Press release

Renewable Hexene Production Cost Analysis 2025: Investment Opportunities, Financial Analysis and ROI

Setting up a renewable hexene production facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.IMARC Group's report titled "Renewable Hexene Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a renewable hexene production plant cost, covering everything from product overview and production processes to detailed financial insights.

Request For a Sample Report: https://www.imarcgroup.com/renewable-hexene-manufacturing-plant-project-report/requestsample

What is Renewable Hexene?

Renewable hexene is a bio-based chemical compound derived from sustainable resources such as biomass, plant oils, or bioethanol, rather than traditional fossil fuels. As an alpha-olefin, hexene has six carbon atoms and features a reactive double bond, making it a valuable building block in the production of polymers, synthetic lubricants, detergents, and plasticizers. Its renewable origin reduces dependence on petroleum-based chemicals and contributes to lower carbon emissions. By leveraging green chemistry principles, renewable hexene provides industries with an environmentally friendly alternative while maintaining comparable performance to its petrochemical counterpart in applications requiring high reactivity and versatility.

What is Driving the Renewable Hexene Market?

The renewable hexene industry is experiencing steady growth driven by global demand for sustainable and low-carbon chemical solutions. Increasing environmental regulations and carbon reduction targets in regions such as Europe and North America are pushing manufacturers to adopt bio-based alternatives over conventional fossil-derived hexene. Technological advancements in biomass conversion, fermentation, and catalytic processes have enhanced production efficiency, making renewable hexene more economically viable. Additionally, the rising demand for bio-based polyethylene and high-performance polymers is creating new downstream applications, which further fuels market expansion. Key drivers include growing consumer awareness of sustainability, corporate commitments to green supply chains, and government incentives supporting renewable chemical production. Collaborative efforts between chemical companies and biotech firms are also accelerating product innovation, improving yield, and reducing production costs. Moreover, the increasing shift toward circular economy models in industries like packaging, automotive, and personal care is reinforcing the preference for renewable hexene as a building block for eco-friendly products.

Buy now: https://www.imarcgroup.com/checkout?id=28479&method=1911

Key Steps Required to Set Up a Renewable Hexene Plant

1. Market Analysis

The report provides insights into the landscape of the renewable hexene industry at the global level. The report also provides a segment-wise and region-wise breakup of the global renewable hexene industry. Additionally, it also provides the price analysis of feedstocks used in the production of renewable hexene, along with the industry profit margins.

• Segment Breakdown

• Regional Insights

• Pricing Analysis and Trends

• Market Forecast

2. Product Production: Detailed Process Flow

Detailed information related to the process flow and various unit operations involved in the renewable hexene production plant project is elaborated in the report.

These include:

• Land, Location, and Site Development

• Plant Layout

• Plant Machinery

• Raw Material Procurement

• Packaging and Storage

• Transportation

• Quality Inspection

• Utilities

• Human Resource Requirements and Wages

• Marketing and Distribution

3. Project Requirements and Cost

The report provides a detailed location analysis covering insights into the plant location, selection criteria, location significance, environmental impact, and expenditure for renewable hexene production plant setup. Additionally, the report also provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Machinery and Equipment

• List of machinery needed for renewable hexene production

• Estimated costs and suppliers

Raw Material Costs

• Types of materials required and sourcing strategies

Utilities and Overheads

• Electricity, water, labor, and other operational expenses

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=28479&flag=C

4. Project Economics

A detailed analysis of the project economics for setting up a renewable hexene production plant is illustrated in the report. This includes the analysis and detailed understanding of capital expenditure (CAPEX), operating expenditure (OPEX), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis.

Capital Expenditure (CAPEX)

• Initial setup costs: land, machinery, and infrastructure

Operating Expenditure (OPEX)

• Recurring costs: raw materials, labor, maintenance

Revenue Projections

• Expected income based on production capacity, target market, and market demand

Taxation

Depreciation

Financial Analysis

• Liquidity Analysis

• Profitability Analysis

• Payback Period

• Net Present Value (NPV)

• Internal Rate of Return

• Profit and Loss Account

Uncertainty Analysis

Sensitivity Analysis

Economic Analysis

5. Legal and Regulatory Compliance

• Licenses and Permits

• Regulatory Procedures and Approval

• Certification Requirement

6. Hiring and Training

• Total human resource requirement

• Salary cost analysis

• Employee policies overview

The report also covers critical insights into key success and risk factors, which highlight the aspects that influence the success and potential challenges in the industry. Additionally, the report includes strategic recommendations, offering actionable advice to enhance operational efficiency, profitability, and market competitiveness. A comprehensive case study of a successful venture is also provided, showcasing best practices and real-world examples from an established business, which can serve as a valuable reference for new entrants in the market.

About Us:

IMARC is a global market research company offering comprehensive services to support businesses at every stage of growth, including market entry, competitive intelligence, procurement research, regulatory approvals, factory setup, company incorporation, and recruitment. Specializing in factory setup solutions, we provide detailed financial cost modeling to assess the feasibility and financial viability of establishing new production plants globally. Our models cover capital expenditure (CAPEX) for land acquisition, infrastructure, and equipment installation while also evaluating factory layout and design's impact on operational efficiency, energy use, and productivity. Our holistic approach offers valuable insights into industry trends, competitor strategies, and emerging technologies, enabling businesses to optimize operations, control costs, and drive long-term growth.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Renewable Hexene Production Cost Analysis 2025: Investment Opportunities, Financial Analysis and ROI here

News-ID: 4169771 • Views: …

More Releases from IMARC Group

India Mobile Gaming Market Size, Share, Industry Growth, Trends Analysis & Resea …

According to the latest report by IMARC Group, titled "India Mobile Gaming Market Report by Monetization Type (In-app Purchases, Paid Apps, Advertising), Platform (Android, iOS, Others), Game Type (Sports, Strategy, Action, Adventure), and Region 2025-2033", the report presents a thorough review featuring the India Mobile Gaming Market growth, share, trends, and research of the industry.

