Press release

Navigate Debt with Confidence in Canada: Start with a Consultation

Debt can be a daunting aspect of financial life for many Canadians. Whether it's student loans, credit card debt, mortgages, or personal loans, the burden of debt can feel overwhelming and suffocating. However, the journey towards financial freedom begins with understanding and managing debt effectively. In Canada, there are numerous resources and strategies available to help individuals navigate their debt with confidence. One crucial step in this process is seeking professional guidance through a consultation.Why Consultation Matters

*

Assessment of Financial Situation: A Debt Relief Consultation [https://www.bromwichandsmith.com/debt-relief-consultation] with a financial advisor or debt counselor provides an opportunity to assess your current financial situation comprehensively. They can analyze your income, expenses, assets, and liabilities to gain a clear understanding of your financial health.

*

Customized Solutions: Every individual's financial circumstances are unique, and there is no one-size-fits-all solution to debt management. A consultation allows for the development of customized strategies tailored to your specific needs and goals.

*

Education and Empowerment: Consulting with a financial expert empowers you with knowledge about debt management strategies, budgeting techniques, and financial planning. This education equips you with the tools and confidence to make informed decisions about your finances.

*

Exploration of Options: Debt consultation opens up a discussion about the various options available for managing debt, such as debt consolidation, negotiation with creditors, or debt settlement programs. Exploring these options helps you choose the most suitable path towards debt relief.

*

Long-Term Financial Planning: Beyond immediate debt concerns, a consultation facilitates discussions about long-term financial planning, including savings, investments, retirement planning, and building a strong financial foundation for the future.

Understanding Canadian Debt Landscape

*

Types of Debt: Canadians commonly carry various types of debt, including mortgage debt, consumer debt (credit cards, personal loans), student loans, and car loans. Each type of debt comes with its own terms, interest rates, and repayment schedules.

*

Debt Statistics: According to Statistics Canada, household debt-to-income ratio in Canada reached a record high in recent years, indicating the significant burden of debt on Canadian households. Understanding these statistics underscores the importance of effective debt management strategies.

*

Regulatory Environment: Canada has regulations and consumer protection measures in place to govern lending practices and debt collection. Understanding these regulations can help individuals navigate their rights and responsibilities when dealing with debt-related issues.

*

Interest Rates and Economic Factors: Interest rates set by the Bank of Canada and economic factors such as inflation and unemployment can impact borrowing costs and debt repayment. Staying informed about these factors is crucial for making sound financial decisions.

Benefits of Debt Consultation in Canada

*

Professional Guidance: Debt consultation in Canada offers access to professional financial expertise, including certified financial planners, credit counselors, and debt management professionals. These experts can provide personalized advice and guidance based on your unique financial circumstances.

*

Debt Consolidation Options: Debt consolidation is a common strategy recommended during debt consultations. This involves combining multiple debts into a single loan with lower interest rates, making it easier to manage payments and reduce overall debt burden.

*

Credit Counseling Services: Many non-profit credit counseling agencies in Canada offer free or low-cost counseling services to help individuals develop effective debt repayment plans, improve budgeting skills, and avoid future financial pitfalls.

*

Debt Settlement Programs: For individuals struggling with high levels of unsecured debt, debt settlement programs may offer a viable solution. These programs negotiate with creditors to settle debts for less than the full amount owed, providing a path to debt relief.

*

Legal Protections: Debt consultation ensures that individuals are aware of their legal rights and protections under Canadian consumer protection laws, including regulations governing debt collection practices and bankruptcy proceedings.

*

Financial Education and Empowerment: Beyond immediate debt relief, debt consultation fosters financial literacy and empowerment by equipping individuals with the knowledge and skills to manage their finances effectively and make informed financial decisions in the future.

Conclusion

Navigating debt with confidence in Canada starts with a consultation. By seeking professional guidance, individuals can assess their financial situation, explore debt management options, and develop personalized strategies for achieving debt relief and long-term financial stability. Whether through debt consolidation, credit counseling, or debt settlement programs, consulting with financial experts empowers individuals to take control of their finances and build a brighter financial future. Take the first step towards financial freedom today by scheduling a consultation and embarking on your journey towards debt-free living.

