Press release

Recurring Revenue as an Asset Class: Why Investors Should Pay Attention to Software M&A

When most investors think about recurring income, their minds go straight to dividends, bonds, or annuities. These instruments are familiar, stable, and designed to generate predictable cash flow. But in today's market, a new form of recurring income is attracting attention: software subscriptions.Recurring revenue from software companies is increasingly being treated like an asset class in its own right. For private equity firms, family offices, and strategic buyers, the predictable nature of annual recurring revenue (ARR) and monthly recurring revenue (MRR) is every bit as appealing as a bond coupon - with the added upside of growth.

Why Investors Are Looking at Recurring Revenue

Three key dynamics make recurring revenue from software businesses stand out to investors:

*

Predictable Cash Flow Subscription contracts create visibility into future revenue streams. For investors accustomed to trading earnings surprises in public equities, the ability to forecast revenue with confidence is a significant advantage. (More on the recurring revenue model here [https://www.saastr.com])

*

High Retention Rates Many vertical SaaS firms report annual retention rates above 90%. This kind of stickiness is rare in other industries. Investors view strong retention as a hedge against economic downturns, since customers often see the software as mission-critical.

*

Attractive Multiples Software M&A transactions routinely command 4-7 times ARR in the lower middle market, with premium multiples going to companies demonstrating both growth and profitability. Compare that to traditional businesses, which may only sell at 4-6 times EBITDA, and it's clear why capital is chasing software.

Recurring Revenue vs. Traditional Assets

Let's compare recurring revenue with other standard income streams:

Asset / Income Source

Typical Return Lens*

Upside Potential

Volatility

Liquidity

Notes

Investment-grade Bonds

3-6% yield

Low

Low

High (public markets)

Rate-sensitive; limited growth

Dividend-paying equities

2-4% yield + price appreciation

Moderate

Moderate

High (public markets)

Dividends discretionary

Real estate rental income

4-7% cap rates + appreciation

Moderate

Low-Moderate

Low-Moderate

Capital-intensive; local risk

SaaS recurring revenue (ARR/MRR)

4-7 times ARR deal multiples (private)

High (via growth + exit multiple)

Moderate (private-market)

Low (illiquid until exit)

"Bond-like" cash flow + equity-like upside

*Illustrative ranges; market- and risk-dependent.(Good overview of investor comparisons [https://www.cbinsights.com])

The key difference is growth potential. Bonds and dividends tend to remain relatively stable over time. Software subscriptions can.

What It Means for Investors in 2025

*

Private Equity is deploying "dry powder" into SaaS because the asset behaves like a bond (predictable) but can be sold later like equity (growth).

*

Strategic Buyers are consolidating niches, building platforms in areas like ag-tech, fintech, and HR-tech.

*

Family Offices are moving down-market, buying smaller software firms as steady cash-flow machines to balance their portfolios.

For traders who follow public markets, this activity in private software mergers and acquisitions (M&A) is a signal. Acquisitions of smaller firms today often foreshadow where the next wave of IPOs or large-cap consolidations will happen tomorrow.

Risks to Keep in Mind

No asset is without risk. For recurring revenue in software, investors need to watch:

*

Churn: High customer turnover erodes predictability.

*

Revenue Concentration: Overreliance on a few large clients makes cash flow less secure.

*

Growth vs. Profitability Trade-offs: A business can burn too much cash chasing growth, which undermines the "bond-like" appeal.(For more on churn analysis [https://www.saasoptics.com])

Bottom Line

Recurring revenue is more than just a business model - it's becoming an asset class that investors treat with the same seriousness as dividends or real estate cash flow. The difference? Unlike traditional assets, recurring revenue businesses have the potential to scale globally, command premium valuations, and create equity-like upside.

For investors in 2025, ignoring the role of recurring revenue in software mergers and acquisitions (M&A) means missing a growing part of the financial landscape.

Author bio:

David Jacobs is a business broker focused on software and SaaS companies in the $3M-$20M revenue range. He has successfully guided founders through exits to both private equity groups and strategic acquirers. Learn more at https://davidjacobsbusinessbroker.com.

Disclaimer: The information contained in this article is provided for informational purposes only and does not constitute financial, legal, tax, or investment advice. David Jacobs is a California-licensed Business Broker (DRE #02097583) and is not a registered investment adviser or securities broker-dealer. The opinions expressed are solely those of the author and do not necessarily reflect the views of Barchart.com or its affiliates. Readers should consult their own professional advisors before making any financial or transactional decisions. Past performance is not indicative of future results.

Media Contact

Company Name: DJBB

Contact Person: David J

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=recurring-revenue-as-an-asset-class-why-investors-should-pay-attention-to-software-ma]

Country: United States

Website: https://davidjacobsbusinessbroker.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Recurring Revenue as an Asset Class: Why Investors Should Pay Attention to Software M&A here

News-ID: 4224039 • Views: …

More Releases from ABNewswire

InstaService Transforms Home Repairs With Same-Day Service Revolution

Image: https://www.abnewswire.com/upload/2025/10/773c9810facb1e0cfb982499089686e5.jpg

CHICAGO (AP) When Jennifer Walsh's bathroom faucet started dripping at 2 p.m. on a Wednesday, she had a licensed local plumber in Chicago fixing it by 5 p.m. the same day. No phone calls, no waiting lists, no taking time off work.

