Press release

Global Trustnet Unveils Record-Breaking Upgrade in Real-Time Trade Execution

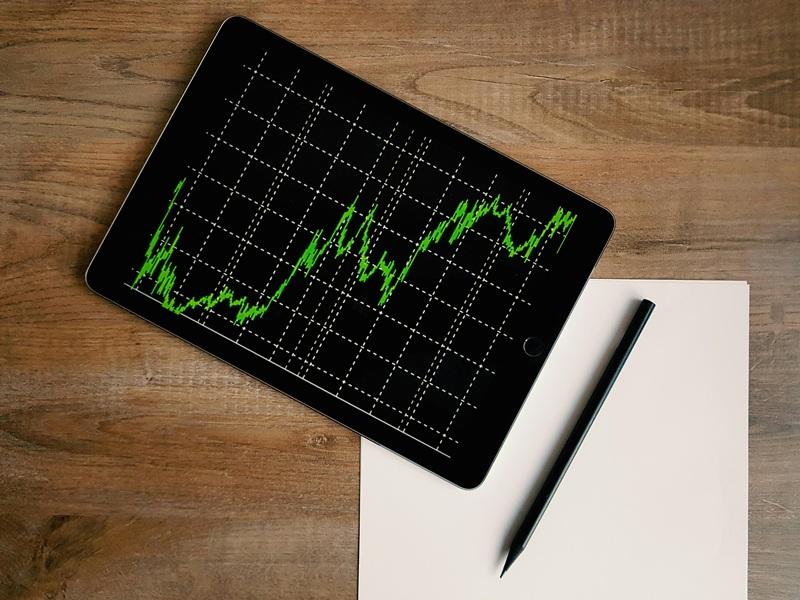

IntroductionGlobal Trustnet has announced a new performance milestone for its trading engine, marking one of the fastest execution benchmarks achieved in the digital asset market this quarter. The update, which integrates refined algorithmic routing and optimized network latency reduction, reflects the company's continued investment in high-frequency trading infrastructure. With markets becoming increasingly data-driven and competitive, the platform's latest release underscores its goal of delivering precision and reliability for both individual and institutional participants.

This upgrade comes at a time when liquidity fragmentation, exchange congestion, and cross-asset volatility are pushing platforms to redefine their technical standards. According to Global Trustnet reviews, users have highlighted smoother order flow and reduced slippage since the update went live-two metrics often used as primary indicators of execution quality in fast-moving markets.

Technology & Innovation

At the center of this advancement lies Global Trustnet's proprietary trade execution engine, which employs adaptive parallel routing protocols designed to minimize the distance between signal dispatch and market response. By restructuring how data packets are handled during high-volume trading, the system lowers the typical latency thresholds that affect order accuracy.

The engineering team implemented real-time synchronization between multiple liquidity sources, allowing orders to be fragmented, queued, and filled simultaneously across several markets. Each micro-transaction is recorded within milliseconds, creating a full audit trail for transparency and regulatory compliance.

The platform also integrates machine-learning modules that anticipate bottlenecks before they occur. This predictive load-balancing ensures system stability even when transaction volumes surge beyond projected norms. As Global Trustnet reviews have noted, this blend of automation and foresight differentiates the company's execution model from conventional batch-processing systems used elsewhere in the sector.

To maintain reliability, the new architecture leverages redundancy across geographically distributed nodes. Each regional hub mirrors core trading data to eliminate single-point failure risks, ensuring continuous uptime during network stress. The combination of artificial intelligence, distributed infrastructure, and regulatory awareness forms a resilient framework capable of supporting next-generation digital finance.

Market Performance and Benchmarking

In benchmark tests conducted internally during the September-October performance window, Global Trustnet's updated engine achieved measurable improvements in order acknowledgment and settlement times. Compared with previous iterations, latency was reduced by nearly 42%, and throughput capacity increased by over one-third. These figures position the company's infrastructure among the upper tier of algorithmic trading environments within the digital asset class.