Media Contact

Company Name: Bromwich & Smith

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=navigate-debt-with-confidence-in-canada-start-with-a-consultation]

Country: Canada

Website: https://www.bromwichandsmith.com/debt-relief-consultation

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Navigate Debt with Confidence in Canada: Start with a Consultation here

News-ID: 3508935 • Views: …

More Releases from ABNewswire

Exploring the Impact of U.S. Government Shutdown on the Global Markets - An Excl …

Image: https://www.abnewswire.com/upload/2025/11/6ab92174e3dc0ee6c1bfafc8e655cfb4.jpg

A shutdown of the U.S. federal government, when Congress fails to pass spending legislation and many agencies cease non-essential operations, poses a material risk to the economy. But when viewed through the lens of market history and global asset flows, the evidence suggests that such shutdowns are often absorbed by the markets and, in several ways, may present tactical opportunities for globally diversified investors.

1. What a U.S. Government Shutdown…

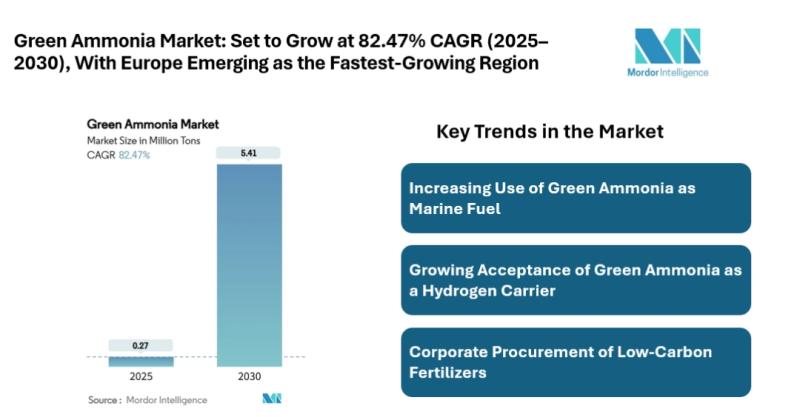

Green Ammonia Market size growing at CAGR of 82.47% by 2030 | Rising Fertilizer …

The latest research by Mordor Intelligence covers the "Green Ammonia Market," delivering insights into market dynamics, drivers of growth, and long-term forecasts.

Green Ammonia Market Overview:

The global green ammonia market is expanding steadily as countries accelerate the shift toward low-carbon fertilizer, marine fuel, power generation, and hydrogen transport solutions. The green ammonia market [https://www.mordorintelligence.com/industry-reports/green-ammonia-market?utm_source=abnewswire] size is expected to grow from 0.27 million tons in 2025 to 5.41 million tons by 2030,…

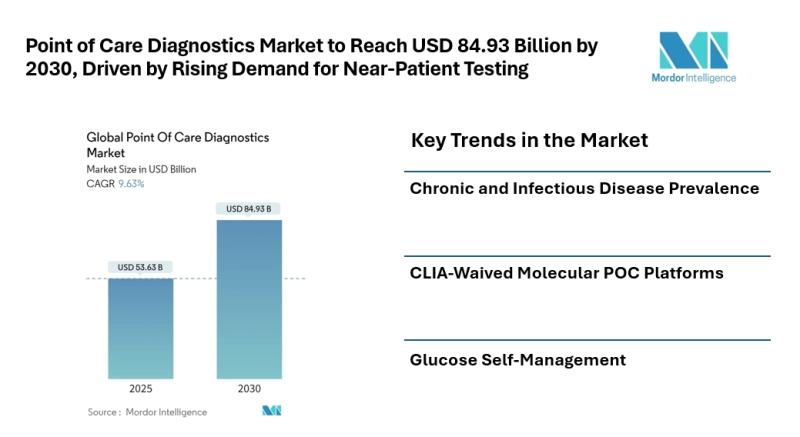

Point of Care Diagnostics Market to Reach USD 84.93 Billion by 2030, Driven by R …

Mordor Intelligence has published a new report on Point Of Care Diagnostics Market offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

