Press release

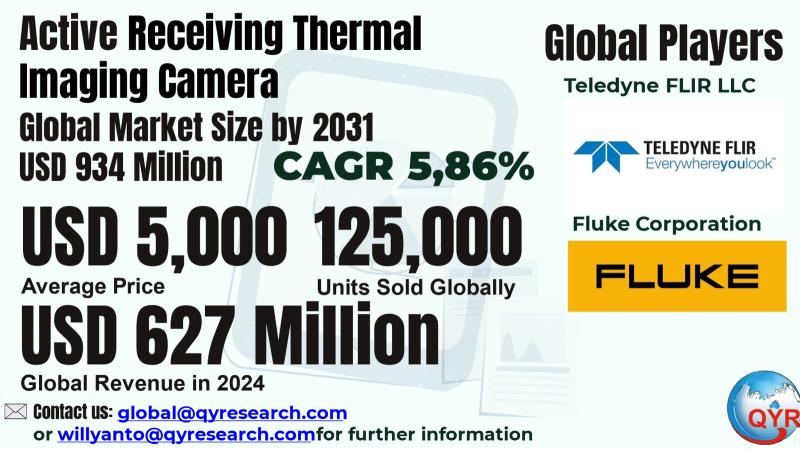

Active Receiving Thermal Imaging Camera Market to Reach USD 934 Million by 2031 Top 10 Company Globally

Active receiving thermal imaging cameras are devices that detect infrared radiation and convert it into visible thermal images; the adjective active receiving in some contexts refers to systems that combine on-board processing, active illumination or enhanced sensor readout and communications to boost sensitivity and situational awareness for security, industrial inspection, automotive sensing and defense applications. The product set ranges from consumer dongles and compact handheld imagers through mid-tier industrial scanners to high-end cooled and uncooled scientific cameras. Key performance attributes are sensor type (cooled MWIR vs uncooled LWIR), resolution, NETD (sensitivity), frame rate, optics, software analytics and integration capability (bi-spectrum, networking, AI-based detection). Because thermal imaging is used across safety, predictive maintenance, building diagnostics, military targeting and automotive driver assistance, the market mixes recurring hardware sales with software and services such as analytics, cloud storage and integrated monitoring subscriptions.The active receiving thermal imaging camera market size valued USD 627 million and a conservative blended CAGR of 5,86% to 2031, producing a projected market value of approximately USD 934 million by 2031. 2024 average selling price across the global is approximately USD 5,000 per unit, implies roughly 125,000 thermal imaging units sold globally in 2024.

Latest Trends and Technological Developments

The technology trajectory blends higher-volume, lower-cost uncooled LWIR sensors and AI analytics with continuing innovation in sensor cores, multispectral/bispectral solutions and OEM partnerships for turnkey systems. On June 2025 Seek Thermal announced a next-generation LWIR sensor tailored for automotive applications, signaling continued sensor-level investment and cost-performance improvements. On March 2025 Hikvision publicized a partnership integrating its bi-spectrum thermal cameras into a real-time condition-monitoring solution an industrial use-case expansion that highlights software integration and predictive maintenance as demand drivers. In mid-2025 Teledyne FLIR refreshed its OEM branding and maintained momentum around higher-performance industrial and scientific cameras, underscoring continuing market bifurcation between commodity imagers and premium, capability-dense units. Consumer and prosumer dongles and compact handhelds continue to push adoption via aggressive pricing and app ecosystems recent product reviews and listings throughout 20242025 show professional-grade small cameras priced under USD 400, broadening the market base. Dates: June 2025 (Seek Thermal sensor launch); March 2025 (Hikvision partnership announcement); mid-2025 branding/product updates from Teledyne FLIR; ongoing retail launches and deals through 20242025 for compact devices.

Asia Pacific is the largest and fastest-growing regional market for thermal imaging due to several overlapping drivers: heavy industrialization with predictive maintenance programs, wide adoption for security and perimeter surveillance, rapid growth of automotive ADAS programs in China and Korea, and large volumes of consumer and prosumer device adoption across populous markets. Regional market studies show APAC commanding the biggest regional share and growing at a steady mid-single-digit CAGR; APAC demand is supported by local manufacturing of sensors and modules, strong distribution across e-commerce channels, and government procurement for border security, port and energy infrastructure monitoring. Key OEMs maintain substantial APAC presence and manufacturing or JV footprints, which shortens lead times and enables competitive pricing for both entry and professional tiers.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4933719

Active Receiving Thermal Imaging Camera by Type:

Cooled Thermal Imaging Camera

Uncooled Thermal Imaging Camera

Active Receiving Thermal Imaging Camera by Application:

Militray and Defense

Automotive

Healthcare

Industrial

Others

Global Top 10 Key Companies in the Active Receiving Thermal Imaging Camera Market

Teledyne FLIR LLC

L3Harris Technologies

BAE Systems

Fluke Corporation

Testo SE & Co. KGaA

RTX Corporation

Leonardo DRS

Opgal Optronic Industries

Bosch Security Systems

Honeywell Intenational Inc

Regional Insights

Within Southeast Asia, adoption patterns vary. Singapore is a mature buyer for smart-city and critical-infrastructure thermal systems, while Thailand, Malaysia, Vietnam, Indonesia and the Philippines are scaling industrial predictive-maintenance programs, energy-sector monitoring and security deployments. Indonesias manufacturing clusters, rapidly expanding data-center and energy infrastructure, and archipelagic logistics needs create particular use-cases for thermal inspection (substation/plant monitoring, port security, fire detection), and 20242025 market commentary highlights rising procurement by regional integrators and utilities. Channel dynamics favor local distributors bundling analytics and cloud services with hardware, and regional OEM partnerships (and local system integrators in Indonesia) are becoming the primary route to market for higher-end systems. APAC and ASEAN growth is therefore driven by a combination of local manufacturing, public-sector projects and industrial digitalization.

The market faces a set of clear constraints. First, component supply and sensor cadence matter: while uncooled microbolometer manufacturing has scaled, advanced LWIR sensors and cooled MWIR/thermal cores remain supply-constrained and capital intensive, supporting premium pricing but slowing premium-segment growth. Second, market fragmentation and price compression at the entry level push OEMs to differentiate through software, analytics and integration which requires R&D and after-sales support. Third, regulatory and export controls for high-performance thermal sensors (military/dual-use restrictions in some jurisdictions) complicate cross-border sales and can reduce addressable volumes for high-end systems. Fourth, end-customer procurement inertia and long validation/qualification cycles for industrial systems slow replacement cadence, making recurring revenue from services important to supplier economics.

Successful manufacturers and integrators pursue a two-track strategy: capture volume at the lower end through scalable module supply, simplified OEM modules and strong retail channels, while defending margin at the high end by bundling analytics, warranties and service contracts for industrial/critical infrastructure customers. Integration partners and software ecosystems convert one-time camera sales into recurring revenue and raise switching costs. Asia and ASEAN specialists gain advantage through local distribution networks, fast field service and solution bundles (camera + cloud analytics + managed alerts) tailored to utilities, ports and large manufacturers. For investors or entrants, value accrues to companies that control sensor procurement (long-term supply deals), own edge analytics IP, or provide high-value service contracts.

Product Models

Active Receiving Thermal Imaging Cameras are vital tools for capturing infrared radiation to visualize and measure thermal patterns.

Cooled thermal imaging cameras incorporate cryogenic or Stirling coolers to enhance sensitivity and resolution ideal for advanced R&D, defense, or industrial diagnostics. Notable products include:

Ultra-Long-Range PTZ Cooled Thermal Camera (CTC Series) Jinan Hope-Wish: Pan-tilt-zoom, cooled thermal cameras designed for border security and monitoring with impressive detection range (1060 km), high NETD performance, and integrated optics.

JH320-300/75 Dual-FOV Cooled Thermal Security Camera Wuhan Joho Technology: High-reliability, security-grade cooled thermal camera using a 320 × 256 FPA detector with dual fields of view (300 mm / 75 mm), tailored for situational awareness.

FX640I Cooled Thermal Camera Module - InfiRay: A high-sensitivity MWIR (3.7-4.8 μm) module featuring InSb detector, 640×512 resolution, NETD ≤ 25 mK, and support for high-speed imaging (up to 100 Hz). Ideal for long-range, high-detail applications

ImageIR Series Infratec: High-end cooled cameras with resolutions up to 1280 × 1024 and MicroScan technology, suited for precision R&D, aerospace, and industrial non-destructive testing.

RCTL240DA (60/240 mm Dual FOV F4) Radifeel: Dual field of view (wide and narrow) cooled thermal camera suitable for rapid transitions between observation scales.

Uncooled thermal imaging cameras rely on ambient-temperature microbolometers, offering compactness, lower power, and broad usability in fields like electrical inspection, maintenance, and consumer-grade applications. Examples include:

Optris PI 640i Optris Infrared Sensing, LLC: A compact, uncooled thermal camera offering VGA resolution with precise, real-time thermography.

