Press release

Lithium Fluoride Production Cost Analysis 2025: CapEx, OpEx, and ROI Analysis

Setting up a lithium fluoride production facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.IMARC Group's report titled "Lithium Fluoride Production Cost Analysis Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a lithium fluoride production plant cost, covering everything from product overview and production processes to detailed financial insights.

Request For a Sample Report: https://www.imarcgroup.com/lithium-fluoride-manufacturing-plant-project-report/requestsample

What is Lithium Fluoride?

A lithium fluoride production plant is an industrial facility designed to produce lithium fluoride (LiF), an inorganic compound that plays a critical role in the global aluminum smelting, nuclear, ceramics, and specialty glass industries. Lithium fluoride is primarily derived from lithium carbonate or lithium hydroxide through neutralization reactions with hydrofluoric acid under controlled temperature and pressure conditions. In some cases, it can also be produced through direct synthesis from lithium metal and fluorine gas, or through precipitation methods using lithium chloride and sodium fluoride. A lithium fluoride production plant is equipped with specialized units for raw material preparation, reaction vessels with corrosion-resistant linings, crystallization systems, filtration, drying, and packaging to ensure the required purity, particle size, and moisture content of lithium fluoride, which can vary depending on its end use. The main product grades include technical-grade lithium fluoride for aluminum electrolysis flux applications, high-purity grades for optical and nuclear applications, and specialized grades for ceramic and glass manufacturing. Technical-grade lithium fluoride is widely used as a flux in aluminum smelting to lower the melting point and improve electrolyte conductivity, while high-purity grades serve in optical components, scintillation detectors, and molten salt nuclear reactors. These facilities also emphasize stringent safety protocols, corrosion management, and environmental controls due to the hazardous nature of hydrofluoric acid and the need for specialized handling of fluorine-containing compounds. With their broad range of applications in aluminum production, nuclear technology, specialized optics, and advanced ceramics, a lithium fluoride production plant serves as a cornerstone in the global specialty inorganic chemicals and advanced materials supply chain.

What is Driving the Lithium Fluoride Market?

The lithium fluoride production plant market is being driven by growing aluminum production, expanding nuclear energy sector, and increasing demand for specialty optical and ceramic materials across the globe. One of the primary growth drivers is the rapidly expanding aluminum industry, as lithium fluoride serves as a crucial flux component in Hall-Héroult aluminum smelting processes, improving energy efficiency and reducing operating temperatures in electrolytic cells. The rising global demand for lightweight aluminum in automotive, aerospace, construction, and packaging industries, particularly in emerging economies, has significantly increased the consumption of lithium fluoride for aluminum production. Additionally, the nuclear energy sector's steady growth, coupled with increasing interest in advanced reactor technologies such as molten salt reactors, is boosting the demand for high-purity lithium fluoride as a coolant and fuel carrier medium. Technological advancements in aluminum smelting processes and the development of more efficient electrolyte compositions have improved the performance characteristics of lithium fluoride applications, further supporting market growth. Moreover, the expanding electronics and optics industries are driving demand for ultra-high-purity lithium fluoride used in specialized optical components, laser systems, and radiation detection equipment. The growing renewable energy sector's need for advanced battery technologies and energy storage systems is creating indirect demand through increased aluminum and lithium compound requirements. Furthermore, the development of advanced ceramic and glass applications in aerospace, defense, and high-temperature industrial processes is influencing investments in specialized lithium fluoride production capabilities. Together, these factors make the lithium fluoride production plant market a crucial segment in the global specialty chemicals and advanced materials landscape.

Buy Now: https://www.imarcgroup.com/checkout?id=9246&method=1911

Key Steps Required to Set Up a Lithium Fluoride Plant

1. Market Analysis

The report provides insights into the landscape of the lithium fluoride industry at the global level. The report also provides a segment-wise and region-wise breakup of the global lithium fluoride industry. Additionally, it also provides the price analysis of feedstocks used in the production of lithium fluoride, along with the industry profit margins.

• Segment Breakdown

• Regional Insights

• Pricing Analysis and Trends

• Market Forecast

2. Product Production: Detailed Process Flow

Detailed information related to the process flow and various unit operations involved in the lithium fluoride production plant project is elaborated in the report.

• Land, Location, and Site Development

• Plant Layout

• Plant Machinery

• Raw Material Procurement

• Packaging and Storage

• Transportation

• Quality Inspection

• Utilities

• Human Resource Requirements and Wages

• Marketing and Distribution

3. Project Requirements and Cost

The report provides a detailed location analysis covering insights into the plant location, selection criteria, location significance, environmental impact, and expenditure for lithium fluoride production plant setup. Additionally, the report also provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Machinery and Equipment

• List of machinery needed for lithium fluoride production

• Estimated costs and suppliers

Raw Material Costs

• Types of materials required and sourcing strategies

Utilities and Overheads

• Electricity, water, labor, and other operational expenses

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9246&flag=C

4. Project Economics

A detailed analysis of the project economics for setting up a lithium fluoride production plant is illustrated in the report. This includes the analysis and detailed understanding of capital expenditure (CAPEX), operating expenditure (OPEX), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis.

