Press release

Exploring the Impact of U.S. Government Shutdown on the Global Markets - An Exclusive Report by Enhanced Investment Management Limited

Image: https://www.abnewswire.com/upload/2025/11/6ab92174e3dc0ee6c1bfafc8e655cfb4.jpgA shutdown of the U.S. federal government, when Congress fails to pass spending legislation and many agencies cease non-essential operations, poses a material risk to the economy. But when viewed through the lens of market history and global asset flows, the evidence suggests that such shutdowns are often absorbed by the markets and, in several ways, may present tactical opportunities for globally diversified investors.

1. What a U.S. Government Shutdown Is & Why It Matters

A government shutdown in the United States happens when appropriations lapse and agencies furlough non-essential staff or curtail operations.

For example:

*

The 2018-19 shutdown lasted 35 days and the Congressional Budget Office (CBO) estimated it cost at least US$11 billion in GDP, including about US$3 billion of permanent loss.

*

The 2025 shutdown (October 1 - November almost equal to 12) is the longest in U.S. history (about 43 days), and involved roughly 900,000 furloughed federal workers.

From an economic standpoint, although disruption occurs, the size of the U.S. economy means the direct hit tends to be moderate compared to global GDP. That helps explain why financial markets often treat shutdowns as temporary political noise rather than structural crises.

2. U.S. Stock Markets: Historical Patterns

2.1 Performance During Shutdowns

*

According to Invesco [https://www.invesco.com/us/en/insights/us-government-shutdown-market-impact.html], there have been 22 funding gaps since 1976 and in more than half of the prior 21 cases the S&P 500 posted positive returns during the closing.

*

Morgan Stanley finds that "the S&P 500 has gained an average of 4.4% during shutdowns and remained in positive territory during the last five events."

*

For the 2025 shutdown, the S&P 500 added about 0.6% during the first 40 days of the shutdown.

These data points show that, despite the headline risk, U.S. equities often remain stable or even advance during shutdown periods, suggesting an inherent market resilience to government funding interruptions.

2.2 Performance After Shutdowns

*

Invesco reports that the average 12-month S&P 500 return after past shutdowns is +16.95%.

*

Other commentary (for example, from Edward Jones) concurs: stocks were positive more often than not three and six months after shutdowns.

While markets don't assume shutdowns cause growth booms, they show a pattern: when the funding dispute resolves, sentiment improves, spending resumes, data flows get unblocked, and markets often benefit.

3. Global Markets, Currencies & Commodities: The Wider Spillover

3.1 International Equity Effects

Although much of the research [https://luskin.ucla.edu/tilly-on-global-impact-of-u-s-economic-data-interruption] focuses on U.S. equities, global markets also often react interestingly. For example, economists note that foreign investors monitor U.S. policy risks and sometimes use them as entry points when U.S. risk premiums fade.

3.2 Currencies & Commodities

Shutdowns can affect global asset flows via currencies and commodities:

*

During U.S. shutdowns, the dollar may soften because of delayed data and higher uncertainty, which can benefit commodity exporters and emerging-market assets.

*

The 2025 shutdown saw safe-haven assets like gold hit records and the U.S. dollar weaken.

3.3 Sentiment & Relief Rallies

The market often anticipates resolution of the shutdown and responds positively when funding negotiations gain traction. For instance, on November 10, 2025, global equities rallied [https://www.reuters.com/business/possible-us-shutdown-end-brings-investor-relief-fresh-data-focus-2025-11-10/] amid news of a near-deal to end the shutdown.

For global investors, these dynamics mean the shock is localized, the U.S. remains functioning, and when resolution arrives, global risk assets often participate in the rebound.

4. Why a Shutdown Can Be Viewed Constructively (with the Right Lens)

4.1 Known Risk with Contained Impact

Because shutdowns recur and their typical economic cost is moderate, markets often treat them like known calendar risks rather than black-swans. For example, Lord Abbett writes that "in general, the economic impact of shutdowns has been small; in most cases, stock prices rose after the shutdown ended."

4.2 Data and Policy Delays Create Depth for Markets

Shutdowns may delay key data and central-bank decisions (as seen in 2025), which can increase volatility temporarily but also offer opportunities for tactically repositioning.

4.3 Currency Tailwinds & Global Risk Appetite

A softer dollar and revived risk appetite post-shutdown often shift flows toward commodities, emerging markets, and non-U.S. equities. For globally diversified portfolios, this can provide an advantage.

4.4 Relief Rally & Re-engagement

Once a shutdown ends, pent-up spending resumes, back-payments are made, and data flows restart. That often leads to a re-acceleration in growth or sentiment, and markets tend to participate. The 2025 example again showed this in real time.

5. Important Caveats & Boundaries

*

It's critical to remember that these are historical patterns: no guarantee they will hold in the future.

*

The positive framing is conditional: the benefit arises after resolution, not during the escalation phase. A very long or systemic shutdown (especially combined with debt ceiling risk) could still be damaging.

*

Economic damage still occurs: for example the 2018-19 shutdown's GDP cost.

