Press release

Digital Banking Market Report Expands Growth Strategies, Investment Feasibility and Opportunities 2017-2022

Digital Banking Market, by Services (Non Transactional Activities, Transactional), By Deployment Type (On- Premises, On Cloud), by Technology (Internet Banking, Digital Payments, Mobile Banking), By Industries (Media & Entertainment, Manufacturing, Retail, Banking, Healthcare) - Forecast 2016-2022Digital Banking Market – Overview

Digital banking is a concept which enables the banks and their customers to carry out banking activities seamlessly such as - the end-to-end processing of banking transactions, operation etc. Technology proliferation in various parts of banking system and arrival of smartphone is helping the bankers to move their traditional banking system to modern. Easy availability, maximum utility and low cost are some of the important factor for the high adoption of digital banking in current environment. The global Digital Banking market is expected to grow at CAGR of around 8% during the years 2016 to 2022.

The Global Digital Banking Market is majorly driven by factors such as easy access, convenience, fast and efficient operation among others. High technology proliferation and support heavy investment by the companies operating in the technology service are helping in the development of efficient cashless system. Many banks around the world are adopting cashless policies for various areas such as payments, transfers among other things. Increasing use of internet and smartphones to do the banking transaction are result of digital banking which makes the task easy and more transparent.

Digital Banking Market Players

Urban FT, Inc. (U.S.),

Misys (U.K.),

Kony, Inc. (U.S.),

Backbase (Netherlands),

Technisys (Subsidiary of FMC Technologies) (U.S),

Infosys (India),

Cachet Financial Solutions, Inc. (U.S),

Innofis (Spain),

Mobilearth (Canada)

Request a Sample Report @ https://www.marketresearchfuture.com/sample_request/1986

Other prominent players operating in this market are- Nymbus, NLS Banking, IDEALINVENT Technologies, Capital Banking Solutions and among others.

Digital Banking Global Market Synopsis & Scenario

Banks are constantly adapting new applications to cater to the needs of their customers by providing services like ATM, internet banking, mobile banking, SMS banking among others. This study identifies some dynamic trends that contribute the market growth & the factors that challenge the market growth; such as - the high usage of digital devices in management, growing market of smartphones and tablets, growing demand for security and growing cloud-based solution are some major key trends in the market of digital banking. Whereas factors such as – existing digital immigrants (someone who has not grown up using technology like Internet & mobile phones) among the population and lack of internet infrastructure in various countries are some of the major restrains which is expected to slow the growth of market.

Digital Banking Market Regional Analysis

North America is dominating the market of digital banking. High density of smartphone users and technologically advanced countries such as U.S. and Canada gives North America a competitive advantage over the other regions.

Browse Report @ https://www.marketresearchfuture.com/reports/digital-banking-market-1986

Europe stands as second biggest revenue generator in this market. Rich financial sector of U.K., France and Germany among other countries are the major contributor in the growth of digital banking in Europe region. Also, high literacy rate and knowledge towards internet and mobile application are some of the factor which is supporting the market of digital banking in Europe.

Asia-Pacific has emerged as fastest growing market due to the growing economy of India, China among other countries, and green earth initiatives. Also, the government of these countries is also helping the market by adopting new policies regarding digital economy.

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

Contact

Akash Anand,

Market Research Future

+1 646 845 9312

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Report Expands Growth Strategies, Investment Feasibility and Opportunities 2017-2022 here

News-ID: 790758 • Views: …

More Releases from Market Research Future

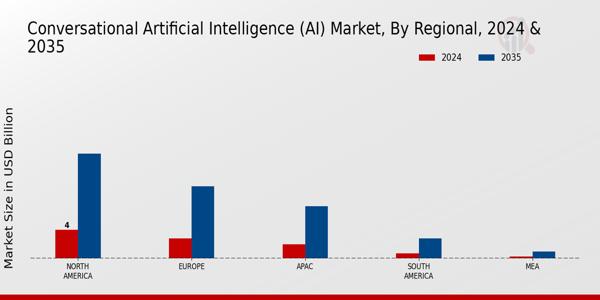

Conversational Artificial Intelligence Market to Reach USD 35.0 Billion by 2035, …

Conversational Artificial Intelligence Market Overview:

The Conversational Artificial Intelligence (AI) Market is witnessing remarkable expansion as enterprises increasingly deploy AI-driven communication technologies to enhance customer engagement and operational efficiency. According to Market Research Future (MRFR), the global Conversational AI Market is projected to grow from USD 9.81 Billion in 2024 to USD 35.0 Billion by 2035, demonstrating a strong growth trajectory across industries.

Conversational AI solutions-powered by Natural Language Processing (NLP), machine…

Glue Machine Market to Reach USD 14.9 Billion by 2035, Growing at 4.56% CAGR

The Glue Machine Market is witnessing significant growth due to the increasing adoption of adhesive technologies across various industries, including packaging, woodworking, automotive, furniture, and construction. Valued at USD 9.15 billion in 2024, the market is projected to reach USD 14.9 billion by 2035, registering a CAGR of 4.56% between 2025 and 2035.

Glue machines, also known as adhesive application machines, are critical for efficiently dispensing adhesives in industrial and commercial…

Expansion Valves Market to Reach USD 5.39 Billion by 2035, Growing at 4.62% CAGR

The expansion valves market is witnessing steady growth due to increasing demand for efficient heating, ventilation, air conditioning, and refrigeration (HVACR) systems across residential, commercial, and industrial sectors. Valued at USD 3.28 billion in 2024, the market is projected to reach USD 5.39 billion by 2035, growing at a CAGR of 4.62% between 2025 and 2035.

Expansion valves, also known as thermostatic expansion valves (TXVs) or electronic expansion valves (EEVs), are…

Cheese Packaging Market to Reach USD 101.31 Billion by 2034, Growing at 3.50% CA …

The Cheese Packaging Market is poised for steady growth over the next decade due to rising demand for dairy products, evolving consumer preferences, and increasing focus on food safety and sustainability. According to recent estimates, the market was valued at USD 71.87 billion in 2024 and is projected to reach USD 101.31 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.50% between 2025 and 2034.

Cheese packaging…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…