TarisIR mini 600 InfraTec GmbH: Entry-level uncooled microbolometer camera at an excellent price, suitable for general-purpose thermography.

FLIR T620 (OSXL-T620) FLIR / OMEGA Engineering: Ergonomic handheld with dual-digit visible and thermal cameras for documentation and inspection.

ThermoIMAGER TIM41 Micro-Epsilon: Industrial uncooled thermal imager with motorized focus and automated hot/cold spot monitoring.

TI332 Handheld Fujian Lilliput Optoelectronics: Portable uncooled thermal camera with 320×240 resolution, fusion modes, and temperature alarms.

Active receiving thermal imaging cameras are in a healthy expansion phase in 20242031 as sensor costs fall, software analytics improve, and commercial/industrial buyers scale programs for predictive maintenance, safety and security. With a modeled 2024 global market of USD 627 million, a blended ASP of USD 5,000, and an implied 125,000 units sold in 2024 at the midpoint ASP, the segment offers a mix of high-volume consumer growth and recurring-revenue industrial opportunities. Growth through 2031 is projected at roughly 5,86% CAGR, favoring suppliers that balance volume with higher-value integration and regional execution in Asia and ASEAN.

Investor Analysis

For investors, the what is a hardware + software market with durable secular drivers industrial digitalization, security modernization and growing automotive sensing needs. The how is by investing in firms that combine reliable sensor supply, sticky software/analytics and strong field service or channel partnerships in APAC/ASEAN to capture both device sales and recurring service revenue. The why is that hardware commoditization at the low end makes margin growth dependent on software and services, while control of advanced sensor supply (or OEM exclusives) creates tangible moats in premium segments. Near-term catalysts include broader adoption of AI analytics at the edge, rising industrial O&M budgets in APAC, and the continued trickle of high-performance sensor cost declines that enable new commercial use cases. Investors should prioritize balance-sheet strength for capex in sensor supply deals, software/IP ownership, and regional distribution footprints in fast-growing Asian markets.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4933719

5 Reasons to Buy This Report

It reconciles multiple market-research baselines into a defensible 2024 global market estimate and a reasoned CAGR to 2031.

It translates market dollars into unit economics using real ASP bands and retail/manufacturer price points, producing an actionable unit sales estimate for 2024.

It highlights dated, verifiable technology and product news through 2025 that change sensor cost curves and OEM positioning.

It delivers region-level insight for Asia and ASEAN (including Indonesia) to inform go-to-market, distribution and localization strategies.

It profiles the competitive set across volume and premium tiers helpful for partner screening, M&A diligence and product roadmap alignment.

5 Key Questions Answered

What is the best-supported 2024 global market size for active thermal imaging cameras and the projected CAGR to 2031?

What are realistic ASP bands across consumer, professional and premium thermal cameras, and how many units were sold globally in 2024 under blended assumptions?

Which dated technology and vendor developments in 20242025 most materially affect supply, pricing and integration opportunities?

How do Asia and ASEAN demand drivers differ from North America and Europe, and where should suppliers invest in field service and channel partnerships?

Which companies are best positioned across the value chain from sensor cores to analytics and what are the likely routes to durable margins?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Active Receiving Thermal Imaging Camera Market to Reach USD 934 Million by 2031 Top 10 Company Globally here

News-ID: 4158991 • Views: …

More Releases from QY Research

Single Phase Variable Shunt Reactor Market to Reach CAGR 7,4% by 2031 Top 20 Com …

Single phase variable shunt reactors (VSRs) are grid-level inductive devices that provide continuously adjustable reactive-power absorption in high-voltage alternating-current systems; by varying their effective reactance (commonly via on-load tap changers or multi-winding arrangements) they reduce light-load overvoltages on long transmission lines and stabilise voltage in corridors with high transmission capacitance (cables, long AC links, or large offshore wind hubs). VSRs are a subset of the broader shunt-reactor family but are…

Food Tub Packaging Market to Reach CAGR 5,15% by 2031 Top 20 Company Globally

Food tub packaging covers a wide set of rigid and semi-rigid containers used to sell and distribute foods such as ice cream, spreads and butters, ready meals, yogurt, sauces, confectionery tubs, and larger food-service tubs; formats include injection-moulded and thermoformed plastic tubs and lids, paperboard/paper-based tubs with barrier treatments, and specialty multilayer tubs (e.g., PCR-filled PP or PE, coated paperboard). The product category sits at the intersection of convenience, branding…

