Press release

Smart Coating - M&A Strategies will continue to be the Game Changer in Paints and Coatings Industry | 2024

The merger and acquisition activities will continue to be at the center of paint and coatings industry despite being a seller’s market. The overall market for paint and coating is reaching and maturity stage, which is currently driving the M&A activities. Many industry experts recognize a seller’s market in the coatings industry where both private equity and strategic buyers are aggressively pursuing targets and boosting up valuation, especially for premium firms. A majority of the leading players are primarily functioning in the developed markets with significant underlying growth. The mechanism is limited for these companies to achieve growth and meet the rising expectations of their investors. Therefore, acquisition is one way to fulfill their requirements.Companies are making smart decisions by implementing strategic M&A, which also helps they achieve substantial synergies through acquisitions. It also helps is reduction of raw material cost, as companies can cut down on operational expenses and gain greater control over pricing. Most the companies highlight on the savings through synergies while announcing new acquisition or merger news, making it an important consideration in the transaction.

View TOC for Research Report @ https://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=11186

Over the past couple of years, M&A activities have been robust and substantial, with majority of deals qualifying moderate and bolt-on acquisitions that are were easily integrated and quickly yielded ample synergies. Also, some of the deals typically highlight the inclusion of new capabilities- new technologies, expanded operations and addition of innovative products.

Reportedly, firms that are based in U.S. show greater interest in purchasing companies primarily functioning in the non-U.S. markets. This statistic indicate towards high level of consolidation in some verticals of the paint and coatings industry such as industrial and architectural coatings. At the same time, some of the companies are focusing on establishing stronger foothold in the emerging markets that are expected to exhibit significant growth opportunities. In the near future, the M&A activities are expected to witness a slight increase from the current level, which is already at a high level.

For more information on this report, fill the form @ https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=11186

The rising valuation in the industry that is currently being experienced can be a massive incentive for stakeholder who have been anticipating the sale of their business to reach full maturity before putting up their companies on the market. A recent study conducted by Transparency Market Research (TMR), finds that there has been a greater demand for smart coatings, owing to exponential growth of the electronic industry.

In addition, this coating segment is expected to present lucrative growth opportunities in the near future and may very well be a good option for making investment in. Increasing sales of the smart phones and handheld devices is likely to boost the application smart coatings that possess self-cleaning and self-healing capabilities.

About Us:-

Transparency Market Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers.

We are privileged with highly experienced team of Analysts, Researchers and Consultants, who use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Contact Us:-

Transparency Market Research

90 State Street, Suite 700, Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smart Coating - M&A Strategies will continue to be the Game Changer in Paints and Coatings Industry | 2024 here

News-ID: 722870 • Views: …

More Releases from Transparency Market Research

Global Spiritual and Wellness Products Market to Reach US$ 9.6 Billion by 2034, …

The global spiritual and wellness products market is witnessing unprecedented growth as consumers around the world increasingly prioritize mental, emotional, physical, and spiritual well-being. According to the latest industry analysis, the market, valued at US$ 4.2 billion in 2023, is projected to expand at a CAGR of 8.0% from 2024 to 2034, ultimately reaching US$ 9.6 billion by 2034. This surge underscores a dramatic shift toward wellness-focused lifestyles and scientific…

Global Outdoor Furniture Market to Reach USD 36.8 Billion by 2034, Driven by Ris …

The global Outdoor Furniture Market is poised for substantial expansion, projected to grow from US$ 19.5 billion in 2023 to US$ 36.8 billion by 2034, registering a CAGR of 6.0% during the forecast period. According to the latest industry assessment, rising consumer inclination toward outdoor living, rapid urbanization, and strong recovery in the hospitality and tourism industry continue to boost demand for stylish, weather-resistant, and durable outdoor furnishings.