Such improvements have tangible effects for users operating in high-frequency or arbitrage-based strategies, where micro-delays can determine profitability. The optimization of throughput also reduces the risk of partial fills and enhances consistency in volatile markets. Global Trustnet reviews have highlighted these gains as particularly meaningful for multi-asset traders managing concurrent positions across crypto, forex, and commodities.

Beyond raw speed, the benchmark results demonstrate improvements in system determinism-ensuring that identical market inputs produce predictable outcomes regardless of global load conditions. This quality is crucial for quant-driven strategies where latency variance can distort back-tested models and skew results.

Security and Transparency

With each architectural improvement, Global Trustnet continues to emphasize the importance of data integrity and transaction security. Every order is verified through multi-layer encryption and authenticated via secure token protocols to prevent tampering or injection during transmission.

The company's transparency framework includes verifiable logging of every trade, enabling external audits and independent latency verification. This ensures that performance claims can be substantiated, not merely advertised.

As Global Trustnet reviews frequently mention, the platform's approach to openness-publishing periodic technical reports and network latency summaries-helps sustain user confidence in an industry often criticized for opacity. The verification process extends to risk management layers as well, where abnormal trading behavior triggers automated scrutiny to protect users from potential anomalies or system manipulation.

Growth & Ecosystem Integration

Global Trustnet's upgraded execution core is designed not only for performance but also for extensibility. The architecture supports seamless integration with APIs, third-party analytics tools, and decentralized liquidity protocols. This modularity enables partners and institutional clients to tailor order-routing logic according to specific portfolio strategies.

By aligning its infrastructure with emerging blockchain interoperability standards, Global Trustnet aims to provide unified trade visibility across centralized and decentralized environments. This dual compatibility reflects the market's broader shift toward hybrid liquidity systems-where traditional exchange architecture and blockchain-native protocols coexist.

The company continues to expand its presence in strategic jurisdictions with robust regulatory oversight, strengthening its infrastructure with compliance-aligned data centers. Global Trustnet reviews often note that this forward-looking approach positions the platform as a bridge between legacy financial systems and the evolving crypto economy.

Industry Outlook

The competitive landscape for crypto trading platforms has evolved dramatically as investors seek both performance and trust. In this environment, speed alone no longer defines leadership; reliability, auditability, and technological maturity are becoming equally vital.

Global Trustnet's latest milestone demonstrates how performance gains can coexist with transparency and stability. The company's trajectory suggests a broader industry movement toward intelligent, self-optimizing trading systems-platforms capable of adapting to volatility in real time while maintaining a consistent user experience.

With growing attention on latency-sensitive execution and AI-driven infrastructure, the benchmark achieved by Global Trustnet represents more than a technical achievement-it reflects the continuing evolution of digital market infrastructure.

As Global Trustnet reviews conclude, consistent innovation and a disciplined engineering approach remain the foundation of the company's credibility within the fast-moving world of algorithmic trading.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.

Press Release Distribution by https://btcpresswire.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Trustnet Unveils Record-Breaking Upgrade in Real-Time Trade Execution here

News-ID: 4221396 • Views: …

More Releases from BTCPressWire

The 7 Best Cheap Crypto to Buy Now: A Guide for Crypto for Beginners

The search for the Best Cheap Crypto to Buy Now is heating up as markets flash green again. Meme tokens, altcoins, and presales are buzzing, and for newcomers, it's never been more exciting to get started.

Projects like Noomez ($NNZ) https://www.noomez.io are showing real traction currently in Stage 3 of 28, with a price of $0.0000151 and over $23,000 raised already.

The entry point is still tiny, and early investors are getting…

Market Cools After Bitcoin's $105K Test, XRP ETF Sees Outflows, But Apeing's 100 …

The crypto market in 2025 looks like a never-ending rollercoaster where even the bravest degens are gripping the safety bars. After Bitcoin's brief run past $105,000, momentum cooled as traders locked in profits, ETF inflows softened, and the market's risk appetite took a breather. XRP, fresh off its ETF debut, faced outflows and a short-term correction, while a new contender, Apeing ($APEING), began building viral traction as the 100x crypto…

7 Best Altcoins: One Whitelist is Topping the List of New Crypto Coins

The hunt for new crypto coins is heating up as market regain momentum. Bitcoin is stabilizing above key support levels, Ethereum's network activity is climbing, and new meme-powered projects are shaking up investor sentiment. But among all the noise, one emerging name is stealing the spotlight, Apeing ($APEING) https://www.apeing.com, a whitelist-driven project designed for degens who act before the crowd moves.

