Press release

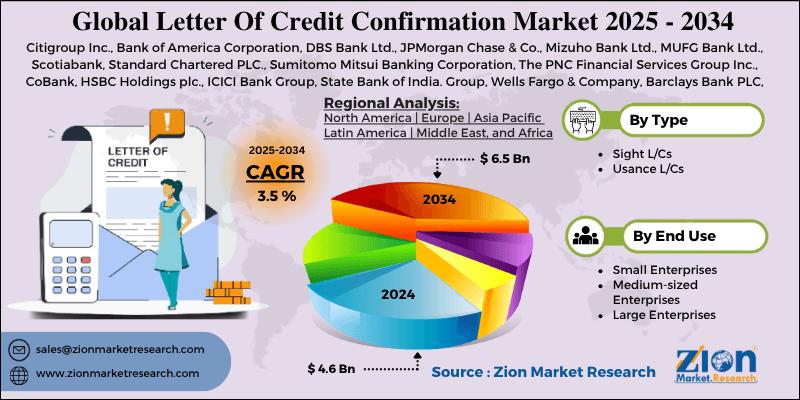

Letter Of Credit Confirmation Market Size to Reach $6.5 Billion by 2034, Driven by Steady 3.5% CAGR Growth

Executive SummaryThe global letter of credit confirmation market was valued at USD 4.6 billion in 2024 and is projected to reach USD 6.5 billion by 2034, expanding at a CAGR of ~3.5% from 2025 to 2034. Growth is primarily driven by the increasing volume of international trade, heightened risk of non-payment in cross-border transactions, demand for secure financial instruments, and rising trade with emerging markets. LC confirmations remain crucial for exporters dealing with unfamiliar buyers, unstable political environments, or volatile economies.

Access key findings and insights from our Report in this sample -https://www.zionmarketresearch.com/sample/letter-of-credit-confirmation-market

Market Dynamics

Key Growth Drivers

Rising global trade volumes: Exporters increasingly require LC confirmation services to mitigate counterparty risk.

Emerging market demand: Expanding trade with Africa, Latin America, and Asia-Pacific nations with weaker credit ratings.

Risk mitigation: Banks offer LC confirmation to shield exporters from political, economic, and currency risks.

Regulatory compliance & security: Stricter trade finance regulations encourage businesses to use confirmed LCs.

Growth in SME participation in global trade: Smaller firms prefer LC confirmation for enhanced security.

Market Challenges

High costs of LC confirmation compared to other trade finance instruments.

Digital disruption: Blockchain and fintech-driven trade finance alternatives are reducing dependency on traditional LCs.

Complex documentation processes that increase transaction delays.

Geopolitical instability affecting trade flows and banking relations.

Opportunities

Digitalization of trade finance: Use of blockchain, AI, and electronic LCs to streamline transactions.

Increased adoption by SMEs seeking credibility in cross-border trade.

Rising intra-Asia trade: APAC-led growth due to booming exports in China, India, and Southeast Asia.

Green trade finance: Growing demand for sustainability-linked LC products.

Market Segmentation

By LC Type

Sight LCs (most common for immediate payments)

Usance/Deferred Payment LCs

Transferable LCs

Standby LCs

By End-User

Exporters (primary demand side)

Importers

Banks & Financial Institutions

SMEs & Corporates engaged in international trade

By Service Provider

Large International Banks (HSBC, Citi, Standard Chartered, BNP Paribas)

Regional & Local Banks

Specialized Trade Finance Institutions

Regional Insights

North America: Stable growth led by strong banking institutions and trade with Asia-Pacific & Latin America.

Europe: Significant market share due to EU intra-trade and extensive trade with developing economies; banks like Deutsche Bank, BNP Paribas, Barclays are key players.

Asia-Pacific (fastest-growing region): Rising trade flows from China, India, Japan, and Southeast Asia, higher reliance on LCs for trade with Africa and Latin America.

Latin America: Increasing adoption in Brazil, Mexico, and Chile due to exports of commodities and agricultural products.

Middle East & Africa: Growing demand for LC confirmation due to oil, gas, and infrastructure-related trade with Europe and Asia.

Access our report for a comprehensive look at key insights -https://www.zionmarketresearch.com/report/letter-of-credit-confirmation-market

Competitive Landscape

Key Players

HSBC Holdings plc

Citigroup Inc.

Standard Chartered Bank

BNP Paribas

JPMorgan Chase & Co.

Deutsche Bank AG

Barclays Bank

Mizuho Bank Ltd.

ANZ Banking Group

Regional & local banks in emerging economies

Strategies:

Expanding digital LC platforms for faster processing.

Forming partnerships with fintech firms for blockchain-based LC solutions.

Offering customized LC confirmation products for SMEs.

Strengthening presence in emerging markets with high trade risk.

Technology & Innovation Trends

Blockchain-enabled digital LCs (reducing fraud & paperwork).

AI-based risk assessment in LC approvals and confirmations.

Electronic presentation of trade documents for faster clearance.

Sustainable LC products linked to ESG standards and green trade finance.

Outlook & Recommendations (2025-2034)

Adopt digital platforms (blockchain, AI, e-docs) to reduce cost and time of LC confirmations.

Target SMEs and mid-sized exporters, offering simplified LC services.

Expand services in high-risk regions (Africa, Latin America, Southeast Asia) where LC confirmations are critical.

Develop sustainability-linked LC solutions to capture green trade finance demand.

Collaborate with fintech firms to innovate and remain competitive against non-bank trade finance alternatives.