Capital Expenditure (CAPEX)

• Initial setup costs: land, machinery, and infrastructure

Operating Expenditure (OPEX)

• Recurring costs: raw materials, labor, maintenance

Revenue Projections

• Expected income based on production capacity, target market, and market demand

Taxation

Depreciation

Financial Analysis

• Liquidity Analysis

• Profitability Analysis

• Payback Period

• Net Present Value (NPV)

• Internal Rate of Return

• Profit and Loss Account

Uncertainty Analysis

Sensitivity Analysis

Economic Analysis

5. Legal and Regulatory Compliance

• Licenses and Permits

• Regulatory Procedures and Approval

• Certification Requirement

6. Hiring and Training

• Total human resource requirement

• Salary cost analysis

• Employee policies overview

The report also covers critical insights into key success and risk factors, which highlight the aspects that influence the success and potential challenges in the industry. Additionally, the report includes strategic recommendations, offering actionable advice to enhance operational efficiency, profitability, and market competitiveness. A comprehensive case study of a successful venture is also provided, showcasing best practices and real-world examples from an established business, which can serve as a valuable reference for new entrants in the market.

About Us:

IMARC is a global market research company offering comprehensive services to support businesses at every stage of growth, including market entry, competitive intelligence, procurement research, regulatory approvals, factory setup, company incorporation, and recruitment. Specializing in factory setup solutions, we provide detailed financial cost modeling to assess the feasibility and financial viability of establishing new production plants globally. Our models cover capital expenditure (CAPEX) for land acquisition, infrastructure, and equipment installation while also evaluating factory layout and design's impact on operational efficiency, energy use, and productivity. Our holistic approach offers valuable insights into industry trends, competitor strategies, and emerging technologies, enabling businesses to optimize operations, control costs, and drive long-term growth.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Fluoride Production Cost Analysis 2025: CapEx, OpEx, and ROI Analysis here

News-ID: 4175228 • Views: …

More Releases from IMARC Group

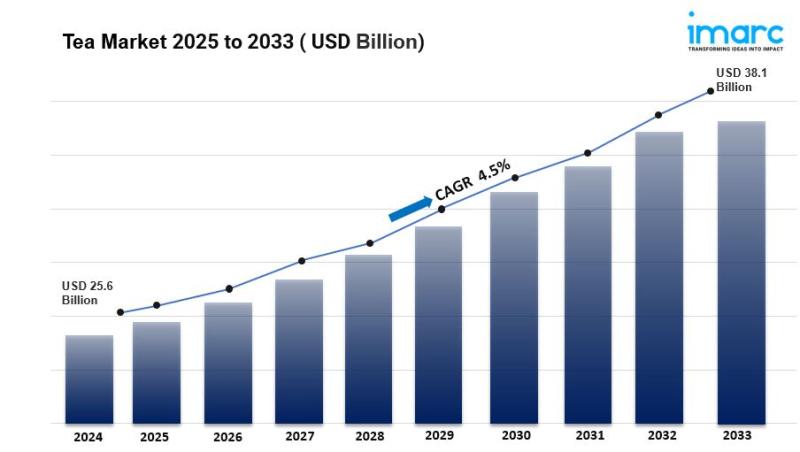

Tea Market is Projected to Grow USD 38.1 Billion by 2033 | At CAGR 4.5%

Tea Market Overview:

The global tea market was valued at USD 55.8 Billion in 2024 and is projected to reach USD 78.4 Billion by 2033, exhibiting a CAGR of 3.9% during the 2025-2033 forecast period. Growing consumer awareness about health benefits, rising demand for specialty and premium teas, and expanding café culture are driving this growth. The tea market size is expanding rapidly due to increasing consumer preference for natural and…

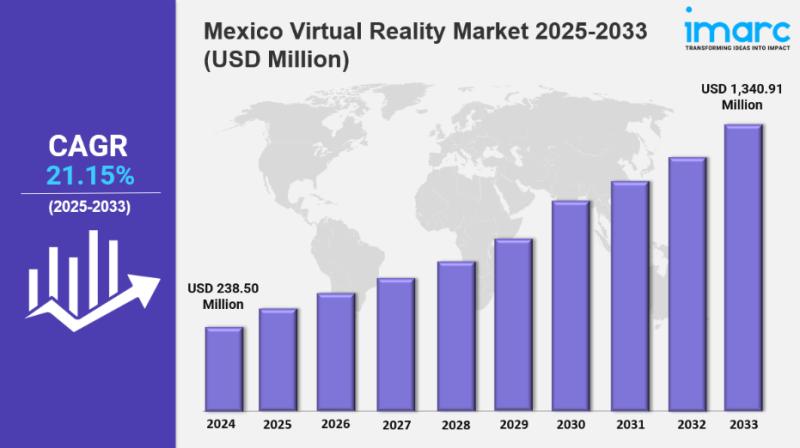

Mexico Virtual Reality Market 2025 : Industry Size to Reach USD 1,340.91 Million …

