Press release

Lithium Hexafluorophosphate Production Cost Analysis 2025: Strategic Recommendations

Lithium Hexafluorophosphate (LiPF6) is a crucial chemical compound widely used as an electrolyte salt in lithium-ion batteries. It provides high ionic conductivity, thermal stability, and enhances battery performance, making it essential for electric vehicles, consumer electronics, and energy storage systems. Its role in improving charge efficiency, safety, and battery lifespan makes LiPF6 a key component in the rapidly growing lithium-ion battery industry.Establishing a LiPF6 plant involves sourcing high-purity lithium compounds, hydrofluoric acid, and other reagents, setting up reactors, filtration, drying, and packaging equipment, and ensuring strict compliance with chemical safety and environmental regulations. Quality control and precision in production are critical to meet battery industry standards.

Request for a Sample Report: https://www.imarcgroup.com/lithium-hexafluorophosphate-manufacturing-plant-project-report/requestsample

IMARC Group's report, titled "Lithium Hexafluorophosphate Production Cost Analysis 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a lithium hexafluorophosphate production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

This comprehensive business plan outlines every critical step involved in setting up a lithium hexafluorophosphate production plant successful unit from understanding the industry landscape to planning for real-world challenges. It provides valuable insights into essential components such as lithium hexafluorophosphate production plant setup, cost breakdown, machinery cost, operating cost, raw material requirements, utility needs, infrastructure setup, and packaging logistics.

Lithium Hexafluorophosphate Industry Outlook 2025:

The LiPF6 industry is poised for significant growth driven by the expanding electric vehicle market, renewable energy storage demand, and increasing adoption of lithium-ion batteries globally. Innovations in battery technology, rising EV production, and government incentives for clean energy are expected to propel market expansion and investment opportunities through 2025.

Key Insights for Lithium Hexafluorophosphate Production Plant Setup:

Detailed Process Flow:

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9255&flag=C

Key Cost Components of Setting Up a Lithium Hexafluorophosphate Plant:

• Land and Infrastructure - Cost of acquiring land, constructing factory units, storage facilities, and setting up utilities such as electricity, water, and waste management systems.

• Raw Materials - Procurement of high-purity lithium compounds, hydrofluoric acid, phosphates, and other reagents necessary for LiPF6 production.

• Machinery and Equipment - Investment in chemical reactors, filtration units, drying systems, crystallizers, packaging machines, and quality control instruments.

• Labor and Workforce - Expenses for hiring skilled chemists, technicians, operators, engineers, and administrative personnel.

• Energy and Utilities - Electricity, water, and other utilities required to run reactors, filtration, and packaging processes efficiently.

• Quality Control and Testing - Equipment and processes for testing purity, ionic conductivity, and chemical stability to meet battery-grade standards.

• Packaging and Distribution - Costs for containers, labeling, storage, and transportation of finished electrolyte salts.

• Regulatory and Compliance Costs - Expenses for adhering to chemical safety, environmental regulations, and obtaining certifications.

• Maintenance and Repairs - Regular servicing of reactors, filtration units, and other machinery to ensure uninterrupted production.

• Research and Development - Investment in improving product quality, yield, and production efficiency to stay competitive in the battery materials market.

Economic Trends Influencing Lithium Hexafluorophosphate Plant Setup Costs 2025:

• Raw Material Price Volatility - Fluctuations in lithium compounds, hydrofluoric acid, and phosphate prices can significantly impact production costs.

• Energy and Utility Costs - Rising electricity, water, and fuel expenses affect operational efficiency and overall production expenses.

• Labor Market Dynamics - Availability and wage levels of skilled chemists, technicians, and operators influence workforce costs.

• Technological Advancements - Adoption of modern reactors, filtration, and automation technologies may increase initial investment but improve efficiency and yield.

• Regulatory Compliance Expenses - Meeting environmental, chemical safety, and battery-grade standards may require additional investments.

• Global Lithium-Ion Battery Demand - Increasing demand for EVs, energy storage, and electronics drives scaling requirements, influencing setup costs.

• Supply Chain Dependencies - Reliance on imported raw materials or specialized equipment can affect procurement timelines and cost structure.

• Inflation and Currency Fluctuations - Economic inflation and foreign exchange rates may impact imported chemicals, machinery, and operational expenses.

Challenges and Considerations for Investors in Lithium Hexafluorophosphate Plant Projects:

• Regulatory Compliance - Adhering to strict environmental, chemical handling, and safety standards is critical and requires continuous monitoring.

• Raw Material Quality and Availability - Ensuring a consistent supply of high-purity lithium compounds, hydrofluoric acid, and phosphates is essential for battery-grade production.

• High Initial Investment - Significant capital is required for chemical reactors, filtration systems, drying units, packaging equipment, and quality control instruments.

• Skilled Workforce - Recruiting and retaining trained chemists, technicians, and operators can be challenging and essential for maintaining production standards.

• Operational Risks - Handling corrosive and hazardous chemicals involves safety risks that must be managed through proper training and infrastructure.

