Press release

Automated Liquid Handling Robots Market to Reach CAGR 10,5% by 2031 Top 10 Company Globally

Automated liquid handling robots are precision instruments that automate piping, dispensing, mixing and sample-transfer tasks across life-science workflows; they combine mechanical platforms, precision liquidics, sensors, software controls and consumables to replace repetitive manual piping and to raise throughput, reproducibility and regulatory compliance in drug discovery, genomics, clinical diagnostics, and biomanufacturing. The industry spans standalone benchtop workstations, modular on-deck automation integrated into larger robotic labs, and consumables/reagents optimized for automated workflows; downstream demand comes from pharmaceutical R&D, contract research organizations (CROs), diagnostics laboratories, biotechnology firms, and academic research institutions.The 2024 global market of automated liquid handling robots is USD 2,296 million and a compounded annual growth rate of 10.5% through 2031 reaching USD 4,575 million in 2031 as its primary forecast basis. At that 2024 market size the typical packaged automation system sells at an industry-average list price around USD 95,000 per machine, implying global unit sales in the 24,168 units in 2024. Average factory cost of goods sold is estimated at roughly 75% of list price with typical COGS composition split across mechanical subsystems, electronics, software & firmware, final assembly and test, packaging and accessories. Using those price and COGS assumptions the factory gross profit per machine is USD 23,750 per unit with a factory-level gross margin just around 25%. Typical full-machine production capacity per single dedicated production line in a specialist automation factory is 1,200 units per line per year, while downstream industry demand is concentrated in pharmaceuticals/R&D ~40%, clinical diagnostics ~25%, biotechnology & CDMOs ~15%, academic & government research ~10% and CRO/others ~10%.

Latest Trends and Technological Developments

The dominant short-term trend across vendors is tighter integration of AI/data analytics, modular workflow-as-a-service architectures, and more compact/high-precision low-volume dispensers for single-cell and NGS applications. A major product launch illustrative of that trend is Tecans introduction of the Veya liquid-handling platform (announced January 2025), which bundles prebuilt AI-assisted workflows, digital monitoring, and modular scaling for labs of different sizes. Hamiltons Microlab Prep family expansion and its Prep CAP HEPA/UV variant (announced July 2024) underline demand for integrated clean-bench features in sample-prep automation. Collaborative product efforts have also accelerated: BD and Hamilton jointly announced automation-ready reagents and workflows to standardize sequencing sample prep (October 2024). More broadly, reports and market analyses through 2024 to 2025 highlight AI/ML integration, on-deck real-time analytics, and a rising share of revenue from consumables and reagents as key drivers. These product announcements and market commentaries point to an industry rapidly moving from hardware-first to hardware+software+consumables business models.

Asia is a structurally important growth engine for automated liquid handling. Investment in national genomics capacity, expansion of clinical diagnostics networks, and heavy R&D spending by large regional pharma and biotech groups are increasing machine adoption across China, Japan, South Korea, India and the broader Asia Pacific. Pricing sensitivity in many markets has driven vendor strategies that include localized production partnerships, modular lower-capex benchtop offerings, and bundled reagent contracts to lower total cost of ownership. In addition, major vendors have accelerated channel and service investments across Asia to shorten lead times and increase installed-base uptime; these service networks materially increase aftermarket recurring revenue from consumables and calibration services. Regional manufacturing hubs in China and Taiwan also help reduce per-unit landed cost for price-sensitive customers, supporting higher unit volumes even when average selling prices are constrained. Market reports and vendor Q1-Q2 disclosures in 20242025 show Asias share rising faster than the global average, led by clinical diagnostics and genomics use cases.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5075839

Automated Liquid Handling Robots by Type:

Single

8channels

12channels

24channels

Others

Automated Liquid Handling Robots by Application:

E Commerce

Offline

Global Top 10 Key Companies in the Automated Liquid Handling Robots Market

Tecan Group Ltd

Beckman Coulter,Inc.

