Press release

Cyber Security as a Service Market - Key Players, Capability Assessment & M&A Indicators

As cyber threats escalate across industries, the cyber security as a service market has evolved into a critical foundation for protecting digital infrastructure. With enterprises accelerating cloud adoption, remote work models, and API-driven ecosystems, the security landscape has become more complex and decentralized. Modern organizations now require continuous monitoring, zero-trust frameworks, and AI-powered threat detection capabilities that react in real time.The Cyber Security as a Service market is rapidly gaining traction as businesses shift from traditional on-premise security to flexible, scalable, and intelligence-driven managed security models. This article examines the top companies shaping the competitive landscape, key strategic developments, and major investment themes driving this high-growth segment.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4538

Top Companies & Their Strategies

The cyber security as a service market is led by global cybersecurity vendors, cloud-native innovators, MSSPs, and AI-driven threat intelligence providers. The following companies are strengthening their market positioning through product innovation, global reach, and deep specialization.

1. Cisco Systems, Inc. - Cisco leverages its extensive security portfolio-covering network security, cloud protection, endpoint defense, and threat analytics-to deliver integrated CSaaS offerings. Its strategy focuses on zero-trust adoption, unified security management, and AI-backed detection across enterprise environments. Cisco's major strengths include its broad partner network, hardware-software integration, and strong presence across regulated industries.

2. Palo Alto Networks - Palo Alto Networks dominates the market with its Prisma Cloud, Cortex XDR, and advanced threat intelligence platforms. Its strategy emphasizes autonomous response, secure access solutions, and deep integration within hybrid cloud ecosystems. The company's strength lies in its sophisticated AI engine, expanding cloud capabilities, and leadership in next-gen firewall technologies.

3. CrowdStrike Holdings, Inc. - CrowdStrike has built strong momentum with its cloud-native Falcon platform, offering endpoint protection, identity defense, and breach prediction services. Its strategy centers around modular, subscription-based security services and rapid threat response through its global intelligence grid. CrowdStrike's advantages include high detection accuracy, lightweight architecture, and rapid adoption across mid-sized enterprises.

4. IBM Corporation - IBM delivers robust CSaaS solutions through its Security Services division and AI-driven QRadar platform. Its strategy highlights secure cloud migration, incident response services, and automation-driven security operations. IBM's strength stems from its deep managed security expertise, strong research footprint, and integration across enterprise-scale IT environments.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-4538

5. Fortinet, Inc. - Fortinet offers cost-effective and scalable security-as-a-service solutions through its FortiGuard and FortiSASE platforms. The company emphasizes network convergence, AI-enhanced threat prevention, and cloud-delivered security frameworks. Fortinet's key strengths include high-performance hardware, strong value proposition, and wide adoption among SMBs and large enterprises.

6. Check Point Software Technologies Ltd. - Check Point is known for its unified security architecture, secure cloud gateways, and threat intelligence services. Its strategy focuses on reducing operational complexity and providing end-to-end cloud security. The company's strengths include a strong Middle East and European customer base, low-latency security infrastructure, and consistent innovation in threat prevention.

7. Zscaler, Inc. - Zscaler is a pioneer of cloud-native security, offering zero-trust network access (ZTNA), secure web gateways, and identity-driven authentication. Its strategy centers on edge security, SASE integration, and digital experience monitoring. Zscaler's strengths include strong cloud presence, robust global edge infrastructure, and adoption among organizations shifting to hybrid work models.

8. Rapid7, Inc. - Rapid7 focuses on vulnerability management, cloud security, and incident detection through its Insight Platform. Its strategy highlights automation-led SOC modernization and risk-based security prioritization. Rapid7's strengths include analyst-friendly tools, cost-effective deployment, and strong traction among mid-market customers.

➤ View our Cyber Security as a Service Market Report Overview here: https://www.researchnester.com/reports/cyber-security-as-a-service-market/4538

SWOT Analysis

Strengths - Leading companies in the cyber security as a service market benefit from AI-driven threat detection, global threat intelligence networks, and integrated platform ecosystems. Their strong cloud partnerships across AWS, Azure, and Google Cloud ensure scalable and flexible service delivery. Many of these firms also possess deep security research capabilities and large customer bases across BFSI, telecom, healthcare, and government sectors. Their innovation in zero-trust, SASE, and automated incident response provides significant competitive leverage.

Weaknesses - Despite strong growth, many CSaaS providers face challenges related to talent shortages in cloud security, data forensics, and advanced threat analytics. High dependency on subscription-based pricing exposes them to revenue fluctuations during economic slowdowns. Integration complexity across multi-cloud and hybrid infrastructures can slow deployment timelines and increase operational costs. Some companies also struggle with differentiating their offerings in an increasingly crowded and commoditized security services landscape.