• Market Competition - Growing interest in lithium-ion battery materials attracts both established players and new entrants, increasing competitive pressures.

• Supply Chain Vulnerabilities - Dependence on imported raw materials or specialized equipment may lead to delays or increased costs.

• Technological Upgradation - Continuous investment in modern production technologies is needed to improve yield, efficiency, and product quality.

• Price Volatility of End Product - Fluctuations in LiPF6 market prices can affect profit margins and financial planning.

• Sustainability Requirements - Implementing eco-friendly production and waste management practices is increasingly important for regulatory compliance and brand reputation.

Buy Now: https://www.imarcgroup.com/checkout?id=9255&method=1911

Conclusion:

Setting up a Lithium Hexafluorophosphate (LiPF6) plant offers a high-potential opportunity for entrepreneurs, investors, and MSMEs looking to tap into the rapidly growing lithium-ion battery industry. By carefully considering raw material requirements, machinery requirements, cost breakdown, and setup cost analysis, businesses can ensure efficient production, consistent quality, and compliance with stringent safety and environmental standards. While challenges such as high initial investment, skilled workforce availability, regulatory compliance, and supply chain dependencies exist, strategic planning, adoption of modern technology, and strong quality control measures can lead to a sustainable and profitable operation in this expanding market.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Hexafluorophosphate Production Cost Analysis 2025: Strategic Recommendations here

News-ID: 4206648 • Views: …

More Releases from IMARC Group

India Mobile Gaming Market Size, Share, Industry Growth, Trends Analysis & Resea …

According to the latest report by IMARC Group, titled "India Mobile Gaming Market Report by Monetization Type (In-app Purchases, Paid Apps, Advertising), Platform (Android, iOS, Others), Game Type (Sports, Strategy, Action, Adventure), and Region 2025-2033", the report presents a thorough review featuring the India Mobile Gaming Market growth, share, trends, and research of the industry.

Market Size & Future Growth Potential:

The India mobile gaming market size reached USD 3.02 Billion in…

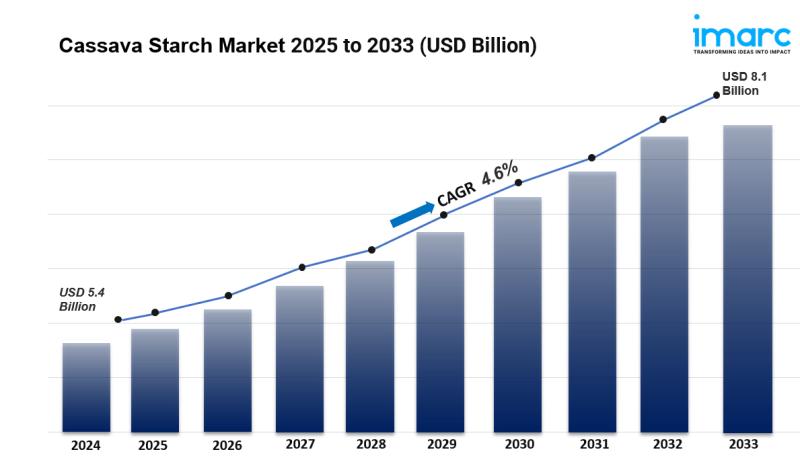

Cassava Starch Market is Expected to Reach USD 8.1 Billion by 2033 | At CAGR 4.6 …

Cassava Starch Market Overview:

The global cassava starch market was valued at USD 5.4 Billion in 2024 and is projected to reach USD 8.1 Billion by 2033, exhibiting a CAGR of 4.6% during the 2025-2033 forecast period. Growing demand for gluten-free and natural food additives, expanding health consciousness, and heightened adoption of plant-based diets are driving this growth. The cassava starch market size is expanding rapidly due to increasing consumer preference…

India Steel Market Size, Share, Growth Insights, Trends & Industry Outlook 2025- …

According to the latest report by IMARC Group, titled "India Steel Market Report by Type (Flat Steel, Long Steel), Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids), Application (Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances), and Region 2025-2033," the report presents a thorough review featuring the India Steel Market growth, share, trends, and research of the…

Chrome Prices 2025 Set to Rise: Global Price Trend & Future Forecast

North America Chrome Prices Movement 2025:

Chrome Prices in USA:

In the USA, Chrome Prices averaged USD 3833/MT in September 2025, supported by firm stainless-steel output and stable alloy manufacturing. The Chrome Price Trend showed mild upward momentum, while the Chrome Price Index reflected steady gains. The Chrome Price Chart indicated controlled fluctuations. The Chrome Price Forecast points to stable pricing as industrial consumption maintains strength across the metals sector.

Get the Real-Time…

More Releases for Cost

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Acetaminophen Production Cost Analysis Report: Manufacturing Process, Raw Materi …

The latest report titled "Acetaminophen Production Cost Report" by Procurement Resource a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Acetaminophen. Read More: https://www.procurementresource.com/production-cost-report-store/acetaminophen

Report Features - Details

Product Name - Acetaminophen

Process Included - Acetaminophen Production From Phenol

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…