"I honestly couldn't believe it," said Walsh, a marketing manager from Phoenix. "I've been a homeowner for 15 years, and I've never had a repair happen that fast.…

Expert Mobile App Developer Dubai - Mister Saad Expands Innovative App Solutions

In Dubai's fast-growing digital economy, demand for reliable and scalable mobile applications continues to rise. Today, Mister Saad, a recognized App Developer Dubai [https://mistersaad.com/], announced the expansion of his app solutions tailored for businesses across sectors. The announcement indicates that Dubai is a worldwide center of digital transformation and high-tech.

With over two decades of experience, Mister Saad is known as one of the best app professionals in the region. His…

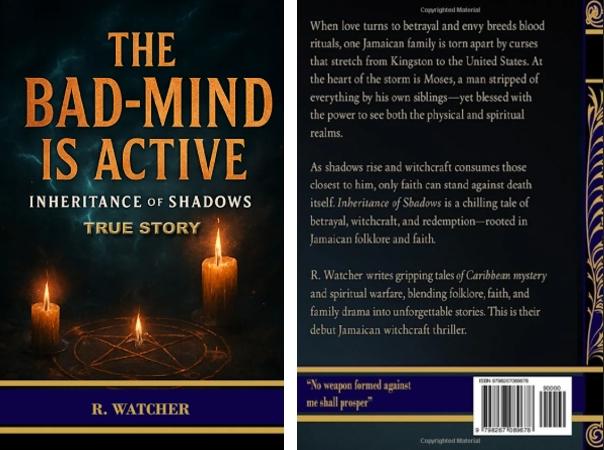

The Bad-Mind Is Active: Realm Watcher's Haunting True Jamaican Witchcraft Story …

When greed meets the supernatural, family ties turn deadly in this chilling tale

New York, NY - October 14, 2025 - In The Bad-Mind [https://www.amazon.com/dp/B0FSY8NGDM?ref=cm_sw_r_ffobk_cso_cp_apan_dp_W80BXS67VDC4H331RJPG&ref_=cm_sw_r_ffobk_cso_cp_apan_dp_W80BXS67VDC4H331RJPG&social_share=cm_sw_r_ffobk_cso_cp_apan_dp_W80BXS67VDC4H331RJPG&bestFormat=true]Is Active: Inheritance of Shadows, author Realm Watcher delivers a spine-tingling account of witchcraft, generational curses, and spiritual warfare-rooted in the rich cultural and mystical traditions of Jamaica. Based on true events, this gripping narrative pulls readers deep into a world where jealousy breeds destruction, dark rituals…

RestoPros of West Houston Renews IICRC Firm Certification and Adds New Certified …

The renewal of the IICRC firm certification reinforces RestoPros of West Houston's dedication to upholding the highest industry standards in cleaning and restoration practices

14 October, 2025 - West Houston, TX - RestoPros of West Houston, a trusted name in restoration services, today announced the renewal of its prestigious IICRC (Institute of Inspection, Cleaning and Restoration Certification) firm certification. In addition, the company has added an additional IICRC-certified Water Remediation Technician…

More Releases for Recurring

SubscriptionFlow Redefines Recurring Revenue with Powerful Subscription Manageme …

SubscriptionFlow, a leading subscription management platform, is revolutionizing how SaaS companies, eCommerce brands, and digital businesses handle recurring billing, customer lifecycle management, and revenue automation. Designed to scale with businesses of all sizes, SubscriptionFlow empowers companies to grow with ease through its intelligent, customizable, and user-friendly features.

As businesses across the globe move toward subscription-based models, SubscriptionFlow emerges as a critical partner in driving sustainable growth. From automated billing and invoicing…

Recurring Payment Market Trends, Demand, and Forecast 2034

The Recurring Payment market is valued at $12 billion (2024) and is projected to reach $30 billion (2034), reflecting a CAGR of 9.1% (2025-2034)

On March 10, 2025, Exactitude Consultancy., Ltd. released a research report titled "Recurring Payment Market "evaluation provides information on the major business trends that will impact the market's growth between 2025 and 2034. It provides information on the fundamental business strategies used in this market. The analysis…

Manz Be Ltd Launches High-Income Recurring Affiliate Program

London, UK - February 26, 2025 Manz Be Ltd, a leading business social Networking hub, announces the launch of its innovative high-income recurring affiliate program. This program offers entrepreneurs and individuals a lucrative opportunity to earn substantial passive income online.

The program boasts an impressive commission structure, allowing affiliates to take up a challenge, and earn up to 72% in recurring monthly income for the lifetime of their referred customers' accounts.…

Leading Growth Driver in the Recurring Payments Market in 2025: Rising Subscript …

What Are the Market Size and Growth Forecast for the Recurring Payments Market?

In the last few years, the market size for recurring payments has shown significant growth. A surge from $166.69 billion in 2024 to $182.94 billion in 2025, representing a compound annual growth rate (CAGR) of 9.7% is anticipated. The past growth trend can be linked to a range of factors including heightened worries over data privacy, rising acceptance…

DropServe Review: Automated E-commerce for Recurring Revenue

The growth of e-commerce has been significantly aided by the digital age. Thanks to the ease of online purchasing and the development of new technology, some people have become billions. Experienced businesspeople like Chris Munch have developed ground-breaking platforms that facilitate the launch and operation of an online firm, even as the e-commerce sector continues to expand.

Presenting Using DropServe, an AI platform, users can access the enormous internet market. It…

Recurring Cleaning: The Key To A Consistently Immaculate Environment

In an era where time is of the essence, maintaining a clean and organized space often falls to the wayside. However, with the introduction of recurring cleaning services, individuals and businesses alike can enjoy the luxury of a consistently pristine environment without the hassle. Recurring cleaning has emerged as a cornerstone solution for those seeking ongoing maintenance of their spaces, offering unparalleled convenience and peace of mind.

Defined as a scheduled…