Eppendorf SE

Echo Robotics

Hamilton Company

Hudson Robotics

PerkinElmer

Labman Automation

Isogen Lifescience

Automata

Regional Insights

Southeast Asia shows a heterogeneous, opportunity-rich profile. Singapore and Malaysia are adoption leaders due to advanced research infrastructure and regional CRO hubs; Indonesia, the Philippines and Vietnam exhibit growing demand driven by expanding hospital diagnostic labs, national genomics programs and an increase in local biomanufacturing projects. Indonesia specifically is moving toward expanded molecular testing capacity and local vaccine/biologic manufacturing initiatives that create multi-year demand for automation for sample prep and QC. However, adoption in parts of ASEAN is tempered by price sensitivity, limited local service chains, and slower replacement cycles in academic labs. Vendors that offer modular financing, on-site service agreements, localized consumables supply, and training programs are achieving faster penetration in ASEAN. Public tenders and regional initiatives in 20242025 show governmental investments in diagnostic infrastructure and research capacity that will act as demand pull for automated platforms in Indonesia and neighboring ASEAN countries.

Key industry challenges are cost and total-cost-of-ownership compression, supply-chain exposure for critical subcomponents (precision pumps, motors, optical sensors), regulatory and calibration requirements (e.g., new ISO guidance relating to volumetric performance), and workforce skill gaps for operating integrated workflows. Smaller labs and price-sensitive public health customers can delay purchases, leading to elongated selling cycles and pressure on margins. The second major challenge is software and data interoperability: customers increasingly expect open APIs and validated workflows that integrate with lab information management systems (LIMS), which raises development and certification costs for vendors. Finally, the shift toward selling consumables and reagents as recurring revenue creates dependency on supply continuity and tight quality control; any supply disruption can damage reputation and retrofit economics.

From a vendor perspective, differentiating on software-enabled workflows, consumables lock-in, and localized service is critical; strategic playbooks that combine a lower-entry-price benchtop offering with upsell paths to modular automation and reagent subscriptions capture more customer lifetime value. M&A and partnerships (acquisitions of robotics/software integrators and reagent companies) are logical accelerants to broaden capabilities quickly. From a buyer perspective, procurement should evaluate total cost of ownership (instrument price, consumables spend, service & calibration, and data-integration costs) and favor platforms with validated clinical or regulated workflows and strong local support. For investors, tiered exposure (hardware + recurring consumables + software services) reduces volatility and increases predictable revenue. Several vendors have been actively strengthening integration capabilities and partnerships in 20242025, consistent with this strategic direction.

Product Models

Automated liquid handling robots greatly accelerate and standardize workflows in biology, medicinal chemistry, diagnostics, and other fields by automating repetitive piping tasks. These systems may use different numbers of parallel channels (or tips) to suit varying throughput and flexibility needs.

Single channel robot is ideal for highly flexible, well-by-well operations. Notable products include:

Hudson SOLO (single-channel mode) Hudson Robotics: A compact automated pipettor configured in single-channel mode, offering precise aspiration/dispense and flexible integration on decks.

Seyonic PCNC-0061-00 Seyonic SA: An air-driven single-channel piping head (0.5 μL to 5 mL) with integrated flow sensor and liquid-level detection.

ASSIST PLUS + D-ONE single module INTEGRA: The ASSIST PLUS robot can mount a D-ONE single-channel module to automate flexible, sparse or custom well assignments.

EpMotion (single-channel config) Eppendorf: The EpMotion series supports single-channel piping as one mode among multichannel configurations.

BRAND Liquid Handling Station (single-channel liquid end) BRANDTECH Scientific: The system offers interchangeable liquid ends, including a single-channel option for precision small-volume tasks.

8-channel system balances throughput and flexibility. Examples include:

Hudson SOLO (8-channel head) Hudson Robotics: The SOLO supports an 8-channel pipette head for parallel row piping across plates.

FLO i8® PD Formulatrix: An 8 independent positive-displacement channel system with non-contact dispensing, useful for viscous liquids.