Opportunities - Significant opportunities exist in identity security, OT/ICS protection, API security, and secure cloud workload management. Emerging economies in Asia-Pacific, the Middle East, and Latin America are investing heavily in digital infrastructure, creating new demand for security-as-a-service. The rise of IoT ecosystems, 5G networks, and SaaS-native applications offers major revenue potential for providers specializing in risk analytics and autonomous cyber defense. Companies offering managed detection and response (MDR), SASE, and continuous compliance services are positioned for accelerated adoption.

Threats - The market faces escalating threats from cybercriminal sophistication, AI-enabled attacks, and evolving regulatory frameworks across data privacy and cybersecurity standards. Competition from open-source security tools and low-cost regional MSSPs continues to pressure commercial service providers. Rapid technological change means that companies must constantly innovate to remain relevant. Additionally, geopolitical tensions, cyber warfare risks, and nation-state attacks pose increased challenges for global service delivery and threat intelligence accuracy.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-4538

Investment Opportunities & Trends

1. AI, Automation & Zero-Trust Architecture Investments

Investors are increasingly prioritizing companies with strong AI capabilities, autonomous detection systems, and zero-trust security frameworks. Solutions focusing on identity protection, behavioral analytics, and automated incident response are attracting enterprise spending. AI-driven SOC platforms and cloud-native security services continue to gain strategic attention from private equity firms and cybersecurity-focused investors.

2. M&A Activity and Strategic Collaborations

Mergers and acquisitions remain a defining feature of the cyber security as a service market. Large vendors such as Palo Alto Networks, Cisco, and IBM have acquired niche startups specializing in cloud workload protection, API security, and threat analytics. Collaborations between hyperscale cloud providers and cybersecurity vendors have accelerated the development of integrated security frameworks. Security orchestration and automation (SOAR) companies are also increasingly being acquired to strengthen managed security portfolios.

3. Regional Expansion & New Delivery Centers

North America maintains strong dominance due to advanced cloud adoption, enterprise digitization, and high security spending. Europe continues to expand, driven by stringent data privacy laws and increasing cyber resilience mandates. Asia-Pacific is witnessing rapid growth as enterprises in India, Singapore, Japan, and Australia shift toward managed cloud security services. The Middle East is becoming an emerging investment hotspot due to smart city projects and national cybersecurity policies.

4. Technology Integration Across SASE, Cloud & DevSecOps

Convergence of secure access service edge (SASE), cloud access security brokers (CASB), and DevSecOps tools is emerging as a major investment theme. Cybersecurity vendors integrating with CI/CD pipelines, edge networks, and multi-cloud platforms are seeing stronger enterprise adoption. Security offerings with automated patching, identity privilege controls, and container security are gaining strategic investor interest.

Notable Market Developments in the Last 12 Months

• Multiple cybersecurity vendors launched AI-powered autonomous detection and response tools.

• Cisco, CrowdStrike, and Zscaler expanded cloud security collaborations with hyperscalers.

• Several cyber intelligence startups secured multi-million-dollar funding in identity security, API protection, and cloud-native threat analytics.

• New government mandates in Europe, the Middle East, and Asia-Pacific strengthened data privacy and cybersecurity compliance.

• Zero-trust architectures and SASE deployments accelerated across multinational enterprises.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4538

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Security as a Service Market - Key Players, Capability Assessment & M&A Indicators here

News-ID: 4300842 • Views: …

More Releases from Research Nester Pvt Ltd

Pharmacy Market size to cross $3.4 Trillion by 2035 | Pfizer Inc., Novartis AG, …

Market Outlook and Forecast

The pharmacy market is undergoing a transformative shift as global healthcare systems expand, chronic disease prevalence rises, and digital health ecosystems mature. In 2025, the market size stands at USD 1.7 trillion, supported by strong demand for prescription medicines, over-the-counter (OTC) therapies, and advanced pharmacy services. Driven by technology adoption, increasing patient awareness, and evolving care delivery models, the market is projected to reach USD 3.4 trillion…

Next Generation Memory Market Players - Competitive Positioning, Strategic Stren …

The next generation memory market is entering a pivotal stage as computing architectures evolve, energy-efficient data processing becomes critical, and AI-driven workloads push the boundaries of traditional storage systems. Emerging memory technologies-such as MRAM, ReRAM, PCM, FRAM, and 3D XPoint alternatives-are reshaping how devices store and access data. With rising adoption across consumer electronics, automotive electronics, cloud infrastructure, and industrial automation, next-generation memory is becoming an essential enabler of performance-oriented…

Biobanking Market size to reach $60.37 Billion by 2035 | Key players include The …

Market Outlook and Forecast

Biobanking Market is experiencing strong expansion as organizations deepen their focus on translational research, genomic sequencing, biomarker discovery, and stem cell applications.

