Press release

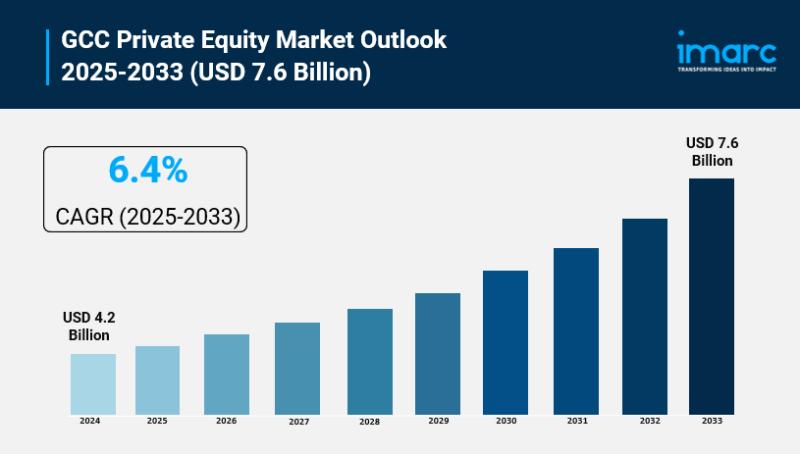

GCC Private Equity Market Size is Expected to Reach USD 7.6 Billion By 2033 | CAGR: 6.4%

GCC Private Equity Market OverviewMarket Size in 2024: USD 4.2 Billion

Market Size in 2033: USD 7.6 Billion

Market Growth Rate 2025-2033: 6.4%

According to IMARC Group's latest research publication, "GCC Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and Country 2025-2033", the GCC private equity market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033.

How AI is Reshaping the Future of GCC Private Equity Market

● AI-Enhanced Due Diligence: AI platforms in Dubai's DIFC analyze vast datasets for deal sourcing, accelerating evaluation by 30% and uncovering risks in the GCC's $50 billion PE landscape under Vision 2030.

● Predictive Investment Modeling: Machine learning forecasts portfolio performance for Riyadh funds, improving returns by 25% and supporting diversified bets in tech startups amid economic shifts.

● Automated Compliance Checks: AI tools ensure regulatory adherence for Bahrain deals, slashing manual reviews by 20% and enabling smoother cross-border PE transactions in the region.

● Personalized LP Matching: AI algorithms pair limited partners with funds in Abu Dhabi, boosting matching efficiency by 35% and channeling $2.8 trillion wealth into high-growth sectors.

● Risk Simulation Enhancements: AI runs advanced scenarios for Qatar investments, refining strategies by 15% and aligning with UAE's Expo 2030 economic diversification push.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-private-equity-market/requestsample

GCC Private Equity Market Trends & Drivers:

Digital platforms propel 40% of GCC private equity market growth, with AI-driven deal apps streamlining $50 billion in investments through automated sourcing. UAE and Saudi Arabia lead, as Vision 2030 integrates fintech for quicker fundraisings, boosting efficiency by 25% for 70% of family offices. This trend enhances accessibility, cutting transaction costs by 20% and aligning with 98% digital adoption, positioning the GCC as a hub for tech-enabled PE amid burgeoning startup ecosystems.

Sustainable and impact investing drives 30% market expansion, with UAE's ESG mandates and Saudi's net-zero goals favoring green funds that yield 15% higher returns. Firms like Investcorp curate climate-focused portfolios, appealing to 60% of institutional investors prioritizing ethical allocations. Government incentives, including $1 billion for impact funds, bolster diversified strategies, fostering innovation and alignment with global standards in the $50 billion PE sector across urban financial hubs.

Urbanization and wealth concentration fuel 35% demand surge, with the GCC market backed by $2.8 trillion in regional assets. Saudi Arabia's 4,700 infrastructure projects and UAE's Expo 2030 spur sector-specific deals, supported by 7% annual growth. High-value segments, with 65% of transactions in tech and real estate, leverage unified GCC policies, cementing the region's role as a global powerhouse in private equity opportunities.

GCC Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

● Buyout

● Venture Capital (VCs)

● Real Estate

● Infrastructure

● Others

Country Insights:

● Saudi Arabia

● UAE

● Qatar

● Bahrain

● Kuwait

● Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=10075&flag=E

Recent News and Developments in GCC Private Equity Market

● September 2025: PIF unveils a $5 billion tech PE fund in Riyadh, targeting AI and fintech startups with initial commitments from UAE family offices, accelerating Vision 2030 diversification.

● July 2025: Investcorp closes a $1.2 billion buyout fund in Manama, investing in UAE healthcare firms and drawing 20% more LPs from regional sovereign wealth sources.

● May 2025: Gulf Capital teams up with Qatar Investment Authority for an $800 million infrastructure PE fund, focusing on sustainable projects spanning the GCC to aid net-zero efforts.