The Point Of Care Diagnostics Market [https://www.mordorintelligence.com/industry-reports/point-of-care-diagnostics?utm_source=abnewswire] size is estimated at USD 53.63 billion in 2025, and is expected to reach USD 84.93 billion by 2030, at a CAGR of 9.63% during the forecast period (2025-2030). The market's growth is fueled by the increasing need for rapid,…

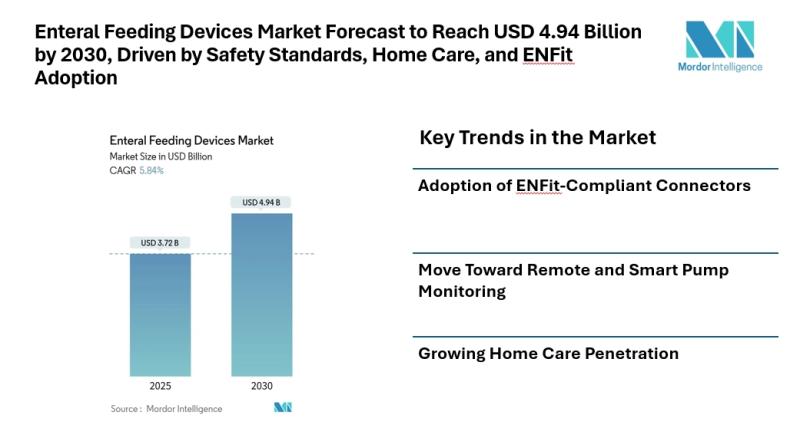

Enteral Feeding Devices Market Forecast to Reach USD 4.94 Billion by 2030, Drive …

Mordor Intelligence has published a new report on enteral feeding devices market offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

The enteral feeding devices market [https://www.mordorintelligence.com/industry-reports/enteral-feeding-devices-market?utm_source=abnewswire] is projected to grow from approximately USD 3.72 billion in 2025 to USD 4.94 billion by 2030, according to a recent report by Mordor Intelligence. The growth reflects a compound annual growth rate (CAGR) of around 5.84 percent, driven primarily by technological…

More Releases for Debt

Debt Settlement Solution Market Impressive Growth 2021-2028 | National Debt Reli …

The Insight Partners announces the research on Global Debt Settlement Solution Market [Report Page Link as it covers the key boundaries Required for your Research Need. This Global Debt Settlement Solution Market Report covers worldwide, local, and nation level market size, pieces of the overall industry, ongoing pattern, the effect of covid19 on worldwide

Market Research Report Investigations Research Methodology review comprises of Secondary Research, Primary Research, Company Share Analysis,…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market Emerging Growth Analysis, Demand and Business Opportuniti …

Debt settlement is the process of negotiating with creditors to reduce overall debts in exchange for a lump sum payment. A successful settlement occurs when the creditor agrees to forgive a percentage of total account balance. Normally, only unsecured debts not secured by real assets like homes or autos can be settled. Debt Settlement Market report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in…

Debt Settlement Market 2019 By Freedom Debt Relief National Debt Relief Rescue O …

This report studies the Debt Settlement market. Debt settlement is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.

Request a Sample of this Report @ https://www.orbisresearch.com/contacts/request-sample/2575396 …

Debt Settlement Market 2018-National Debt Relief, Freedom Debt Relief, New Era D …

The report on Debt Settlement, documents a detailed study of different aspects of the ‘Debt Settlement’ market. It shows the steady growth in market in spite of the fluctuations and changing market trends. In the past four years the ‘Debt Settlement’ market has grown to a booming value of $xxx million and is expected to grow more.

Request a Sample of this Report@ http://www.orbisresearch.com/contacts/request-sample/2335800

Every market intelligence report is based on certain…

Debt Settlement Market 2018 | Global Demand, Top Companies Analysis- National De …

Global Debt Settlement Market Research Report 2018 is a professional and in-depth study on the current state of the global Debt Settlement industry with a focus on the regional market, analysis of industry share, growth factors, development trends, size, majors manufacturers and 2025 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Debt Settlement report introduces market revenue, product & services, latest developments and…