Pluto Workstation (8-channel liquid head) Curiox Biosystems: Pluto is offered with an 8-channel liquid handling head to streamline plate operations.

ASSIST PLUS + 8-channel VIAFLO INTEGRA: The ASSIST PLUS robot may be fitted with an 8-channel VIAFLO electronic pipette for simultaneous row transfers.

EpMotion 5075 (8-channel mode) Eppendorf: The EpMotion 5075 supports 8-channel piping as one of its piping options.

12-channel units often align with 12-column or 384-well formats. Notable products include:

Hudson SOLO (12-channel head) Hudson Robotics: The SOLO offers optional 12-channel heads for broader plate coverage.

ASSIST PLUS + 12-channel VIAFLO INTEGRA: The ASSIST PLUS platform supports mounting of 12-channel multichannel pipettes for denser transfers.

Microlab STAR (12-channel head variant) Hamilton: Some configurations support 12-channel piping for certain plate layouts.

Tecan Freedom Evo (12-channel piping arm) Tecan: The Evo line may include arms or piping heads that address 12 columns in certain modes.

EpMotion (12-channel option) Eppendorf: The EpMotion platform sometimes supports 12-channel piping in addition to 8 and single.

24-channel systems push toward higher throughput by addressing more wells in parallel. Examples include:

Hudson (custom 24-channel head) Hudson Robotics: Custom configurations of Hudsons piping heads may scale to 24 tips for higher density piping.

Tecan (24-channel head option in high-throughput systems) Tecan: In large systems, Tecan can offer 24-channel heads for denser piping tasks.

Analytik Jena / CyBio (24-channel head modules) Analytik Jena: Their modular designs allow 24-tip piping modules in some configurations.

Custom integrator 24-tip modules: lab automation integrators build or source 24-channel liquid handling heads for higher throughput.

Branded bulk reagent dispensers (24-channel dispensing heads): Some bulk reagent dispensers use 24-tip manifolds or dispensing heads aligned with microplates.

The automated liquid handling robots market is in a sustained growth phase driven by genomics, diagnostics scale-up, and the migration of repetitive wet-lab tasks to automated, data-driven platforms. Asia and ASEAN are growth priority regions thanks to public & private investments in diagnostics and biologics, though price sensitivity and service coverage remain adoption constraints in parts of Southeast Asia. Vendors that can deliver integrated hardware-software-consumables solutions, build robust regional service footprints, and offer flexible procurement models will capture the fastest revenue and margin expansion as the market transitions to recurring revenue models.

Investor Analysis

machine ASPs and unit volumes, consumables recurring revenue as a percentage of sales, software/subscription take-rates, regional installed-base growth (especially China/India/Singapore/Indonesia), and M&A moves that add integration or consumables capabilities. How to use it: benchmark target companies against the reports unit economics (average price per unit, COGS ratio, factory gross margin and production capacity) to model EBITDA sensitivity to unit growth and to recurring revenue expansion. Why it matters: automation hardware markets are lumpy but recur from consumables and software; companies that can shift revenue mix toward recurring, high-margin consumables and validated workflows are more investable because they convert installed base into predictable lifetime value and reduce topline volatility. Investors should prefer platform vendors with diversified geographic footprints, strong service networks in Asia/ASEAN, and visible roadmaps to lock in consumables/software revenue. The company-level news cited in this report demonstrates that leading vendors are already executing this playbook, accelerating consolidation and partnership activity that creates both acquisition targets and market leaders with recurring revenue leverage.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5075839

5 Reasons to Buy This Report

It consolidates a validated 2024 market baseline and a regionally focused view that highlights where unit growth is accelerating.

It provides operational unit-economics useful for financial modelling and M&A diligence.

It summarizes the most recent product launches and partnerships (with dates) so readers can track competitive moves and technology direction.

It offers strategic vendor/buyer playbooks for capturing consumables and software recurring revenue in price-sensitive markets.

It includes ASEAN and Indonesia-specific adoption insights to support targeted commercial and service-expansion decisions.

