Press release

Exploring Latest Wheat Price Trend Q1, 2025: Prices Analysis, Historical and Forecast Data

North America Wheat Prices Movement Q1 2025:Wheat Prices in the United States:

US wheat prices climbed to 290 USD/MT in March 2025, representing a 17.8% increase since December 2024. This sharp rise stemmed primarily from escalating trade tensions after the implementation of the American Trade Protection Act, which imposed 12-18% tariffs on agricultural inputs from Canada, Mexico, and China.

These countries responded with retaliatory measures targeting US wheat exports, effectively reducing foreign market access by approximately 22%. Simultaneously, farmers faced rising production costs as fertilizer and equipment prices increased 8.3% following import restrictions. The situation was exacerbated by the 15% reduction in agricultural subsidies under the 2024 Federal Budget Reconciliation Act, leaving wheat producers with diminished financial buffers against these market pressures.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/wheat-pricing-report/requestsample

Note: This analysis can be adjusted to align with the customer's individual preferences

North America Wheat Prices Movement Q1 2025:

Wheat Prices in Canada:

Canadian wheat prices reached 340 USD/MT in March 2025, reflecting significant market volatility throughout Q1. This price point represented a 13.3% increase from January levels, primarily driven by trade disruptions following the United States' implementation of 25% tariffs on Canadian agricultural imports under the revised North American Trade Agreement.

While these tariffs initially destabilized established trade patterns and created uncertainty in regional markets, Canada's position as a premier global supplier of high-protein wheat provided crucial price support. Demand remained robust from alternative markets, particularly from Asian and European buyers seeking Canada's premium-quality wheat for specialty flour production. Agriculture Canada reported export volumes to non-US destinations increased by 18% year-over-year, effectively offsetting much of the reduced American market access while maintaining price strength despite the broader market turbulence.

Note: This analysis can be adjusted to align with the customer's individual preferences

Europe Wheat Prices Movement Q1 2025:

Wheat Prices in Germany:

Germany wheat prices reached 245 USD/MT in March 2025, representing a 7.9% increase from January levels. This price movement was primarily driven by adverse weather conditions across key growing regions, with precipitation levels exceeding historical averages by 32% during the critical winter dormancy period.

Agricultural monitoring reports from the German Farmers' Association indicated that approximately 18% of the winter wheat acreage experienced waterlogging issues, raising significant concerns about potential yield reductions and deteriorating quality parameters, particularly protein content and falling number values. Concurrently, financial market participation in European wheat futures increased by 24% quarter-over-quarter, with speculative long positions reaching their highest levels since 2023, further amplifying price volatility throughout the German market.

Regional Analysis: The price analysis can be expanded to include detailed Soda Ash price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Europe Wheat Prices Movement Q1 2025:

Wheat Prices in United Kingdom:

UK wheat prices reached 330 USD/MT in March 2025, a 9.3% increase since the beginning of Q1 despite decreased domestic consumption. This price movement occurred as bioethanol production facilities reduced wheat usage by 14.2% following the implementation of the UK's Revised Renewable Transport Fuel Obligation. Agricultural market reports indicated that flour millers maintained consistent demand, but overall domestic consumption decreased by 6.8% compared to the previous quarter.

Despite this consumption decline, ending stocks remained remarkably stable at approximately 1.85 million tonnes, as the Department for Environment, Food and Rural Affairs adjusted import forecasts downward by 12% while simultaneously increasing export projections by 8.7% to key European markets, effectively balancing the supply-demand equation.

Regional Analysis: The price analysis can be expanded to include detailed wheat price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

South America Wheat Prices Movement Q1 2025:

Wheat Prices in Brazil:

Brazilian wheat prices reached 250 USD/MT in March 2025, reflecting a 6.4% increase since January. These national average masked significant regional variations, with southern states experiencing notably stronger price appreciation. Paraná and Rio Grande do Sul, which together account for 78% of Brazil's domestic wheat production, saw prices climb to 267 USD/MT and 264 USD/MT respectively.

This regional premium stemmed from localized supply constraints following February's excessive rainfall, which affected quality parameters in approximately 15% of the southern harvest. Additionally, enhanced demand from flour mills in these states, operating at 94% capacity utilization compared to the national average of 87%, created competitive procurement conditions that further supported price firmness despite more moderate market conditions in central Brazil.