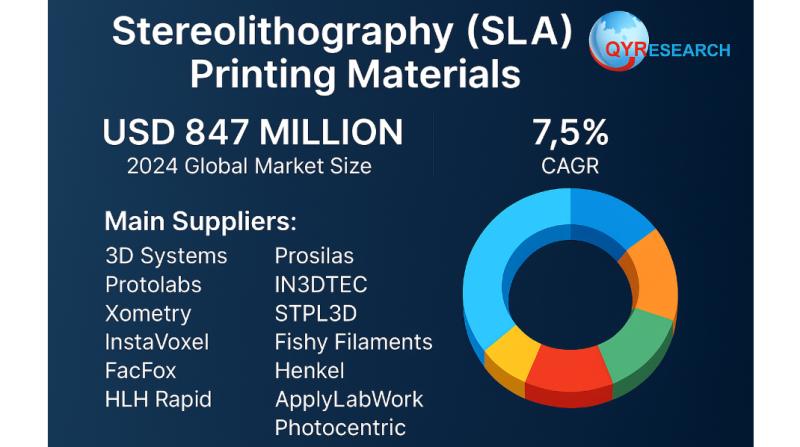

Global and U.S. Stereolithography (SLA) 3D Printing Materials Market Report, Pub …

Stereolithography (SLA) remains one of the most established and widely used additive manufacturing technologies, renowned for its ability to produce parts with exceptional resolution, fine surface finish, and intricate geometries. At the heart of this process are SLA 3D printing materials-primarily photopolymer resins that cure under ultraviolet (UV) laser or light projection. These materials are engineered to balance mechanical strength, accuracy, and aesthetics, and they are tailored for applications across…

Global and U.S. On-demand 3D Printing Market Report, Published by QY Research.

On-Demand 3D Printing, also known as additive manufacturing services, refers to the production of customized parts and prototypes directly from digital files, delivered with minimal lead time. Unlike traditional manufacturing methods that require tooling and inventory, on-demand 3D printing offers flexibility, cost efficiency for low-volume production, and the ability to rapidly iterate designs. Using a variety of processes-including fused deposition modeling (FDM), stereolithography (SLA), selective laser sintering (SLS), and Multi-Jet…

More Releases for Thermal

Thermal Weeder Market

Thermal Weeder Market Value is Anticipated to Increase at a Stable CAGR over the Forecast Period (2023 to 2029). It provides an in-depth analysis of the market segments which include products, applications, and competitor analysis.

Important changes in the business allow key players to attain larger profits. This Thermal WeederMarket study report is the best way to make changes with the help of entire market condition and metrics provided here. These…

Rising Demand for Thermal Analysis Techniques to Boost Differential thermal anal …

[San Francisco, USA] - Market research firm Trouve360Reports has added a latest report on the global differential thermal analysis market. The report offers a comprehensive analysis of the market, providing insights into key trends, growth drivers, and challenges that are shaping the industry.

The report presents a detailed market introduction, highlighting the definition of differential thermal analysis and its applications in various industries. The market overview section of the report offers…

Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) Market …

According to Market Study Report, Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) Market provides a comprehensive analysis of the Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) Market segments, including their dynamics, size, growth, regulatory requirements, competitive landscape, and emerging opportunities of global industry. An exclusive data offered in this report is collected by research and industry experts team.

Get Free Sample PDF (including full TOC,…

What is the Difference Between Direct Thermal and Thermal Transfer Labels?

Northern Label Systems, specialists in supplying high quality labels explain the differences between Direct Thermal https://www.northern-label-systems.co.uk/labels-by-type/direct-thermal-labels and Thermal Transfer Labels https://www.northern-label-systems.co.uk/labels-by-type/thermal-transfer-labels

Thermal Transfer printing uses an ink ribbon to transfer the printed image from the heated printhead of the label printer onto the surface of the label while Direct Thermal printing transfers the image directly onto a heat sensitive material.

There are advantages and disadvantages to both methods. Direct Thermal label…

Global Thermal Transfer Material Market, Global Thermal Transfer Material Indust …

Thermal conductivity refers as an important characteristic for several manufacturing operations. Thermal transfer properties of a variety of materials are effective in certain applications owing to natural molecular structure that allows for direct heat-transfer. Thermal transfer materials are extensively used to manufacture the heat conductive adhesive tapes, printable products and polymer sheets. These polymer sheets are utilized for barcodes, labeling, and QR code labels for retailing, logistics, and consumer goods.…

Global Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) …

Qyresearchreports include new market research report "Global Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) Sales Market Report 2018" to its huge collection of research reports.

This report studies the global Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) market status and forecast, categorizes the global Thermal Carbon Black Products (Low Thermal, Medium Thermal, High Thermal) market size (value & volume) by key players, type, application, and…