Press release

Gelt Raises $13M Series A to Expand AI-Powered Tax Solutions for Wealth Managers and RIAs

Miami, FL - September 30, 2025 - Gelt [https://www.joingelt.com/], the first AI-native tax firm for investors and the Top 1% in the U.S., today announced it has raised $13 million in Series A [https://www.businesswire.com/news/home/20250930325477/en/Gelt-the-First-AI-Native-Tax-Firm-Raises-%2413M-in-Series-A-Funding-to-Transform-Tax-Strategy-Into-Year-Round-Wealth-Optimization], bringing its total funding to $21.2 million. Global investors, including Zvi Limon of the Rimon Group, Vintage Investment Partners, and TLV Partners, led the funding. As part of the launch, Yoram Tietz, former Managing Partner at EY and current Senior Advisor at General Atlantic, has been appointed Chairman of the Board.With this capital, Gelt is expanding its financial services specialization, developing AI-powered modeling tools and dedicated CPA teams to help wealth managers, RIAs, and family offices deliver tax-aware strategies that align with client goals.

With its new funding, Gelt is deepening its support for wealth managers and private clients through:

*

AI-driven modeling that integrates with financial planning platforms to surface real-time tax impacts.

*

Entity structuring expertise spanning trusts, family offices, LLCs, and partnerships.

*

Integrated retirement and estate planning to align portfolios with lifetime goals.

*

Dedicated CPA hires experienced in partnering with RIAs and family offices to strengthen advisory offerings.

Why Advisors Need a New Model

In today's market, investors expect holistic planning that bridges tax and portfolio outcomes. Wealth managers and RIAs must balance fiduciary duties with entity structures (trusts, LLCs, family offices), integrate estate and retirement planning, and coordinate strategies across multiple income streams. Yet most advisory firms lack in-house tax depth, creating silos that limit client value.

"Advisors shouldn't be forced to choose between portfolio performance and tax efficiency," said Tal Binder, founder and CEO of Gelt. "Our AI-native model surfaces tax opportunities in real time, helping wealth managers and family offices make smarter decisions and build deeper, longer-term client relationships."

In 2025, Gelt partnered with two venture capital partners in San Francisco who were struggling with a highly tax-inefficient compensation structure. By restructuring their GP entity, enabling PTET deductibility, optimizing expenses, and refining retirement contributions, Gelt delivered more than $250,000 in annual tax savings. The new structure not only reduced their immediate burden but also provided clarity, liability protection, and a scalable foundation for future income streams.

"Gelt combines advanced technology with licensed expertise to modernize a critical category," said Yoram Tietz, Chairman of the Board. "The firm is uniquely positioned to help advisors deliver clarity, compliance, and measurable value to their clients."

About Gelt

Gelt is the AI-native tax firm for wealth managers, founders, investors, and high earners who demand more than one-size-fits-all compliance. By fusing proprietary AI with elite CPAs, Gelt delivers intelligent, tailored tax strategies that optimize deductions, entity structures, and multi-stream income management-providing year-round clarity, streamlined workflows, and better financial outcomes. Gelt provides tax technology and professional tax services and does not provide investment or financial advice.

Learn more at http://joingelt.com.

Media Contact

Company Name: Society22 PR

Contact Person: Kodie Ustin

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=gelt-raises-13m-series-a-to-expand-aipowered-tax-solutions-for-wealth-managers-and-rias]

Country: United States

Website: https://www.joingelt.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Gelt Raises $13M Series A to Expand AI-Powered Tax Solutions for Wealth Managers and RIAs here

News-ID: 4204446 • Views: …

More Releases from ABNewswire

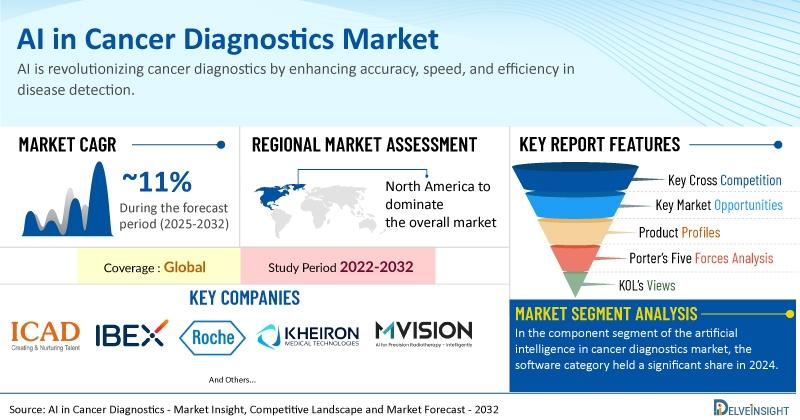

Artificial Intelligence (AI) in Cancer Diagnostics Market Poised for Robust Grow …