Regional Analysis: The price analysis can be expanded to include detailed wheat price data for a wide range of South America countries:

Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries.

Purchase Options: https://www.imarcgroup.com/checkout?id=22699&method=1925

Biannual Updates: For 2 Deliverables, Billed Annually

Quarterly Updates: For 4 Deliverables, Billed Annually

Monthly Updates: For 12 Deliverables, Billed Annually

We Also Provide News and Historical Data of Wheat:

Historical Data: Comprehensive historical pricing and market trends.

Quarterly Analysis: Detailed insights into price fluctuations and market dynamics.

Regional and Global Data: Coverage of key markets and their performance.

Forecast Comparisons: Historical data paired with future market projections.

Customizable Reports: Tailored analysis to meet specific business needs.

What is the Prediction for Wheat Prices?

The wheat market presents a complex interplay of supply constraints and production dynamics as we approach mid-2025. Current prices hover around $5.52 per bushel, with forecasts suggesting variability in the coming months. While U.S. wheat stockpiles have declined significantly from 1.98 billion to 1.24 billion bushels, strong harvests in Australia and Argentina have moderated price escalation. Expert projections indicate a range between $5.00 and $6.00 per bushel through year-end, with the USDA maintaining a $5.55 forecast for the 2024/25 marketing year. More bullish analysts cite dwindling global stocks reaching decade-low levels as potential catalysts for price increases toward $6.00.

However, these projections remain contingent on several variables, including upcoming harvest yields, geopolitical tensions affecting Black Sea exports, and potential weather disruptions in key growing regions. For agricultural markets, this balanced supply-demand equation suggests price stability with moderate volatility, though unexpected climate events or trade policy shifts could rapidly alter this outlook.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=22699&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Wheat Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Wheat price trend, offering key insights into global Wheat market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Wheat demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exploring Latest Wheat Price Trend Q1, 2025: Prices Analysis, Historical and Forecast Data here

News-ID: 3980908 • Views: …

More Releases from IMARC Group

Lithium Hexafluorophosphate Production Cost Analysis 2025: Strategic Recommendat …

Lithium Hexafluorophosphate (LiPF6) is a crucial chemical compound widely used as an electrolyte salt in lithium-ion batteries. It provides high ionic conductivity, thermal stability, and enhances battery performance, making it essential for electric vehicles, consumer electronics, and energy storage systems. Its role in improving charge efficiency, safety, and battery lifespan makes LiPF6 a key component in the rapidly growing lithium-ion battery industry.

Establishing a LiPF6 plant involves sourcing high-purity lithium compounds,…

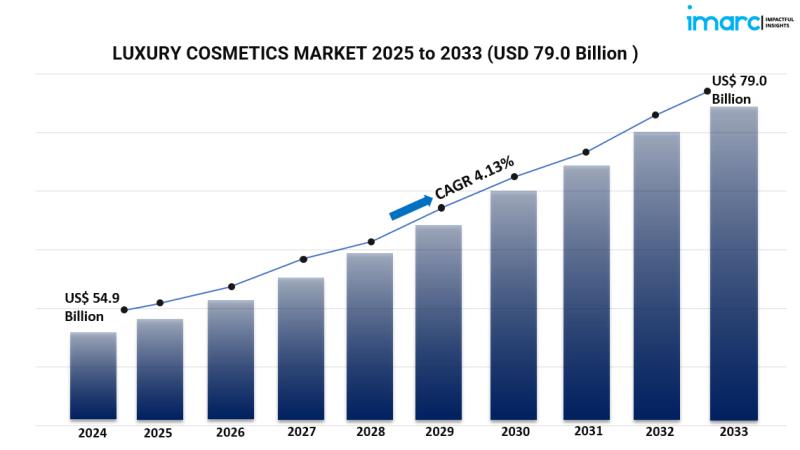

Global Luxury Cosmetics Market Set for Remarkable Growth with Rising Demand for …