As consumers increasingly…

Online Home Decor Market Set to Reach US$ 375.86 Billion by 2034, Driven by Digi …

The global online home decor market is undergoing a transformative shift, fueled by rapid urbanization, lifestyle enhancement trends, and the widespread adoption of digital commerce. As consumers increasingly prioritize aesthetics, functionality, and personalized living spaces, the online home decor industry is emerging as one of the fastest-growing segments in the global e-commerce landscape. According to the latest industry insights, the market, valued at US$ 188.27 billion in 2023, is projected…

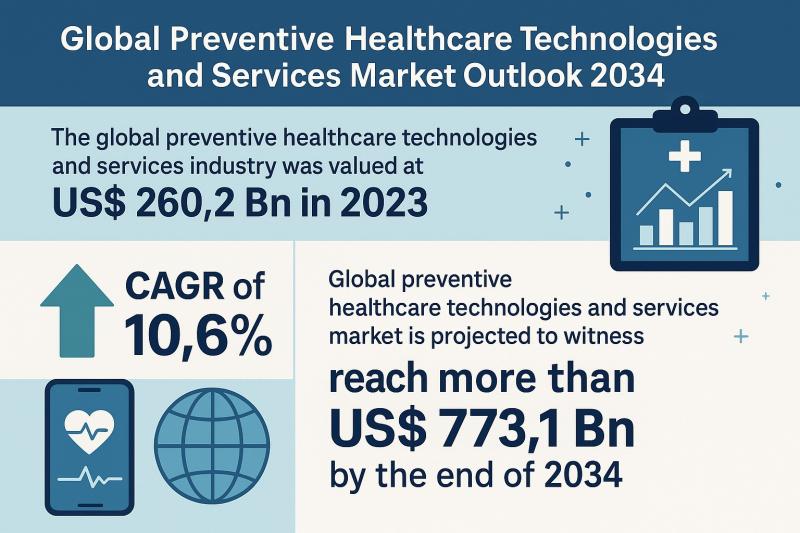

Global Preventive Healthcare Technologies and Services Market Outlook 2034: Indu …

The global preventive healthcare technologies and services market has entered a transformative era, shaped by the increasing shift from curative to preventive care, rapid technological advancements, and growing consumer awareness. Valued at US$ 260.2 billion in 2023, the industry is forecast to expand at an impressive CAGR of 10.6% from 2024 to 2034, ultimately exceeding US$ 773.1 billion by 2034. This robust expansion is driven by innovations in early disease…

More Releases for M&A

industrials m&a,m&a project management,corporate finance mergers and acquisition …

Mergers and acquisitions (M&A) in the industrial sector refer to the process of one company acquiring another company or assets in the manufacturing, construction, and engineering industries. The industrial sector is characterized by a diverse range of businesses, including heavy machinery, aerospace, and defense, chemicals, and engineering services.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The industrial sector is characterized by a high level of consolidation, with companies looking to acquire other companies to gain access…

m&a company,m&a integration,cross border merger,m&a due diligence,m&a strategy,m …

Mergers and acquisitions (M&A) are a common way for companies to grow and diversify their business operations. The process of merging or acquiring another company can be complex and time-consuming, but when executed successfully, it can bring significant benefits to the acquiring company, such as access to new markets, technologies, and customers.

https://upworkservice.com

China M&A advisory

E-mail:nolan@pandacuads.com

When it comes to successful M&A, the key is to ensure that the two companies are a…

private equity m&a,international mergers and acquisitions,technology m&a,m&a pro …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. One type of buyer that is becoming increasingly prevalent in the M&A landscape is private equity firms.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

Private equity firms are investment firms that raise capital from institutional investors and high net…

buy side m&a,global m&a,bank mergers and acquisitions,m&a advisory firms,success …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. The term "buy side" refers to the party that is acquiring the target company. In contrast, the "sell side" refers to the party that is being acquired.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The buy side M&A process…

due diligence in mergers and acquisitions,recent m&a deals 2023,m&a management,m …

Due diligence is an investigation process that companies undertake prior to a merger or acquisition (M&A) in order to assess the target company's financial and operational condition. The goal of due diligence is to identify any potential risks or opportunities that may impact the value of the acquisition and to ensure that the deal is in the best interest of the acquiring company. Due diligence is a critical step in…

m&a valuation,corporate mergers,m&a business,merger integration,sell side m&a pr …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. One crucial aspect of the M&A process is the valuation of the target company. Valuation is the process of determining the fair value of a company, and it is an essential step in the M&A process because it helps companies to determine the terms of the acquisition, such…