Press release

Treasury And Risk Management Application Market Research Report and Outlook by Future Market Insights( 2017-2027)

Historically, treasury’s participation with risk management has been concentrated on finding and evading such financial exposures as interest rates and foreign exchange. The treasurer’s prime accountabilities were to create policies for financial risk management, perform related practices and track and report the results of the program.Treasury & risk management applications are series of software solutions being offered by the vendors focused towards analyzing and optimizing business processes in the finance area of an organization. The treasury and risk management application solution aids its clients with their respective treasury operations by using solution with robust front, middle and back-office ERP.

Request For Report Sample@ https://www.futuremarketinsights.com/reports/sample/rep-gb-3156

Treasury & risk management applications are gaining traction due to digitization and growing internet penetration in emerging regions.

Treasury & Risk Management Application Market: Drivers and Challenges

Advancement in IT infrastructure, penetration of smart devices in emerging regions and increasing awareness of updated technology among the population are factors that impact positively to the global treasury & risk management application market.

However, security breach, threat from hackers are a few challenges that affect the growth of global treasury & risk management application market.

Treasury & Risk Management Application Market: Segmentation

Treasury & risk management application market can be segmented on the basis of deployment type, industry size, industry application and region.

On the basis of deployment type, treasury & risk management application market can be segmented into on-premise and cloud-based deployments.

On the basis of industry size, treasury & risk management application market can be segmented into small and medium enterprises (SMEs) and large enterprises.

On the basis of industry application, treasury & risk management application market can be segmented into banking, financial services and insurance (BFSI), IT and telecommunication, energy and utility, government offices and education, healthcare, retail, hospitality and others.

Treasury & Risk Management Application Market: Regional Overview

Regionally, treasury & risk management application market can be segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, and Middle East and Africa.

North America is expected to hold the major market share during the forecast period owing to the technological advancements, high internet penetration including most users of smartphone or tablet devices. Asia Pacific treasury & risk management application market is expected to experience highest growth in revenue in the forecast period due to the investors and ley vendors focusing on countries in this region. Europe and Japan treasury & risk management application markets would also contribute considerably to the global revenue.

Visit For TOC@ https://www.futuremarketinsights.com/toc/rep-gb-3156

Treasury & Risk Management Application Market: Competition Landscape

Few prominent players in the treasury & risk management application market include:SAP AG,The Sage Group plc, Oracle Corporation, OpenLink Financial Inc., Kyriba Corporation, FIS Global, Misys, ION Trading, Wolters Kluwer, EdgeVerve Limited

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Treasury And Risk Management Application Market Research Report and Outlook by Future Market Insights( 2017-2027) here

News-ID: 723594 • Views: …

More Releases from Future Market Insights

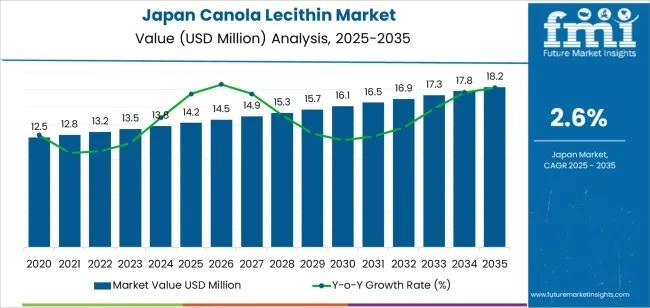

Japan Canola Lecithin Market to Reach USD 18.2 Million by 2035 Driven by Food, P …

Japan's canola lecithin market is entering a phase of steady expansion, supported by rising consumer demand for natural, clean-label emulsifiers and the growing use of plant-based ingredients across food, pharmaceutical, and cosmetics applications. Market projections show demand increasing from USD 14.2 million in 2025 to USD 18.2 million by 2035, driven by a shift toward healthier formulations and sustained growth in processed food and nutraceutical categories.

Canola lecithin continues to gain…

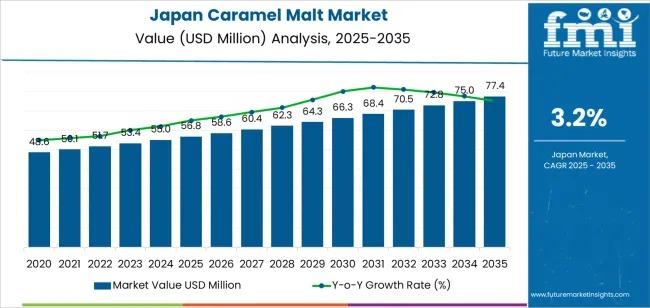

Japan Caramel Malt Market to Reach USD 77.4 Million by 2035 Driven by Craft Brew …

Japan's caramel malt demand is experiencing consistent growth as breweries-both large-scale producers and craft operations-continue to rely on caramel malt for sweetness, foam stability, and refined roasted notes essential to Japan's evolving beer landscape. The market is valued at USD 56.8 million in 2025 and is projected to reach USD 77.4 million by 2035, driven by expanding flavor diversification and the prominence of malt-balanced beer styles across the country.