*

Global spillovers vary significantly: some emerging markets may suffer more than others depending on trade and financial linkages.

*

Active timing matters: capturing post-shutdown rebound may require repositioning, staying passive may simply register the normal incremental gains of broader global markets.

6. Key Takeaways for Global Investors

*

View a U.S. government shutdown as headline risk, not necessarily a market-derailing event.

*

Historically, U.S. equities have been resilient during shutdowns and often rewarded investors in the 12 months after.

*

Global portfolios can benefit from flows that shift away from dollar-strength and into global risk assets when the U.S. resolves its funding impasse.

*

Maintain diversified exposure, monitor the speed of resolution, and consider tactical tilts toward non-U.S. equities and commodities when the U.S. reopening storyline emerges.

*

Remember, the real opportunities often come after the shutdown ends.

Conclusion

A U.S. government shutdown is disruptive, and real economic costs exist, but history shows that markets look through these interruptions. For global investors armed with the right lens, the post-shutdown phase can offer a favourable environment: lower policy risk, resumed spending, and re-energised flows into risk assets. With facts and data as our guide, the remaining task is disciplined positioning, not panic.

About Enhanced Investment Management Limited

Enhanced Investment Management Limited is a collective of professionals dedicated to fostering the financial success of its clients. The company's mission is to create dedicated, bespoke, and personalized financial strategies for each client, taking into account a comprehensive assessment of their goals, aspirations, and concerns.

To learn more, visit https://enhancedinvestments.com/

Media Contact

Company Name: Enhanced Investment Management Limited

Contact Person: Yin Chen

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=exploring-the-impact-of-us-government-shutdown-on-the-global-markets-an-exclusive-report-by-enhanced-investment-management-limited]

Country: HongKong

Website: http://www.enhancedinvestments.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exploring the Impact of U.S. Government Shutdown on the Global Markets - An Exclusive Report by Enhanced Investment Management Limited here

News-ID: 4283180 • Views: …

More Releases from ABNewswire

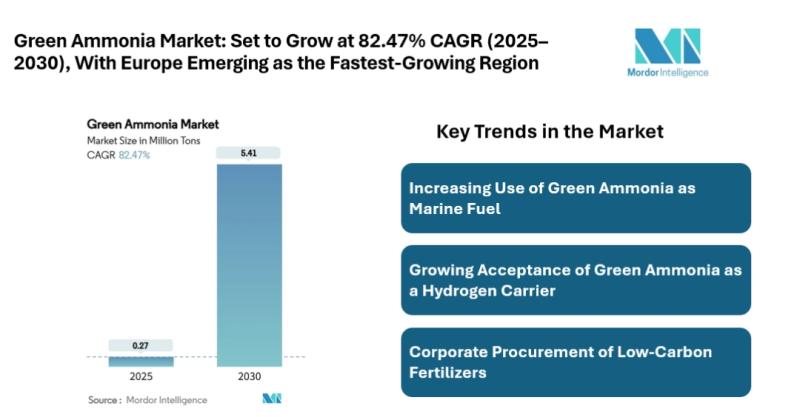

Green Ammonia Market size growing at CAGR of 82.47% by 2030 | Rising Fertilizer …

The latest research by Mordor Intelligence covers the "Green Ammonia Market," delivering insights into market dynamics, drivers of growth, and long-term forecasts.

Green Ammonia Market Overview:

The global green ammonia market is expanding steadily as countries accelerate the shift toward low-carbon fertilizer, marine fuel, power generation, and hydrogen transport solutions. The green ammonia market [https://www.mordorintelligence.com/industry-reports/green-ammonia-market?utm_source=abnewswire] size is expected to grow from 0.27 million tons in 2025 to 5.41 million tons by 2030,…

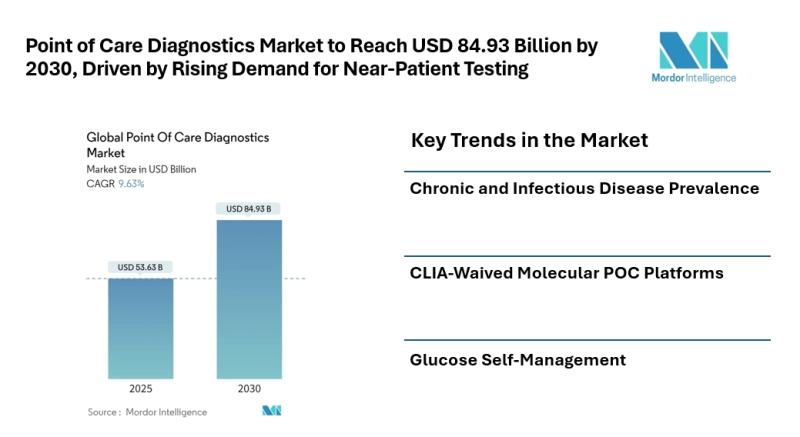

Point of Care Diagnostics Market to Reach USD 84.93 Billion by 2030, Driven by R …

