Press release

Banking Cybersecurity Market: Pin-Point Analysis For Changing Competitive Dynamics

Banking cybersecurity market is rapidly growing and is expected to witness a significant growth during the forecast period. With the increase penetration of technology, banking customers are expecting more digitalization and modernization in their financial services. Therefore, many organizations such as IBM Corporation, Intel Security and others are manufacturing cybersecurity systems for banks as they are focused on their customer’s requirements.In addition, rising digitization and connectivity has triggered a rise in incidents of information breaches, compelling banks to support their security systems. Therefore, the banking sector is adopting web and mobile applications in their systems in order to prevent cyber attack. This factor is triggering market growth of banking cybersecurity globally.

Browse report details https://www.transparencymarketresearch.com/banking-cybersecurity-market.html

Moreover, this new cyber security technology helps in increased digitization and connectivity and more security in financial institutions. Owing to this factor, the market is growing significantly and is expecting a stable growth during the forecast period. Furthermore, organizations are rapidly installing cyber security solutions either on cloud or on-premises.

The demand for cloud based cyber security solutions is increasing owing to time-efficient and cost-effective features of cloud; its growth is specifically rapid in organization, where affordable solutions are essential. However, in rural areas banks are facing challenges to meet customer requirement in terms of technology and culture.

Get brochure for latest technological advancements https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=25154

Therefore, this factor is acting as a restraint of this market. Moreover, many financial institutions are focusing on this new technology to cater customer requirements, so that the impact of this restraint is medium and is expected to be low during the forecast period.The market of banking cybersecurity is segmented into four categories: deployment, solution, service and security type. By deployment the market of banking cybersecurity be divided into cloud and on-premises.

By solution the market is segmented by risk and compliance management, identity and access management, data loss prevention, encryption, unified threat management, security and vulnerability management, firewall, antivirus/antimalware, intrusion detection and prevention systems, web filtering, distributed denial or service mitigation and others.

Get Table of Content for detail analysis https://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=25154

In terms of service, the market of banking cybersecurity be divided into managed service and professional service. Professional services can be further segmented by training and education, consulting, support and maintenance, design and integration, risk and threat assessment. By security type the market of banking cybersecurity is segmented into cloud security, wireless security, application security, network security and endpoint security among others.

By geography the global subscriber data management market is segmented into North America, Europe, Asia Pacific, Middle East and Africa and Latin America. The North American held the largest market share in banking cybersecurity market in 2016 and is expected to hold its position during the forecast period. Owing to its developed economic of U.S. and Canada, there is a high focus on innovations in technology and research and development is fueling the growth of this market.

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. We have an experienced team of Analysts, Researchers, and Consultants, who us e proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR Syndicated Research report covers a different sector – such as pharmaceuticals, chemical, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, our syndicated reports thrive to provide clients to serve their overall research requirement.

Contact

Transparency Market Research

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Cybersecurity Market: Pin-Point Analysis For Changing Competitive Dynamics here

News-ID: 974149 • Views: …

More Releases from Transparency Market Research

Global Monochloroacetic Acid Market Set to Reach USD 1.8 Bn by 2035, Driven by S …

The global Monochloroacetic Acid (MCA) Market is entering a new phase of growth, marked by expanding industrial applications, rising agricultural needs, and notable advancements in pharmaceutical formulations. Valued at US$ 1.1 Bn in 2024, the MCA market continues to gain momentum due to its critical role as an intermediate chemical in the manufacture of herbicides, drugs, and carboxymethyl cellulose (CMC). According to recent industry projections, the market is expected to…

Global Two-Wheeler Navigation Display Market Set to Reach USD 3.5 Bn by 2035, Ex …

The global Two-Wheeler Navigation Display Market is entering a new phase of accelerated growth driven by rapid digitalization, rising motorcycle adoption, and strong demand for advanced rider-assist technologies. According to new industry analysis, the market-valued at US$ 563.3 Mn in 2024-is projected to reach US$ 3.5 Bn by 2035, registering an impressive CAGR of 16.95% during the forecast period (2025-2035).

As two-wheelers continue to dominate mobility across Asia, Europe, and emerging…

Transparent Ceramics Market to Hit USD 8.5 Bn by 2035, Driven by 21.3% CAGR Grow …

The global transparent ceramics market is entering a period of unprecedented expansion, fueled by rising demand in aerospace, defense, consumer electronics, optics, and medical imaging. Valued at US$ 1020.0 Mn in 2024, the market is projected to climb to US$ 8.5 Bn by 2035, registering an exceptional CAGR of 21.3% between 2025 and 2035. Transparent ceramics-recognized for their remarkable optical clarity, mechanical strength, and resistance to extreme temperatures-are emerging as…

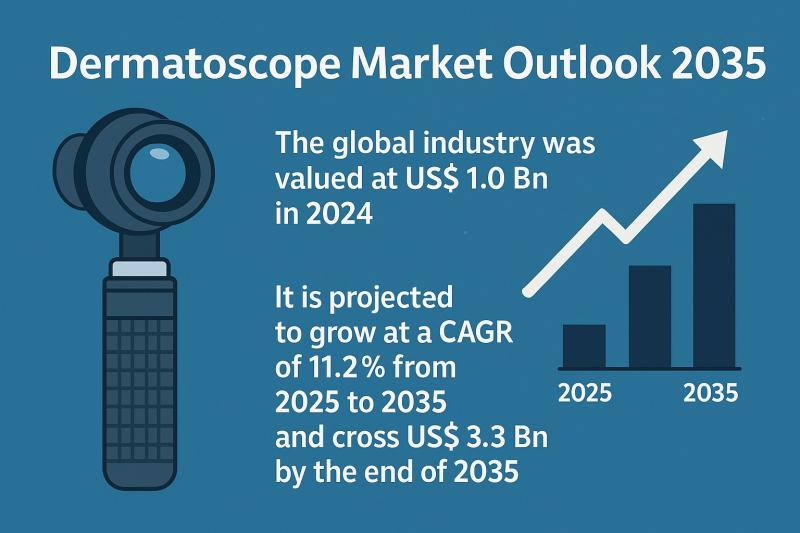

Dermatoscope Market Outlook 2035: Global Revenues to Surge from USD 1.0 Billion …

The global Dermatoscope Market is entering a period of accelerated expansion, supported by a growing global emphasis on preventive dermatology, rising skin cancer incidence, and the widespread adoption of advanced imaging technologies. Valued at US$ 1.0 Bn in 2024, the market is projected to grow at a strong CAGR of 11.2% from 2025 to 2035, eventually crossing US$ 3.3 Bn by the end of 2035. This rapid growth reflects increasing…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…