IMARC Group has recently released a new research study titled "Mexico Virtual Reality Market Size, Share, Trends and Forecast by Device Type, Technology, Component, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico virtual reality market size reached USD 238.50 Million in 2024 and is projected to grow to USD…

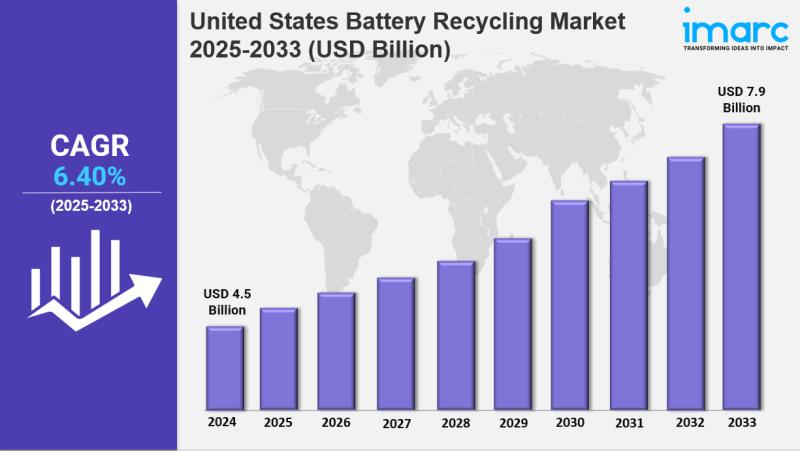

United States Battery Recycling Market Size to Hit USD 7.9 Billion by 2033: Tren …

IMARC Group has recently released a new research study titled "United States Battery Recycling Market Size, Share, Trends and Forecast by Type, Source, End Use, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States battery recycling market was valued at USD 4.5 Billion in 2024 and is projected to reach…

Magnesium Tungstate Production Plant Cost Report: Feasibility Study and Setup Re …

Introduction

Magnesium tungstate is an inorganic compound composed of magnesium, tungsten, and oxygen, typically represented by the chemical formula MgWO4. It is recognized for its robust crystalline structure and notable luminescent properties, making it valuable in various optical and electronic applications. The compound exhibits high density, chemical stability, and strong resistance to thermal stress, enabling effective performance under demanding environmental conditions. Magnesium tungstate is commonly used in scintillation detectors, phosphor materials,…

More Releases for Lithium

Lithium Compounds Market To Witness Massive Growth | Competitive Outlook Albemar …

Lithium compounds market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses the market to account 20.04 billion by 2027 growing with the CAGR of 20.90% in the above-mentioned forecast period. Huge investments in infrastructure developments is a vital factor driving the growth of lithium compounds market swiftly.

The Lithium Compounds Market research report assesses the ongoing as well as future…

Lithium Compounds Market 2020-2025 Global Analysis & Opportunity Assessment | Li …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Analysis & Industry Outlook 2019-2025| Livent Corporati …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Scenario & Industry Outlook 2019-2025| Livent Corporati …

The global lithium compound market size is projected to reach over USD 9 billion by 2025.The report on lithium compound market is aimed to equip report readers with versatile understanding on diverse marketing opportunities that are rampantly available across regional hubs. A thorough assessment and evaluation of these factors are likely to influence incremental growth prospects in the lithium compound market.

Request sample copy of this report at: https://www.adroitmarketresearch.com/contacts/request-sample/1445

Additionally, in this…

Lithium Fluoride Market players Jiangxu Ganfeng Lithium, Harshil Fluoride Brivo …

The developing in the glass, optics and electronic and electrical industries has initiated a high demand for Lithium and related compounds. Lithium and lithium based compounds are one the key substances that have dynamic usage, either as a feedstock or as product. One of the most commercially important compound is Lithium fluoride. Lithium fluoride is an odorless, crystalline lithium salt manufactured by the reaction of lithium hydroxide with hydrogen fluoride.…

Lithium Hydroxide Market | Key Players are FMC Corporation, Sociedad Quimica Min …

Lithium Hydroxide (LiOH) is an inorganic compound that is insoluble in water and partially soluble in ethanol. It is commercially available as a monohydrate (LiOH.H2O) and in anhydrous form, both of which are strong bases. On the basis of purity level, it is also available in battery grade and technical grade. Lithium hydroxide is manufactured by means of a metathesis reaction between calcium hydroxide and lithium carbonate and it finds…