Mordor Intelligence has published a new report on Point Of Care Diagnostics Market offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

The Point Of Care Diagnostics Market [https://www.mordorintelligence.com/industry-reports/point-of-care-diagnostics?utm_source=abnewswire] size is estimated at USD 53.63 billion in 2025, and is expected to reach USD 84.93 billion by 2030, at a CAGR of 9.63% during the forecast period (2025-2030). The market's growth is fueled by the increasing need for rapid,…

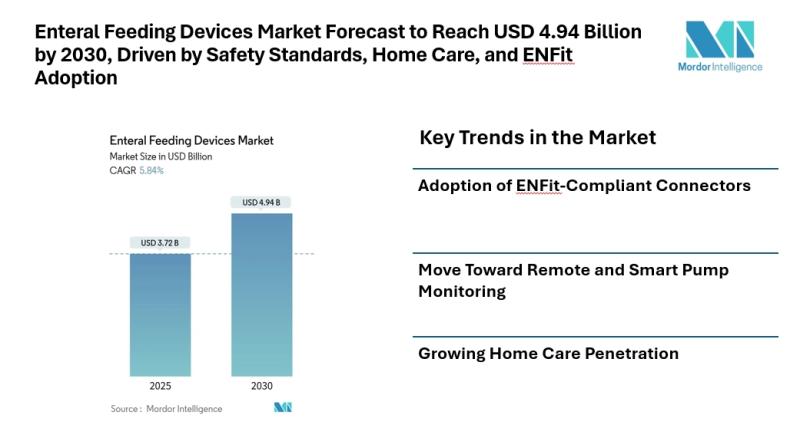

Enteral Feeding Devices Market Forecast to Reach USD 4.94 Billion by 2030, Drive …

Mordor Intelligence has published a new report on enteral feeding devices market offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

The enteral feeding devices market [https://www.mordorintelligence.com/industry-reports/enteral-feeding-devices-market?utm_source=abnewswire] is projected to grow from approximately USD 3.72 billion in 2025 to USD 4.94 billion by 2030, according to a recent report by Mordor Intelligence. The growth reflects a compound annual growth rate (CAGR) of around 5.84 percent, driven primarily by technological…

Still in My Heart Delivers a Soul-Baring Testament to Love's Unyielding Grip

Cassie Porter's debut poetry collection opens a window into the ache, beauty, and complexity of lost love.

In "Still in My Heart," Cassie Porter offers readers more than just poetry, she offers a reckoning. This intimate collection is a raw, emotionally honest exploration of what it means to carry love through absence, to speak when silence feels safer, and to grieve something that still lingers in the heart.

Told through verses that…

More Releases for Shutdown

Workplace Accidents Driving Growth In Emergency Shutdown System Market: Transfor …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Emergency Shutdown System Industry Market Size Be by 2025?

The market size for emergency shutdown systems has seen a considerable increase in recent times. The projection for this market's growth is from $2.01 billion in 2024 to $2.18 billion in 2025, indicating a Compound Annual Growth…

Remote Vehicle Shutdown Market Size & Share Analysis

Remote Vehicle Shutdown Market Size And Forecast by 2028

Remote vehicle shutdown market is expected to grow at a CAGR of 7.4% in the forecast period of 2021 to 2028. Data Bridge Market Research report on remote vehicle shutdown provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market's growth.

The global Remote Vehicle Shutdown Market study presents a…

Workplace Accidents Driving Growth In Emergency Shutdown System Market Driver: L …

"What Are the Projected Growth and Market Size Trends for the Emergency Shutdown System Market?

The emergency shutdown system market has experienced strong growth in recent years. It is expected to expand from $2.01 billion in 2024 to $2.2 billion in 2025, with a compound annual growth rate (CAGR) of 9.2%. The growth can be attributed to industry standards, rising industrial accidents, globalization, insurance requirements, and increased public awareness and pressure.

The…

New app helps prevent government shutdown of businesses

29 June 2020, Johannesburg – With South Africa officially registering the highest number of COVID-19 cases on the continent, businesses and establishments are at increased risk of forced shutdowns and further financial losses.

South Africa now officially stands at 138,134 cases and 2,456 deaths, placing the South African government under increased pressure to implement additional drastic measures to curb the spread of the disease. But the severe economic impact of…

Global Remote Vehicle Shutdown Market

The significant rise in the theft of vehicles and cargos has triggered for the need of automated systems that help in securing the vehicle or the cargo. Even after being equipped with security systems such as complex electronics and alarm systems; the transportation industry is still witnessing huge losses due to theft of vehicle and cargo and thus is vulnerable. Remote immobilization proves to be a viable…

Remote Vehicle Shutdown Market Global Snapshot by 2024

The significant rise in the theft of vehicles and cargos has triggered for the need of automated systems that help in securing the vehicle or the cargo. Even after being equipped with security systems such as complex electronics and alarm systems; the transportation industry is still witnessing huge losses due to theft of vehicle and cargo and thus is vulnerable. Remote immobilization proves to be a viable…