Conclusion

The letter of credit confirmation market is projected to expand moderately from USD 4.6B (2024) to USD 6.5B (2034) at a 3.5% CAGR. While traditional LC confirmations remain vital in mitigating cross-border risks, digitalization, fintech integration, and ESG-linked trade finance will redefine the industry's growth trajectory. Banks and trade finance institutions that invest in technology, emerging market penetration, and SME-focused products will maintain a strong position in this evolving market.

More Trending Reports by Zion Market Research -

Bakery Premixes Market-https://www.zionmarketresearch.com/report/bakery-premixes-market

Fish Protein Hydrolysate Market-https://www.zionmarketresearch.com/report/fish-protein-hydrolysate-market

Cheese Based Snacks Market-https://www.zionmarketresearch.com/report/cheese-based-snacks-market

Fava Beans Market-https://www.zionmarketresearch.com/report/fava-beans-market

Crop Oil Concentrates Market-https://www.zionmarketresearch.com/report/crop-oil-concentrates-market

Asia Pacific Office

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1-855-465-4651

Email: sales@zionmarketresearch.com

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us-after all-if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Letter Of Credit Confirmation Market Size to Reach $6.5 Billion by 2034, Driven by Steady 3.5% CAGR Growth here

News-ID: 4154071 • Views: …

More Releases from Zion Market Research

Wide Body Aircraft MRO Market Size to Reach $38.8 Billion by 2034, Driven by 4.2 …

Executive Summary

The global wide-body aircraft MRO (Maintenance, Repair, and Overhaul) market was valued at USD 25.7 billion in 2024 and is projected to reach USD 38.8 billion by 2034, growing at a CAGR of 4.2% between 2025 and 2034. Increasing global air traffic, rising fleet modernization, growing airline outsourcing of maintenance, and advancements in predictive maintenance technologies are fueling steady market growth. Wide-body aircraft, which serve long-haul international routes, require…

Software Supply Chain Security Market Size to Surge to $4.05 Billion by 2034, Fu …

Executive Summary

The global software supply chain security market was valued at USD 1.19 billion in 2024 and is projected to reach USD 4.05 billion by 2034, growing at a CAGR of 16.50% between 2025 and 2034. Rising cyberattacks targeting software supply chains, increasing adoption of open-source components, growing regulatory pressure for software integrity, and heightened enterprise focus on DevSecOps practices are driving demand. As organizations rely on complex, interconnected ecosystems,…

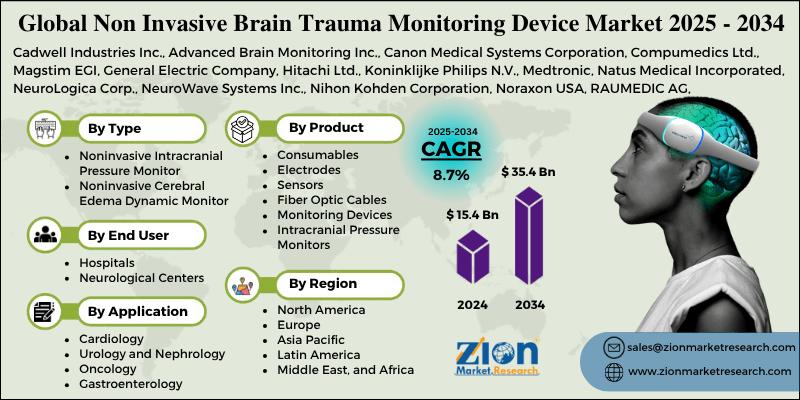

Non Invasive Brain Trauma Monitoring Device Market Size Report 2024-2034: USD 15 …

Executive Summary

The global non-invasive brain trauma monitoring devices market was valued at USD 15.4 billion in 2024 and is projected to reach USD 35.4 billion by 2034, at a CAGR of ~8.7% (2025-2034). Growth is propelled by rising traumatic brain injury (TBI) incidence, aging populations, sports- and workplace-related concussions, military/defense needs, and the clinical push to reduce invasive procedures when possible. Rapid advances in cerebral oximetry (NIRS), quantitative EEG, pupillometry,…

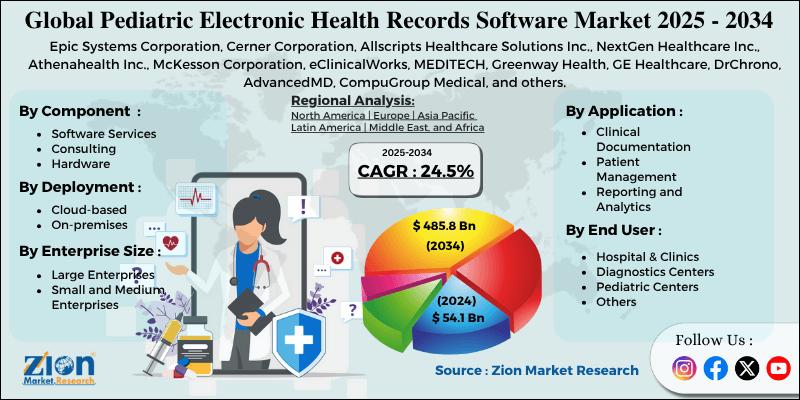

Pediatric Electronic Health Records Software Market Size Report 2024-2034: USD 5 …

Executive Summary

The global pediatric electronic health records (EHR) software market was valued at USD 54.1 billion in 2024 and is expected to reach USD 485.8 billion by 2034, expanding at an impressive CAGR of 24.5% from 2025 to 2034. This exponential growth is driven by the rising focus on child healthcare, government-led digitization initiatives, integration of advanced AI-driven decision support tools, and increasing demand for interoperable, cloud-based, and mobile-friendly EHR…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…