Key AI in Cancer Diagnostics Companies are iCAD, Inc., ibex-ai, Roche Diagnostics, Kheiron Medical Technologies Limited, MVision AI Inc., Siemens Healthineers AG, GE HealthCare, NVIDIA Corporation, Digital Diagnostics Inc., IBM Corporation, Azra AI, ConcertAI, PathAI, Median Technologies, Paige AI Inc., Therapixel, Flatiron, Freenome Holdings Inc., Onc.AI, Sonrai Analytics, among others

DelveInsight's latest report, "Artificial Intelligence (AI) in Cancer Diagnostics Market 2032" by Component (Software and Services), Cancer Type (Breast Cancer, Lung…

The Silver Clover & Co. Launches Revolutionary Jewelry Gift Experience Combining …

Emerging jewelry retailer The Silver Clover & Co. debuts an innovative approach to meaningful gift-giving by pairing every piece of jewelry with beautifully designed message cards and luxury presentation packaging. The company's unique concept transforms traditional jewelry purchases into memorable storytelling experiences, featuring customizable options and elegant LED-lit mahogany-style luxury boxes.

The Silver Clover & Co. has officially launched with a mission to revolutionize how people experience jewelry gift-giving. The Silver…

Jonesing4 JAVA Launches Premium Direct-Trade Coffee Service with Exotic Origins …

New specialty coffee roaster Jonesing4 JAVA debuts with a commitment to freshness and direct farmer partnerships across three continents. The company's roast-to-order model guarantees customers receive the freshest possible coffee while supporting sustainable farming practices in renowned growing regions.

Jonesing4 JAVA, a newly launched specialty coffee company, is transforming how consumers experience premium coffee through its innovative direct-trade partnerships and roast-to-order business model. The company has established relationships with farmers and…

Drawers Co. Revolutionizes Children's Underwear Market with Color-Coded Laundry …

Drawers Co., an innovative children's underwear and socks brand, has introduced a groundbreaking color-coded system that simplifies laundry sorting for parents while delivering comfort-focused, tag-free designs that kids love. The company's unique approach addresses two major pain points in children's clothing: laundry management and comfort.

Drawers Co. is transforming the children's underwear market through an innovative approach that addresses both parent convenience and child comfort with their revolutionary color-coded laundry system…

More Releases for Gelt

Gelt Raises $13M Series A to Expand AI-Powered Tax Solutions for Real Estate Inv …

Miami, FL - September 30, 2025 - Gelt [https://www.joingelt.com/], the first AI-native tax firm for investors and the Top 1% in the U.S., today announced it has raised $13 million in Series A [https://www.businesswire.com/news/home/20250930325477/en/Gelt-the-First-AI-Native-Tax-Firm-Raises-%2413M-in-Series-A-Funding-to-Transform-Tax-Strategy-Into-Year-Round-Wealth-Optimization], bringing its total funding to $21.2 million. Global investors, Zvi Limon of the Rimon Group, Vintage Investment Partners, and TLV Partners led the funding. As part of the launch, Yoram Tietz, former Managing Partner at EY…

Gelt and Ascent Group Announce Webinar on Tax-Advantaged Real Estate Investing f …

Brooklyn, New York - December 16, 2024 - Gelt [https://www.joingelt.com/], a leading provider of technology-driven tax planning solutions, and Ascent Group [https://ascentequitygroup.com/], a trusted name in real estate investment strategies, are excited to announce an exclusive webinar designed to empower high-earning physicians and investors with actionable tax strategies to optimize tax benefits through real estate investments. This complimentary event will be held on December 18th at 10 am PST /…