5 Key Questions Answered

What was the market size in 2024 and what is the assumed growth path through 2031?

What are realistic ASPs, unit volumes, and factory economics for an average automated liquid handling machine?

How are technology trends changing vendor strategies and customer buying criteria?

What is the regional demand profile in Asia and in ASEAN and which barriers constrain adoption?

Which companies are best positioned to capture recurring consumables and software revenue?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automated Liquid Handling Robots Market to Reach CAGR 10,5% by 2031 Top 10 Company Globally here

News-ID: 4207862 • Views: …

More Releases from QY Research

Vehicle Two Ways Radios Market to Reach USD 15,960 Million by 2031 Top 10 Compan …

The vehicle two-way radio industry supplies mobile and fixed radio units, systems and supporting services used for mission-critical and business communications in vehicles across public safety, transport, utilities, logistics and industrial fleets. These radios range from simple analog vehicle-mounted transceivers to full digital mobile radio (DMR), P25 and LTE-integrated systems that provide voice, data, GPS and fleet management functions. Vehicle two-way radios are distinguished from portable handheld units by higher…

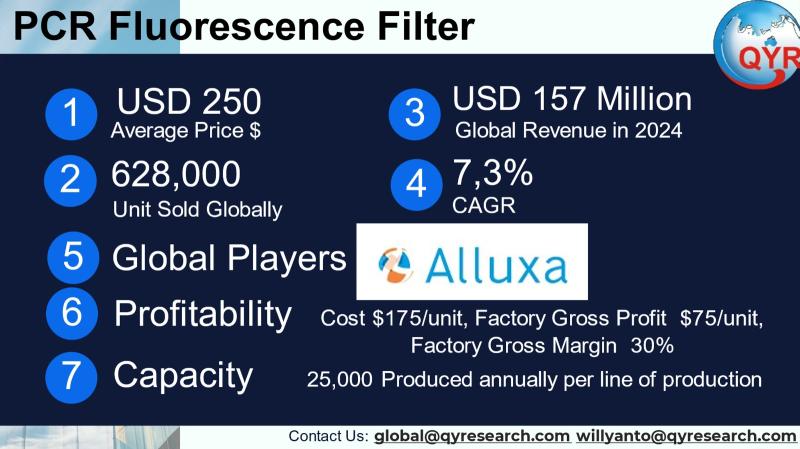

PCR Fluorescence Filter Market to Reach USD 256 Million by 2031 Top 10 Company G …

The PCR fluorescence filter market supplies the optical components (excitation, dichroic, and emission filters and filter sets) that enable fluorescence-based real-time PCR/qPCR instruments to detect and quantify nucleic acids. These filters are manufactured from precision-coated optical substrates and are either sold as OEM components to instrument makers or as replacement/upgrade filter sets to laboratories. Their performance directly affects limit-of-detection, channel multiplexing, and assay reproducibility, and they are therefore considered critical…

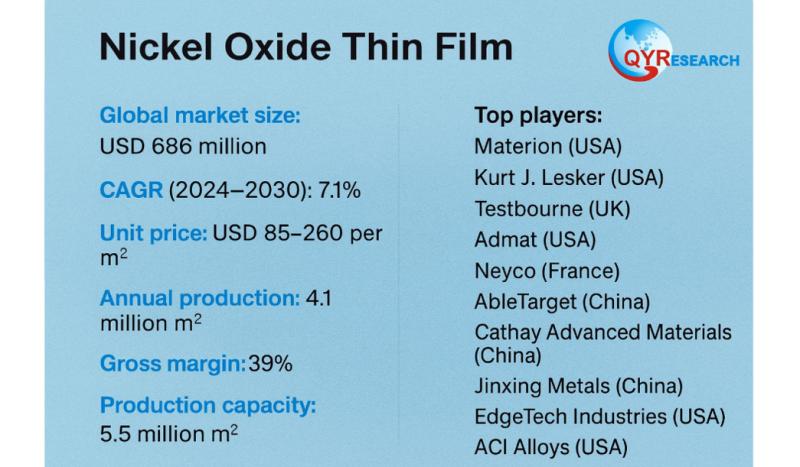

Global and U.S. Nickel Oxide Thin Film Market Report, Published by QY Research.