Light-colour caramel…

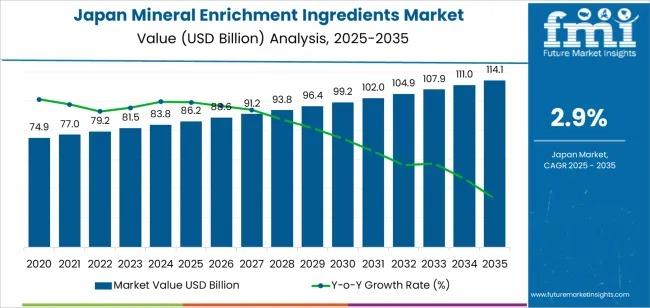

Japan Mineral Enrichment Ingredients Market to Reach USD 114.1 Billion by 2035 D …

The demand for mineral enrichment ingredients in Japan is set to rise from USD 86.2 billion in 2025 to USD 114.1 billion by 2035, expanding at a consistent CAGR of 2.9%. This growth reflects Japan's long-standing emphasis on nutrition enhancement, healthy aging, and expanded use of fortified ingredients across food, beverage, and supplement categories. With consumers seeking functional, nutrient-dense foods, ingredients such as calcium, iron, magnesium, zinc, and trace minerals…

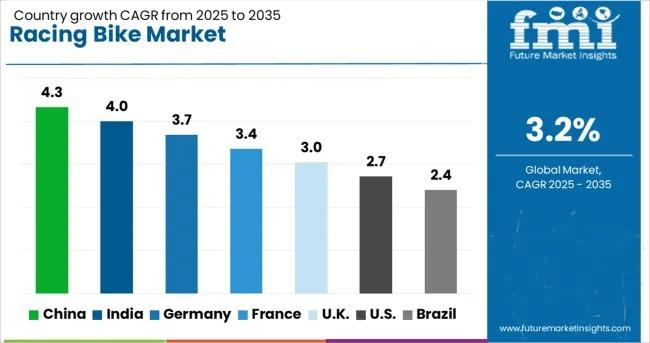

Global Racing Bike Market to Reach USD 9.9 Billion by 2035, Driven by Performanc …

The global Racing Bike Market is entering a phase of steady, technology-led expansion, underpinned by rising participation in competitive cycling, increasing professional sponsorships, and accelerating innovation in lightweight bicycle engineering. The market is valued at USD 7.2 billion in 2025 and is forecast to reach USD 9.9 billion by 2035, expanding at a compound annual growth rate (CAGR) of 3.2% over the ten-year period.

Market fundamentals remain strong as manufacturers align…

More Releases for Treasury

Corporate and Treasury bond Market 2025: Top Key Players: U.S. Treasury, U. S. C …

The report "Global Corporate and treasury bond Market" intends to provide innovative market intelligence and help decision makers take comprehensive investment evaluation. Also identifies and analyses the emerging trends along with major drivers, challenges, opportunities and entry strategies for various companies in the global Corporate and treasury bond Industry.

Corporate and treasury bond market research report provides the newest industry data and industry future trends, allowing you to identify the products…

Treasury Software Market 2019-2027 / CRM Treasury Systems, DataLog Finance And F …

The report covers the forecast and analysis of the treasury software market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the Nordic treasury software market along with the impact they have on the demand over the forecast period. Additionally, the report includes the…

Corporate and treasury bond Market Future Demand Analysis and Business Opportuni …

Corporate and treasury bond is where debt securities are issued and traded. The bond market primarily includes government-issued securities and corporate debt securities, and it facilitates the transfer of capital from savers to the issuers or organizations that requires capital for government projects, business expansions and ongoing operations. The bond market is alternatively referred to as the debt, credit or fixed-income market. Although the bond market appears complex, it is…

Global Corporate and Treasury Bond Market, Top key players are U.S.Treasury,,S.C …

Global Corporate and Treasury Bond Market Size, Trends, Applications, Status, Analysis and Forecast Reports 2019 to 2026

Corporate and Treasury Bond market size by players, regions, product types and end industries, history 2014-2018 and forecast data 2019-2026. This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter’s Five Forces Analysis.

The main goal for the dissemination of…

Corporate and Treasury Bond Market Analysis by Top Key Players U.S.Treasury, U. …

When companies want to expand operations or fund new business ventures, they often turn to the corporate bond market to borrow money. A company determines how much it would like to borrow and then issues a bond offering in that amount; investors that buy a bond are effectively lending money to the company according to the terms established in the bond offering or prospectus.

Get Sample Copy of this Report @…

Corporate and Treasury Bond Market is Booming Worldwide | U.S. Treasury, U. S. C …

HTF MI recently introduced Global Corporate and treasury bond Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are U.S. Treasury, U. S. Corporate and treasury bonding Company,…