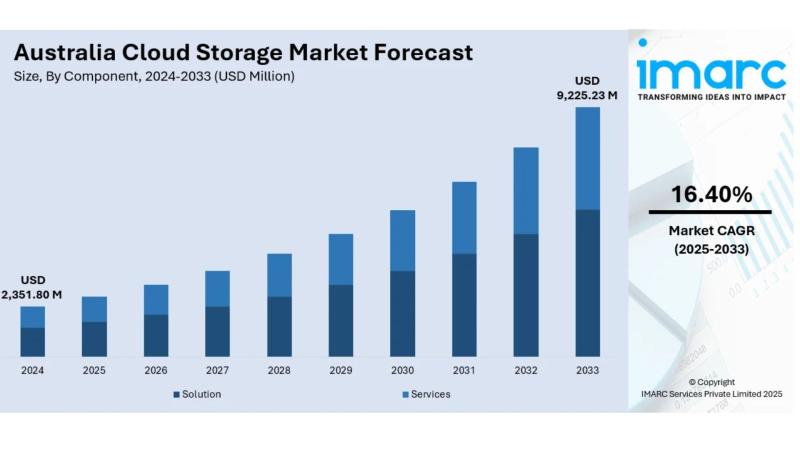

Australia Cloud Storage Market Projected to Reach USD 9,225.23 Million by 2033

The latest report by IMARC Group, titled "Australia Cloud Storage Market Future Growth 2025-2033," offers a comprehensive analysis of the Australia cloud storage market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia cloud storage market size reached USD 2,351.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,225.23 Million by 2033, exhibiting a…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…