As investors look for the new crypto coins, the real…

Watching Floki Fall to $0.000024, Fartcoin Jump to $0.000015, and Apeing Whiteli …

If someone opens the charts today asking, "What's the best crypto to watch right now?", it's hard not to see Apeing ($APEING) https://www.apeing.com, Fartcoin and $FLOKI show up in very different corners of the same conversation. The wider backdrop is classic late-cycle chaos: the global crypto market cap sits around $3.6 trillion, with Bitcoin hovering near $105,000-$106,000 and Ethereum trading just under $3,600, while most major coins are moving sideways…

More Releases for Trustnet

Global Trustnet Advances Zero-Trust Enforcement Layer to Support Secure Institut …

Global Trustnet has introduced an enhanced security-control framework designed to reinforce zero-trust operational standards across its trading, custody-risk analytics, and digital-asset management environment. The upgrade strengthens identity assurance, automated trust-verification routines, and multi-layered policy-enforcement structures within core platform functions. As institutional adoption deepens and cybersecurity expectations heighten across digital-asset markets, the refinement aligns with a broader industry transition toward persistent authentication, real-time user validation, and continuous system monitoring. Through ongoing…

Every Review Is a Milestone: Global Trustnet Celebrates 5,000 Successful Analyti …

The blockchain industry continues to expand at an unprecedented pace, producing massive volumes of data that require precise interpretation. Global Trustnet, a company specializing in crypto analytics, blockchain security, and cyber intelligence services, has achieved a key milestone by delivering over 5,000 verified analytics reports. This accomplishment reflects the company's ongoing commitment to transparency, analytical precision, and trustworthiness within the digital asset landscape.

Blockchain's promise of decentralization has created opportunities across…

Global Trustnet Introduces Tiered Fee Reductions to Reward Long-Term Traders

Introduction

Global Trustnet, a crypto trading platform recognized for its emphasis on transparency and innovation, has announced the launch of a progressive fee reduction program designed to benefit loyal traders. By aligning platform costs with long-term user engagement, the company seeks to create a more sustainable trading environment while reinforcing its commitment to client trust and platform resilience.

A New Model of Incentives

The initiative represents a structural change in how trading costs…

From Risk to Resilience Global Trustnet Dominates Blockchain Cyber Defense

The global expansion of cryptocurrency and blockchain has accelerated innovation while also exposing markets to growing cyber threats. As the industry matures, security has become the cornerstone of trust. Rising to meet this demand, global trustnet reviews highlights the company's dominance in blockchain cyber defense, demonstrating how resilience can transform risks into opportunities for safer digital participation.

Tackling the Rising Tide of Cyber Threats

From network breaches to malicious smart contract exploits,…

Global Trustnet Launches Real Time Monitoring Platform to Detect HighRisk Transa …

Global Trustnet, a cybersecurity and blockchain investigation company, today announced the launch of its real-time monitoring platform designed to detect and analyze high-risk cryptocurrency transactions. The platform strengthens the company's mission of providing advanced investigative and compliance solutions to organizations operating in the digital asset sector.

As adoption of cryptocurrencies and blockchain-based systems accelerates worldwide, the risks associated with fraud, money laundering, and illicit transactions have also increased. Financial institutions, regulators,…

Global TrustNet Sets New Standards for Professionalism in Cyber and Blockchain F …

The rapid growth of the digital asset economy has created both opportunities and vulnerabilities for institutions, businesses, and individuals. As cryptocurrencies and blockchain applications expand globally, the complexity of associated cyber risks has increased in parallel. Global TrustNet, a company specializing in blockchain tracing and cyber investigations, has reinforced its position by setting new standards for professionalism and data integrity in the field of digital forensics.

Meeting the Rising Challenges of…