In 2025, the market size stands at USD 26.7 billion, reflecting robust demand for structured biospecimen repositories and enhanced sample preservation solutions. This growth is supported by rising prevalence of chronic diseases, expanded genomic research funding, and adoption of biobanking technologies by pharmaceutical and biotechnology industries.

By…

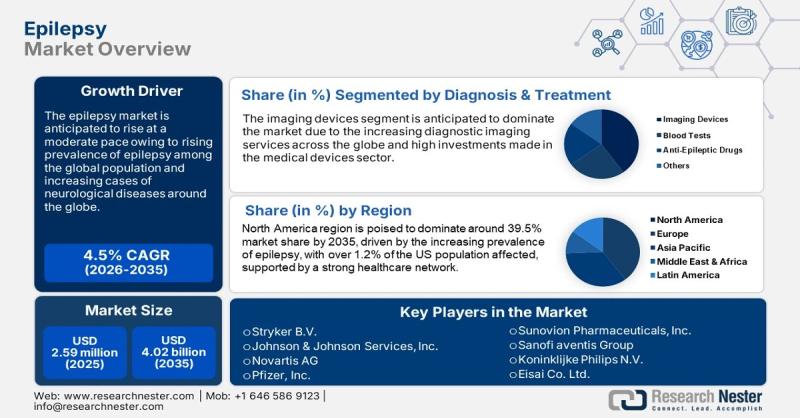

Epilepsy Market size to cross $4.02 Billion by 2035 | Stryker B.V., Johnson & Jo …

Market Outlook and Forecast

The epilepsy market continues to evolve as healthcare systems worldwide prioritize early diagnosis, precision treatment, and improved patient outcomes for neurological disorders. Epilepsy, one of the most prevalent chronic neurological conditions, demands sustained investment in imaging capabilities, therapeutic innovation, and hospital infrastructure. The global market is projected to grow from USD 2.59 billion in 2025 to USD 4.02 billion by 2035, reflecting steady adoption of advanced diagnostic…

More Releases for Security

Aerospace Cyber Security Market : Network security, Wireless security, Cloud sec …

According to a new report published by Allied Market Research, titled, "Aerospace Cyber Security Market," The aerospace cyber security market was valued at $39.7 billion in 2021, and is estimated to reach $92.0 billion by 2031, growing at a CAGR of 9.0% from 2022 to 2031.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 : https://www.alliedmarketresearch.com/request-sample/9433

Aerospace cybersecurity is a security driven technology which is dedicated towards the safety & security of aircrafts, spacecrafts and drones…

Healthcare Cyber Security Market by Type (Service and Solution), Security (Appli …

Healthcare Cyber Security Market: 2023

The global Healthcare Cyber Security Market size was valued at USD 4,591 Million in 2016, and is projected to reach at USD 12,467 Million by 2023, with a CAGR of 15.6% from 2017 to 2023.

Covid-19 latest section covered in this report.

Get Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-1J168/Healthcare_Cyber_Security

Cyber security solutions and services enable healthcare organizations to protect their business-critical infrastructure and patient data, and meet regulatory compliance.

Increase…

Aerospace Cyber Security Market Analysis and Forecasts by Security Type (Network …

The aviation industry is one of the sophisticated industries across the globe and the industry is integrated with advanced technological solutions. This has created a major concern towards securing the enormous quantity of data being generated every day. With the advancements in the different technological fields, the cyber attackers are also finding newer process to gain desired insights. In the current market scenario, aerospace industry is also witnessing substantial upswing…

Security Assessment Market Report 2018: Segmentation by Security Type (Endpoint …

Global Security Assessment market research report provides company profile for Kaspersky (Russia), IBM (US), FireEye (US), Optiv Security (US), Qualys (US), Trustwave (US), Veracode (US), Check Point (Israel), Absolute Software (Canada), Rapid7 (US), CynergisTek (US) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth…

The Mobile Security (mSecurity) Bible: 2014 - 2020 - Device Security, Infrastruc …

Mobile networks around the globe generate more than 86 Exabytes of traffic annually. The immense volume of traffic together with the growing adoption of open source Operating System (OS) platforms such as Android has opened up new security threats. Mobile malware, SMS spam, cyber attacks and unlawful eavesdropping are an ever-increasing problem for enterprises, consumers and mobile network operators around the globe.

This has in turn led to significant investments in…

Mobile Security (MSecurity) Market Analysis To 2020 - Device Security, Infrastru …

Mobile networks around the globe generate more than 86 Exabytes of traffic annually. The immense volume of traffic together with the growing adoption of open source Operating System (OS) platforms such as Android has opened up new security threats. Mobile malware, SMS spam, cyber attacks and unlawful eavesdropping are an ever-increasing problem for enterprises, consumers and mobile network operators around the globe.

This has in turn led to significant investments in…