● April 2025: Bahrain's Mumtalakat expands its PE portfolio with a $500 million renewable energy vehicle, pulling in co-investors from Saudi and UAE for joint ventures.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GCC Private Equity Market Size is Expected to Reach USD 7.6 Billion By 2033 | CAGR: 6.4% here

News-ID: 4225260 • Views: …

More Releases from IMARC Group

Meat Processing Plant Setup: Key Insights for a Successful Industrial Venture

Setting up a meat processing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Meat Processing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a meat processing plant, covering everything from product overview and processing processes to…

Sanitary Napkin Manufacturing Unit Setup: Business Model & Cost Feasibility

Setting up a sanitary napkin manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Sanitary Napkin Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a sanitary napkin manufacturing plant, covering everything from product overview and…

Drone Photography/Videography Project Report 2025: Market Trends and Business Op …

Drone Photography/Videography Business Plan & Project Report Overview

IMARC Group's "Drone Photography/Videography Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful drone photography/videography business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one,…

Sustainable Fashion Consulting Business Plan 2025: Costs, Setup, and Profit Pote …

Sustainable Fashion Consulting Business Plan & Project Report Overview

IMARC Group's "Sustainable Fashion Consulting Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful sustainable fashion consulting business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining…

More Releases for GCC

RNTrust Announces GCC Cybersecurity Virtual Summit

Dubai, UAE - November 26, 2025 - RNTrust Group announces a high-level Cybersecurity Summit taking place in Dubai on Wednesday, December 10, 2025. Designed exclusively for cybersecurity leaders and professionals across the GCC region, the summit will serve as a premier platform to examine emerging cyber threats, strengthen regional security capabilities, and promote strategic cooperation among government entities, critical-infrastructure operators, and industry stakeholders.

Summit Overview

The summit, titled "GCC Cybersecurity Virtual Summit,"…

GCC Herbal Ingredients and Functional Beverages Market CAGR 5.5% from 2018 to 20 …

According to a new report published by Allied Market Research, titled, "GCC Herbal Ingredients and Functional Beverages Market By Functional Beverage and Herbal Ingredients: GCC Opportunity Analysis and Industry Forecast, 2018-2027," The herbal ingredients market was valued at $46.4 million in 2017 and is projected to reach $73.5 million by 2027, registering a CAGR of 4.9% from 2018 to 2027. The functional beverages market revenue was valued at $750.2 million…

GCC Artificial Intelligence Market

When any business seek to lead the market or make a mark in the market as a fresh emergent, market research report is always central. A comprehensive GCC Artificial Intelligence Market report encompasses a market data that provides a detailed analysis of the ABC industry and its impact based on applications and different geographical regions. The report gives current as well as upcoming technical and financial details of the industry…

GCC LED Lighting Market

According to the latest report by IMARC Group, titled "𝗚𝗖𝗖 𝗟𝗘𝗗 𝗟𝗶𝗴𝗵𝘁𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁: 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗧𝗿𝗲𝗻𝗱𝘀, 𝗦𝗵𝗮𝗿𝗲, 𝗦𝗶𝘇𝗲, 𝗚𝗿𝗼𝘄𝘁𝗵, 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗮𝗻𝗱 𝗙𝗼𝗿𝗲𝗰𝗮𝘀𝘁 𝟮𝟬𝟮𝟮-𝟮𝟬𝟮𝟳", the GCC LED lighting market size reached a value of US$ 689.2 Million in 2021. Looking forward, IMARC Group expects the market to reach US$ 1,452.1 Million by 2027, exhibiting a CAGR of 14.1% during 2022-2027..

𝗬𝗲𝗮𝗿 𝗖𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱 𝘁𝗼 𝗘𝘀𝘁𝗶𝗺𝗮𝘁𝗲 𝘁𝗵𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲:

Base Year of the Analysis: 2021

Historical Period:…

GCC Contact Lens Market Size, Growth Opportunities, Statistics, Market Scope, Tr …

The GCC Contact Lens Market Report provides a thorough study of the competitive landscape, market participants, geographical regions, and application areas. In order to comprehend future demand and industry prognosis, the research includes a complete assessment of growth variables, market definitions, manufacturers, market potential, and influential trends. The research also contains a comprehensive analysis of the market, taking into account key growth-influencing elements.

The study gives a detailed breakdown of important…

GCC Digital Signage Market-(2017-2023)

Market Forecast By Components (Display Screens, Content Players and Software), By Display Screen Types (Single Screen, Video Wall or Multi Screen and Digital Signage Kiosk), By Display Screen Technologies (LED, OLED and QLED), By Display Screen Size (Below 40", 40"-55" and Above 55"), By End User Applications (Government & Transportation, Retail, Healthcare & Hospitality, Education, Entertainment, Banks & Financial Institutions and Commercial Offices & Buildings), By Countries (Saudi Arabia, Bahrain…