The global luxury cosmetics market reached a valuation of USD 54.9 billion in 2024, reflecting strong momentum across beauty and skincare categories. Growth in this sector is driven by rising disposable incomes, particularly in emerging economies, and an increasing preference for premium beauty products that emphasize exclusivity and superior quality. Additionally, social media engagement and digital influence have reshaped consumer choices, motivating buyers to explore luxury cosmetic brands and high-end…

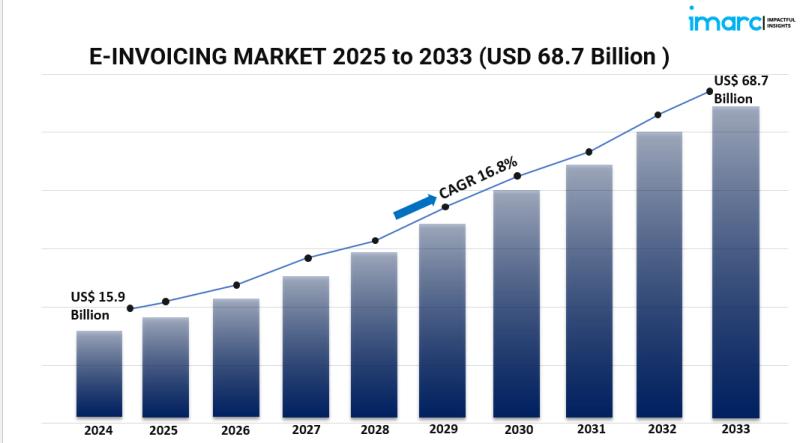

Global E-Invoicing Market Set for Robust Expansion Driven by Digital Transformat …

Market Overview

The global e-invoicing market was valued at USD 15.9 billion in 2024 and is projected to reach USD 68.7 billion by 2033, expanding at a CAGR of 16.8% during 2025-2033. This strong growth is driven by the rapid rise of e-commerce, acceleration of digital transformation across industries, advancements in cloud-based platforms, and increasing government regulations that promote financial transparency and sustainable practices. With automation and digital invoicing becoming standard…

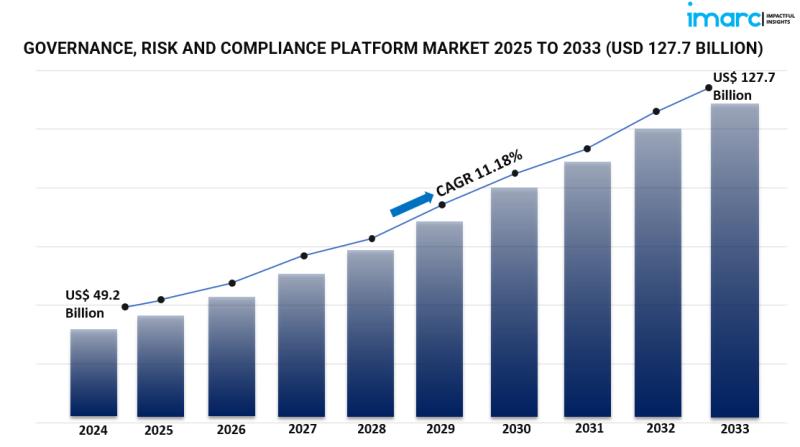

Global Governance, Risk and Compliance Platform Market Set for Robust Growth Dri …

Governance, Risk, and Compliance Platform Market Overview

The global governance, risk, and compliance platform market was valued at USD 49.2 billion in 2024 and is projected to surge to USD 127.7 billion by 2033, advancing at a CAGR of 11.18%. This robust growth is driven by rapid regulatory changes, rising cybersecurity risks, and the widespread adoption of hybrid and remote work models.

Organizations are increasingly adopting advanced GRC platforms powered by cloud…

More Releases for Price

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Dolomite Price Chart, Index, Price Trend and Forecast

North America Dolomite Prices Movement:

Dolomite Prices in United States:

In the last quarter, dolomite prices rose continuously in the United States, reaching 284 USD/MT in December. The increase was affected by constant demand from construction and steel sectors in association with high transport and energy costs. Additionally, logistic challenges and seasonal weather variations contributed to interruption in minor supply, leading to a strong pricing.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/dolomite-pricing-report/requestsample

Note: The analysis…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…