Market Size & Future Growth Potential:

The India mobile gaming market size reached USD 3.02 Billion in…

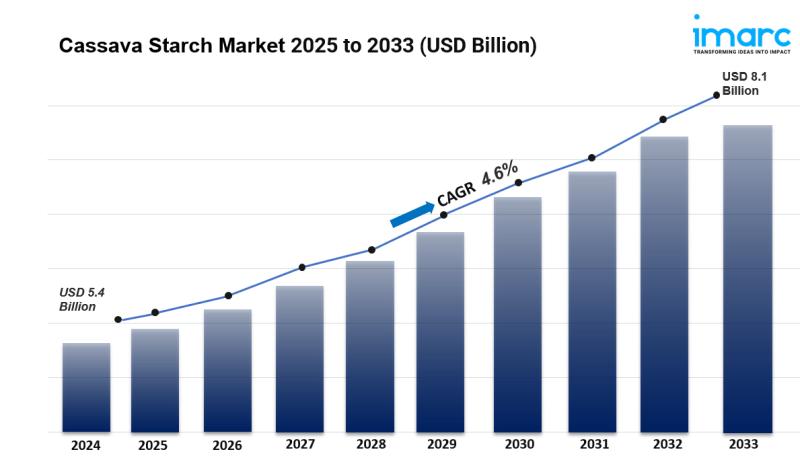

Cassava Starch Market is Expected to Reach USD 8.1 Billion by 2033 | At CAGR 4.6 …

Cassava Starch Market Overview:

The global cassava starch market was valued at USD 5.4 Billion in 2024 and is projected to reach USD 8.1 Billion by 2033, exhibiting a CAGR of 4.6% during the 2025-2033 forecast period. Growing demand for gluten-free and natural food additives, expanding health consciousness, and heightened adoption of plant-based diets are driving this growth. The cassava starch market size is expanding rapidly due to increasing consumer preference…

India Steel Market Size, Share, Growth Insights, Trends & Industry Outlook 2025- …

According to the latest report by IMARC Group, titled "India Steel Market Report by Type (Flat Steel, Long Steel), Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Region 2025-2033," the report presents a thorough review featuring the India Steel Market growth, share, trends, and research of the…

Chrome Prices 2025 Set to Rise: Global Price Trend & Future Forecast

North America Chrome Prices Movement 2025:

Chrome Prices in USA:

In the USA, Chrome Prices averaged USD 3833/MT in September 2025, supported by firm stainless-steel output and stable alloy manufacturing. The Chrome Price Trend showed mild upward momentum, while the Chrome Price Index reflected steady gains. The Chrome Price Chart indicated controlled fluctuations. The Chrome Price Forecast points to stable pricing as industrial consumption maintains strength across the metals sector.

Get the Real-Time…

More Releases for Renewable

Role Of Renewable Energy Certificates In Facilitating Renewable Energy Consumpti …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

How Large Will the Renewable Energy Certificates Market Size By 2025?

In the past few years, the renewable energy certificates market has witnessed a significant enlargement in its size. This market is projected to expand from $17.63 billion in 2024 to $22.73 billion in 2025, demonstrating a compound annual…

Israel Renewable Energy Market Size, Share Projections 2031 by Key Manufacturer- …

USA, New Jersey: According to Verified Market Research analysis, the global Israel Renewable Energy Market size was valued at USD 187.2 Million in 2024 and is projected to reach USD 1633.53 Million by 2032, growing at a CAGR of 31.1% from 2026 to 2032.

What is the current outlook of the Israel renewable energy market and what are the key growth drivers?

Israel's renewable energy market is undergoing rapid transformation. As of…

Key Trend Reshaping the Renewable Energy Storage Market in 2025: Advancements In …

"What combination of drivers is leading to accelerated growth in the renewable energy storage market?

The renewable energy storage market is anticipated to experience growth driven by the increasing investments in the energy sector. In simple terms, investing in this sector is the allocation of financial resources such as capital, funds, or assets to endeavors, projects or assets connected to the production, distribution, and use of energy. This is spurred by…

Prominent Renewable Energy Investment Market Trend for 2025: Advancements In Ren …

What Are the Projected Growth and Market Size Trends for the Renewable Energy Investment Market?

The renewable energy investment market has seen significant growth in recent years. It will rise from $309.77 billion in 2024 to $344.5 billion in 2025, at a CAGR of 11.2%. The growth is driven by public awareness of climate change, the declining costs of renewable technologies, policy incentives and mandates, concerns about energy security, and corporate…

Increasing Availability of Renewable Methanol Essential for the Global Renewable …

According to a new market research report launched by Inkwood Research, the Global Renewable Methanol Market is progressing with a CAGR of 3.82% in terms of revenue and 2.55% in terms of volume from 2022 to 2030 and is set to generate a revenue of $4119.94 million by 2030.

Browse 64 Market Data Tables and 44 Figures spread over 229 Pages, along with an in-depth analysis of the Global Renewable Methanol…

Global Renewable Chemicals Market | Global Renewable Chemicals Market: Ken Resea …

Renewable chemicals, also well-known as bio-based chemicals are generated from natural and bio-based raw materials. They are attained from the agricultural feedstock, agricultural waste, organic waste products, biomass, and microorganisms. Renewable chemicals have appeared as potential substitutes for petroleum-based chemicals as they propose fewer carbon footprints and are eco-friendly. Some of the commonly utilized renewable chemicals comprise polymeric (lignin, hemicellulose, cellulose, starch, protein) and monomeric (carbohydrates, oils, plant extractives,…