Nickel Oxide Thin Film is a functional transition metal oxide layer widely used in electronics, optics, and energy devices due to its p-type semiconducting behavior, optical transparency, electrochromism, and catalytic activity. Deposited via methods such as sputtering, sol-gel, pulsed laser deposition, or chemical vapor deposition (CVD), NiO thin films exhibit high thermal stability, wide bandgap (~3.6-4.0 eV), and tunable electrical conductivity. They are commonly applied in electrochromic smart windows, thin-film…

VR Simulators Market to Reach CAGR 11,2% by 2031 Top 10 Company Globally

Virtual reality (VR) simulators are integrated systems combining head-mounted displays, motion platforms, specialized controls, sensors, bespoke software and often domain-specific content to deliver immersive training, entertainment and visualization experiences. They range from tethered headset-based rigs used in arcades and entertainment venues to full-scale, certified training simulators used by aviation, defense, healthcare and industrial customers. The industry sits at the intersection of hardware manufacturing, real-time 3D software, sensor/electronics supply chains and…

More Releases for Hudson

Dealerslink Welcomes Brian Hudson as Director of Consulting

Broomfield, CO, USA - April 16, 2024 - Dealerslink, a leading SaaS provider of innovative inventory management solutions for automotive dealerships, proudly announces the appointment of Brian Hudson as its new Director of Consulting. Hudson brings over 15 years of experience in automotive SaaS, with a rich background in OEM sales, F&I provider services, sales process optimization, and dealer group account management.

Image: https://www.getnews.info/uploads/f90fa79edf15ddffeb12d501228b5bc2.jpg

Hudson's professional journey began in Elkhart, IN, where…

Therapeutic Singing and Vocal Rehabilitation by Deborah Hudson

Therapeutic Singing Classes with Deborah Hudson

We all know that singing generally is both good for the soul and good for our health. Choir singing in particular can make an awful lot of people very happy. Breathing and heart beats synchronise. The sheer joy of sharing music is transformative for all concerned.

But supposing you lack the self-belief even to get to the point of thinking you can one day join a…

HUDSON VALLEY CLEANING SYSTEMS ANNOUNCES THEIR LAUNCH

NEW PALTZ, NEW YORK- FEBRUARY 11, 2019- Hudson Valley Cleaning Systems is excited to announce their launch as the premier choice for exterior cleaning services. The official opening date was January 2, 2019. Founded by Eric Jacobson, Hudson Valley Cleaning offers professional services with award-winning results.

All services from Hudson Valley Cleaning Systems are available for both residential and commercial customers in the Dutchess County area. Their services extend…

Global Green Concrete Market to 2025: Gammon, Wagners, Hanson, Bonded Hudson NY, …

Researchmoz added Most up-to-date research on "Global Green Concrete Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Green Concrete market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Green Concrete breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Hudson Plumber, New York Solar Heating, hudson valley plumber, solar water heate …

Fishkill, New York – December 1, 2011 – Local Hudson Valley plumbing corporation Smart Systems USA, Inc. recently donated $1000 to the Haldene School Foundation as part of their “Caring Community” initiative, through which the company donates $1000 each month to a local 501c3 organization randomly drawn from charities nominated by the community.

This month’s recipient, the Haldene School Foundation, is a community-based nonprofit organization, registered with New York State as…

New Polarion Integration Plugin for Hudson

"This plugin extends Hudson, which is a popular stand-alone continuous integration tool. It integrates Polarion into Hudson, so that workitem identifiers found in changeset descriptions are hyperlinked to the corresponding workitem detail page in Polarion", says Hermann Lacheiner, who developed that plugin.

Recently Hudson became a popular tool for continuous integration. Its strength lies in its flexibility and extensibility, e.g. not only Hudson can be used to build Maven…